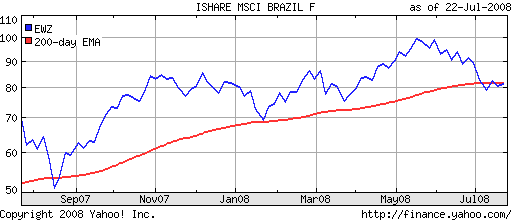

The iShares MSCI Brazil Index (EWZ) exchange traded fund (ETF) is treading water at the same place it did at the beginning of 2008.

With the country’s rapid appreciation in recent years, is there really more room for expansion?

The surprisingly quick pace of growth in this emerging country has had a long run. With a 600% appreciation over the past five years, it could very well still have some room left.

And although many investors have already profited greatly from this run, some believe that this is only the start of the good fortune. The ETF gives exposure to 70 of Brazil’s largest companies, which represent 85% of the Brazilian market, reports Billy Fisher for TheStreet.

The glitch that many have to watch is the risk of inflation. Interest rates are around 12% right now, and this is slowing down home ownership. If they can keep inflation under control, Brazil’s economy will be fine and will eventually develop into a first-world country.

Brazil is a country rich in natural resources, and EWZ reflects that in part. Industrial materials are weighted at 34.7%; energy is 27.3% and financials are 17.3%.

Year-to-date, the fund is up 1%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.