By Justin Sibears, Newfound Research Managing Partner

Low volatility ETFs are on fire. These strategies, which aim to offer lower volatility exposure to various portions of the equity market, brought in $13 billion through June of this year.

In our opinion, these flows are evidence of what can happen when the right story (risk-conscious equity market access) lines up with short-term performance.

Criticisms of Low Volatility and Other Smart Beta Strategies

Of course, success inevitably brings out the critics. One vocal critic has been Rob Arnott of Research Affiliates, which laid out his view in a February article titled “How Can “Smart Beta” Go Horribly Wrong?” His basic argument is:

- Factors can outperform for “structural” or “situational” reasons. Structural outperformance (i.e. premium in value stocks as a result of higher business cycle risk) is sustainable. Situational outperformance – mainly from increasing valuations – is not.

- Certain factor premiums – especially low beta/volatility and quality – become significantly less compelling when the impact of increasing valuations is netted out.

- Performance chasing pushes valuations higher, creating continued short-term outperformance, but also exposing investors to a “reasonable probability of a smart beta crash.”

We agree that factors can out-/underperform for structural and/or situational reasons and that the structural reasons are where the long-term value-add resides.

We agree that performance chasing can perpetuate short-term returns in certain factors and that this behavior can lead to significant pain when the factor mean reverts.

We even agree that factor/smart-beta crashes are inevitable.

We disagree, however, with the conclusion that certain factors – like low volatility – have only outperformed due to increasing valuations and that using them now is dangerous. Any investment strategy can be dangerous if used improperly for a given client. That is nothing new. When used responsibly and thoughtfully, however, we believe that low volatility and other smart beta strategies can have significant roles in many investor portfolios.

More specifically, our disagreements lie with certain aspects of Research Affiliates’ methodology as well as their framing of the issues.

Issues with Research Affiliates’ Methodology

In terms of methodology, Research Affiliates uses value spreads to assess the impact of valuation changes on factor returns. Value spreads quantify the difference in valuations between the long (i.e. low volatility or low beta stocks) and the short (i.e. high volatility or high beta stocks) sides of a long/short factor strategy. A paper published by AQR, “Are Defensive Stocks Expensive? A Closer Look at Value Spreads,” found a “tenuous link between valuations and returns for style premia.” For example, the paper found that the correlation between value spreads and next month returns for the low beta factor has been very close to zero (-0.01 to be exact).

To understand why, it’s helpful to understand the conditions that would have to be met for value spreads to predict returns.

The correlation of -0.01 was for a non-industry neutral version of the factor L/S portfolio. The correlation rises slightly to 0.10 for an industry neutral portfolio.

First, value spreads would need to exhibit mean reversion. This first condition means that relatively high valuations will eventually move downward towards the long-term average and vice versa for relatively low valuations.

Second, changes in valuations would have to be driven mainly by price changes. This second condition means that rising valuations imply rising prices and outperformance while falling valuations imply declining prices and underperformance.

Do Value Spreads Mean Revert?

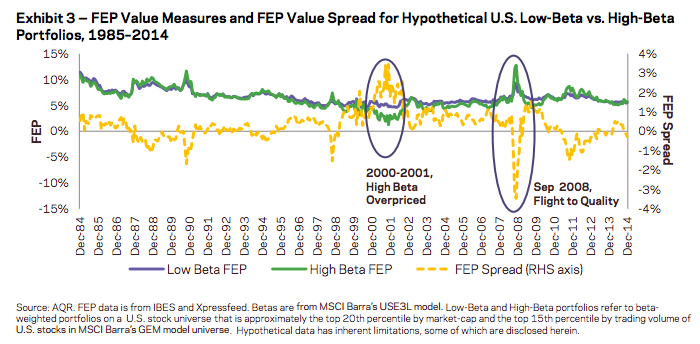

The first condition, value spread mean reversion, does seem to hold as evidenced by the chart below. The yellow dashed line plots the value spread for the low beta factor. When the line is above (below) zero, low beta stocks are undervalued (overvalued) relative to high beta stocks.

