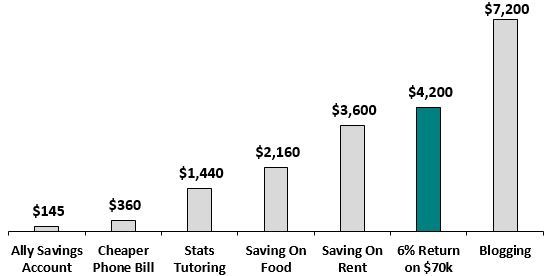

When I moved to Cincinnati, I had the option to move into a slightly larger apartment for $300 more per month, but chose a smaller one with a roommate. That decision will save me about $3,600 over the course of one year.

I also earned a bit over $600 from blogging last month. If I consistently earn that much each month, that’s equivalent to $7,200 over the course of one year.

Combined, all of these savings and earnings add up to $14,905 over the course of a year.

Currently I have around $70,000 invested in various assets across brokerage accounts, IRA’s, and 401(k)’s. In total, these investments would need to earn over a 21% yearly return to match the amount I’m currently saving and earning through my six lifestyle choices listed above.

Related: Financial Technology Isn’t Just for Millennials

![]()

Lifestyle Choices That Were Worth More Than My Investments

For anyone in a position like myself, with a net worth less than $100k, the fastest way to make progress financially is through making the right lifestyle choices. Starting a side hustle, finding a cheaper phone plan, living in a reasonable place, dining out just a bit less, etc. These choices often have a bigger impact on your wallet than your investment returns.

This article has been republished with permission from Four Pillar Freedom.