By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

In the current market environment, with equities near all-time highs and interest rates still below historical averages, we believe alternative investments maybe a solution for investors struggling with how to make money while still managing risk. We think of alternative investments as a basket of securities that, when combined together, can offer greater return potential than traditional bonds, lower volatility than equities, and a lower correlation to both. While we always allocate to alternatives as a part of our risk management, we think this market environment offers special opportunities and can be a valuable part of every allocation. With the growing number of ETF offerings that fit in the alternative’s universe, investors have a variety of ways to allocate to the asset class.

Our process has always focused on “managing risk in real time” and we think 2017 will give advisors plenty of opportunity to do just that. We expect to see expansionary fiscal policy fuel economic growth and present some inflationary pressures over the course of 2017. As a result, we will likely see the U.S. Federal Reserve pick up their pace and raise rates more persistently than consensus expects. With this backdrop, we think there are a lot of uncertainties and risks, which will lead to a volatile year for both traditional equity and fixed income. Allocating to alternatives can help strike a balance between the potential upside of this equity market and the potential safety that bonds may represent.

As investors, we understand that there are things that we think and things that we know. It is important to be able to differentiate between the two. For example, we think that, based on fundamentals, global growth is accelerating, which favors risk assets like equities. We also think that at some point we will enter the end of the cycle, so we must be cautious about potential downside. We also know that no one can be 100% certain when markets will shift away from favoring risk assets, and a lot will depend on the uncertainty of a balance between Fed Policy and Fiscal Policy. As a result, the potential risk, return, and correlation benefits of alternative investments become more appealing.

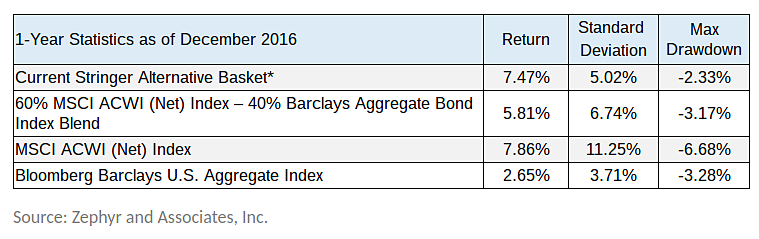

For example, in our Moderate Growth Strategy, which is our most popular strategy, our allocation to alternatives is approximately 24%. This allocation is created to target a particular mix of equity and fixed income sensitivity, thus meeting somewhere in between. Our current allocation to alternatives includes long/short equity and convertible bonds, which give us a degree of equity sensitivity. While we expect these to provide some limited equity upside, they also tend to add downside protection. Variable rate preferreds are used to offer an attractive yield over fixed income with less interest rate sensitivity. Finally, we use non-traditional bond sectors, which tend to have higher yields but also will tend to be less interest rate sensitive than the broad fixed income market. In aggregate, we expect this blend of alternative assets and strategies will generate a higher return than core bonds with only about 40% of the risk of the equity markets. The table below shows these characteristics over calendar year 2016.

By having a third place to go, in addition to traditional equities and bonds, alternative investments can give portfolios the ability to generate attractive returns while potentially mitigating risk appropriately. As the ETF space has matured, we are finding more ways to fill out our alternative allocations. Major ETF sponsors offer a wide variety of product solutions in a liquid and transparent form. Our alternative basket often includes holdings from iShares, First Trust, State Street, and more. With improved product offerings from ETF providers, we expect to investors can continue to benefit from an allocation to alternatives.

This article was written by Gary Stringer, CIO, Kim Escue, Senior Portfolio Manager, and Chad Keller, COO and CCO at Stringer Asset Management, a participant in the ETF Strategist Channel.

*The Stringer Alternative Basket currently consists of 20.83% of SPDR Bloomberg Barclays Convertible Securities ETF (CWB), 16.66% of the SPDR DoubleLine Total Return Tactical ETF (TOTL), 25.00% of the First Trust Preferred Securities and Income ETF (FPE), 16.66% of the iShares Morningstar Multi-Asset Income ETF (IYLD), and 20.83% of the First Trust Long/Short Equity ETF (FTLS).

DISCLOSURES

Any forecasts, figures, opinions or investment techniques and strategies explained are Stringer Asset Management LLC’s as of the date of publication. They are considered to be accurate at the time of writing, but no warranty of accuracy is given and no liability in respect to error or omission is accepted. They are subject to change without reference or notification. The views contained herein are not be taken as an advice or a recommendation to buy or sell any investment and the material should not be relied upon as containing sufficient information to support an investment decision. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Past performance and yield may not be a reliable guide to future performance. Current performance may be higher or lower than the performance quoted.

The securities identified and described may not represent all of the securities purchased, sold or recommended for client accounts. The reader should not assume that an investment in the securities identified was or will be profitable. This material is for informational purpose only. Investments discussed may not be suitable for all investors. No part of the authors’ compensation was, is, or will be directly or indirectly related to the specific views contained in this report. Information provided is obtained from sources deemed to be reliable; but is not represented as complete, and its accuracy is not guaranteed. The information and opinions given are subject to change at any time, based on market and other conditions, and are not recommendations of or solicitations to buy or sell any security. Opinions and forecasts expressed herein may not actually occur.

Data is provided by various sources and prepared by Stringer Asset Management LLC and has not been verified or audited by an independent accountant.