The difficulties in using this knowledge are that over/under-valuations can get more extreme before reverting and that the speed of mean reversion is unpredictable.

Are Valuation Changes Mainly Driven by Price Changes?

The short answer is not necessarily. AQR’s paper on defensive stock valuations goes into quite a bit of detail as to why this is the case. The Cliff’s Notes version is that prices are not the only factor that can drive valuation changes. For example, valuations can change as a result of fundamentals. Earnings growth will cause P/E ratios to fall if prices do not rise accordingly. Valuations in factor portfolios can also change because of portfolio rebalances. Let’s say a low volatility ETF rebalances, increasing its allocation to technology and decreasing its allocation to utilities. Holding all else equal, it would be reasonable to expect this activity to increase the valuation of the portfolio since technology stocks tend to have higher P/E ratios than utilities stocks. Yet, this valuation increase has no immediate impact on strategy returns.

Inconsistent and unpredictable timing of value spread mean reversion combined with a complicated relationship between valuation changes and price changes makes for a weak relationship between low volatility / low beta strategy valuations and returns.

RELATED: Investors: Why Your Diversifier Isn’t Diversified

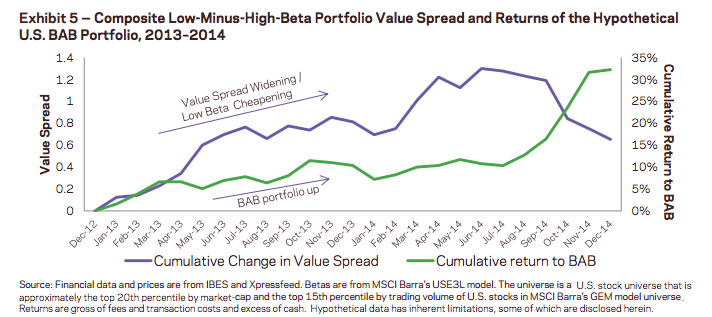

To hammer this point home, AQR discusses an interesting phenomenon for the low beta factor. In 2013 and 2014, the low beta factor got cheaper as low beta stocks became less expensive relative to high beta stocks. Intuitively, we might assume that the factor underperformed, yet the opposite occurred. The low beta factor outperformed over this period despite becoming less expensive.

The AQR paper does a wonderful job decomposing why this is the case. In this particular example, it has to do with differences between how the value spread is calculated (dollar neutral) and how the low beta long/short portfolio is constructed (beta neutral). We encourage readers to read the AQR paper for great insights into this topic.

Image from AQR Paper: “Are Defensive Stocks Expensive? A Closer Look at Value Spreads.”

Issues with Research Affiliates’ Framing

Putting the technical critiques aside, we find Research Affiliates’ forecast of a smart beta crash in overvalued factors like low volatility to be a bit misleading. Not because it isn’t true, but rather because factor “crashes” are nothing new. They’ve happened regularly over time. In fact, factor crashes are completely consistent with the theory that many factor premiums exist as a form of compensation for bearing various types of risk. If risk did not exist, there would be nothing to compensate for and premiums may disappear.

Nowhere is this clearer than with the most famous factor strategy: value. Going back to the 1920s, there has been a 1 in 8 chance that the value factor underperforms by 10% or more over a 12-month period. And in some cases the underperformance has been significantly worse. For example, the value factor lost more than 40% from March 1934 to March 1935 and more than 30% between February 1999 and February 2000.

The Good News

Despite our disagreements, we believe that the Research Affiliates piece and others like it are a positive for the continued growth of factor investing. Short-term performance chasing is dangerous. While we like low volatility strategies generally, the reason for using them has to go beyond solid short-term performance.

Sustainable allocations to factor strategies requires investor’s buying into these products with eyes wide open.

When it comes to low volatility investing, we believe it’s important to recognize that volatility and risk are not synonymous. Take cash as an example. It has very low volatility, but can be an extremely risky investment for a young investor who needs growth to fund retirement.

It follows then that low volatility strategies are not necessarily low risk strategies.