![]() When diversifying into international markets to access global opportunities, investors should consider a currency hedged ETF to capture any upside and diminish downside risks associated with unfavorable foreign exchange movements.

When diversifying into international markets to access global opportunities, investors should consider a currency hedged ETF to capture any upside and diminish downside risks associated with unfavorable foreign exchange movements.

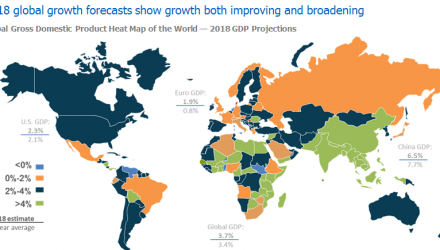

On the recent webcast (available On Demand for CE Credit), Tired of Trying to Determine Which Way the Dollar is Headed?, Salvatore Bruno, Chief Investment Officer and Managing Director of IndexIQ, pointed to the growth opportunity in global markets. For instance, many global developed economies are expected to expand 2% to 4% in 2018. Emerging markets, notably “China, India and Southeast Asia are the growth envy,” as they are projected to grow over 4%. The Eurozone is also enjoying a pick up as growth, business and earnings indicators are positive and gaining momentum.

Meanwhile, valuations also look much more attractive outside the U.S., especially after the recent rally in domestic equities that has pushed U.S. stocks to record highs and forward price-to-earnings ratios to historically elevated levels. For example, the MSCI Europe Index shows a 15.1 P/E ratio, MSCI Japan trades at a 14.6 P/E and the FTSE World Ex U.S. hovers around 14.5 P/E, compared to the 18.1 P/E in the S&P 500. International markets are also relatively cheap compared to historical averages.

“Relative valuations for international developed equity markets are almost one full standard deviation below their 30-year average,” Bruno said.

Income-minded investors are also looking in international markets as yield opportunities look more enticing. The S&P 500 shows a dividend yield of 2.0%, compared to the MSCI World’s 2.4%, MSCI EM’s 2.4% and SMCI EAFE 3.1%.

However, as more investors look to international markets to diversify their portfolios, people will have to consider specific risks associated with foreign equity exposure, such as foreign exchange fluctuations or currency risks.

“Investors must consider what to do about the inherent currency risk that comes with international investing. Options can range from hedging 0% to 100% of the exposure,” Bruno said.

Yan Yan, Associate Director of Research and Analytics at FTSE Russell, pointed out that investors may be overlooking the potentially damaging negative effects currency risks on international equity exposure over the short-term. For example, from June 2014 to June 2015 when the U.S. dollar strengthened or foreign currencies depreciated against the greenback, a 0% unhedged position in the FTSE Developed ex North America Index generated a -2.5% return, whereas a fully 100% hedged position in the index would have generated a 10.8% return over the period.