Note: This article appears on the ETFtrends.com Strategist Channel

By Justin Sibears

Meeting income objectives continues to be a challenge as interest rates remain near all-time lows. The good news for ETF users is that there are options for enhancing yield. 216 of the 1,901 ETFs in etf.com’s database have dividend yields in excess of 4%. The bad news is that these options are so diverse that understanding which exposures to use and how to use them can be daunting.

Enter the multi-asset income ETF. Multi-asset income ETFs provide exposure to a diverse group of high-income asset classes. Sometimes these ETFs hold other ETFs, sometimes they hold individual securities, and sometimes they do a little bit of both.

Related: High Yield: Painting with a Full Palette

We are strong advocates of a multi-asset approach to supplementing portfolio income. However, multi-asset income ETFs are not set it and forget it types of allocations. They require both upfront and ongoing due diligence. When evaluating these products, we believe three reminders are in order.

Reminder #1: Yield is just a number.

Many multi-asset income ETFs offer high yields. Below, we plot trailing 12-month yields for multi-asset income ETFs with at least one year of historical data. For reference, the Barclays Aggregate Bond Index has a trailing yield of approximately 2.3%.

Be careful not to be mesmerized by these high numbers. Yield is just one component of total return for high-income – and for that matter – all asset classes. Take high yield corporate bonds for example. Yes, beginning yield is important, but so are credit losses and fluctuations in interest rates and credit spreads.

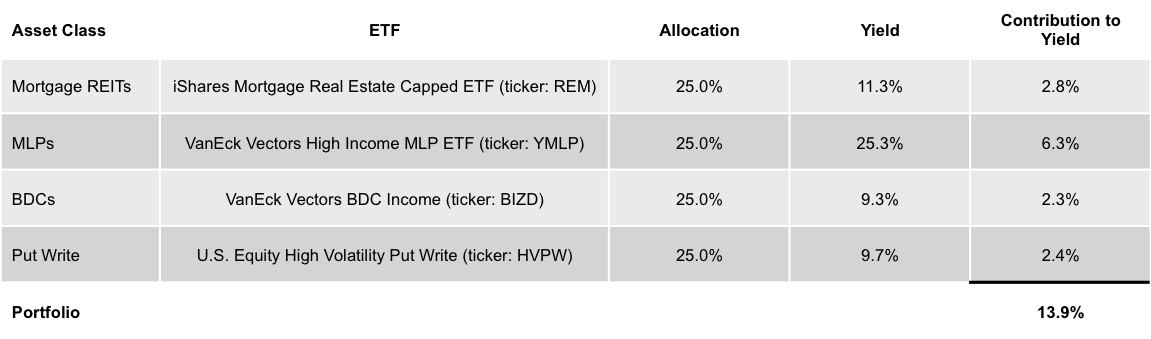

Constructing a portfolio with a high yield is a trivial exercise. Just equal weight mortgage REITs, high yielding MLPs, business development companies, and a put write strategy. Voila! We have a whopping 12-month yield of 13.9%.

Building a strategy with high stated yield is easy. Building a strategy with a high yield, attractive total return, and desirable risk characteristics is much, much more difficult.

For example, an investor who held our naïve high yield portfolio would have had suffered a 34.4% maximum drawdown in the 12 month period ending on 4/30/16. The SPDR S&P 500 ETF (SPY), on the other hand only had a drawdown of 13.0%. Year-to-date, the income strategy had a 16.8% drawdown compared to 10.3% for SPY.

Reminder #2: Look under the hood.

In a perfect world, multi-asset income ETFs would remove the need for investors to consider the merits of each and every high-income asset class. Alas, the world isn’t perfect.