It’s a win-win-win for the global building boom, Caterpillar and exchange traded funds (ETFs) that hold the heavy-equipment manufacturer.

Caterpillar’s (CAT) second-quarter profit jumped 34%, handily dusting expectations, reports Daniel Lovering for the Associated Press. Much of the company’s success in the most recent quarter is owed to areas outside the United States, where 60% of its sales were racked up.

The company said its growth is mostly because of development in emerging markets, as well as growth industries such as energy and mining. Supply is tight for the products, they said, but they’re doing their best to keep up with the pace.

Among the company’s components: machinery and engine sales are up 21%. Across the globe, in the Asia-Pacific region, machinery sales are up 50% and engine sales are up 57%. In Latin America, machinery is up 23% and engines sales grew 42%.

Among the ETFs that could dig up returns if Caterpillar continues to put up the numbers include:

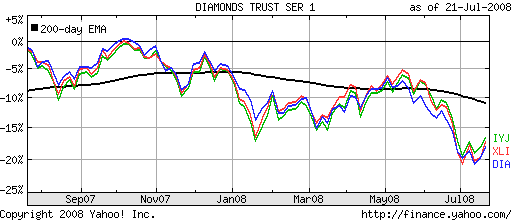

- DIAMONDS Trust, Series 1 (DIA): down 10.5% year-to-date; Caterpillar is 4.6%

- Industrial Select Sector SPDR (XLI): down 12% year-to-date; Caterpillar is 3.5%

- iShares Dow Jones US Industrial (IYJ): down 10.5% year-to-date; Caterpillar is 2.5%

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.