Seven of eight indexes on our world watch list posted gains through April 24, 2023. France’s CAC 40 finished in the top spot with a YTD gain of 16.99%. Germany’s DAXK finished second with a YTD gain of 13.36%, and Tokyo’s Nikkei 225 moved into third with a YTD gain of 9.58%. India’s BSE SENSEX finished last with a loss of 1.29% YTD. Note: all indexes are calculated in their local currencies.

World Indexes and Recent Recessions

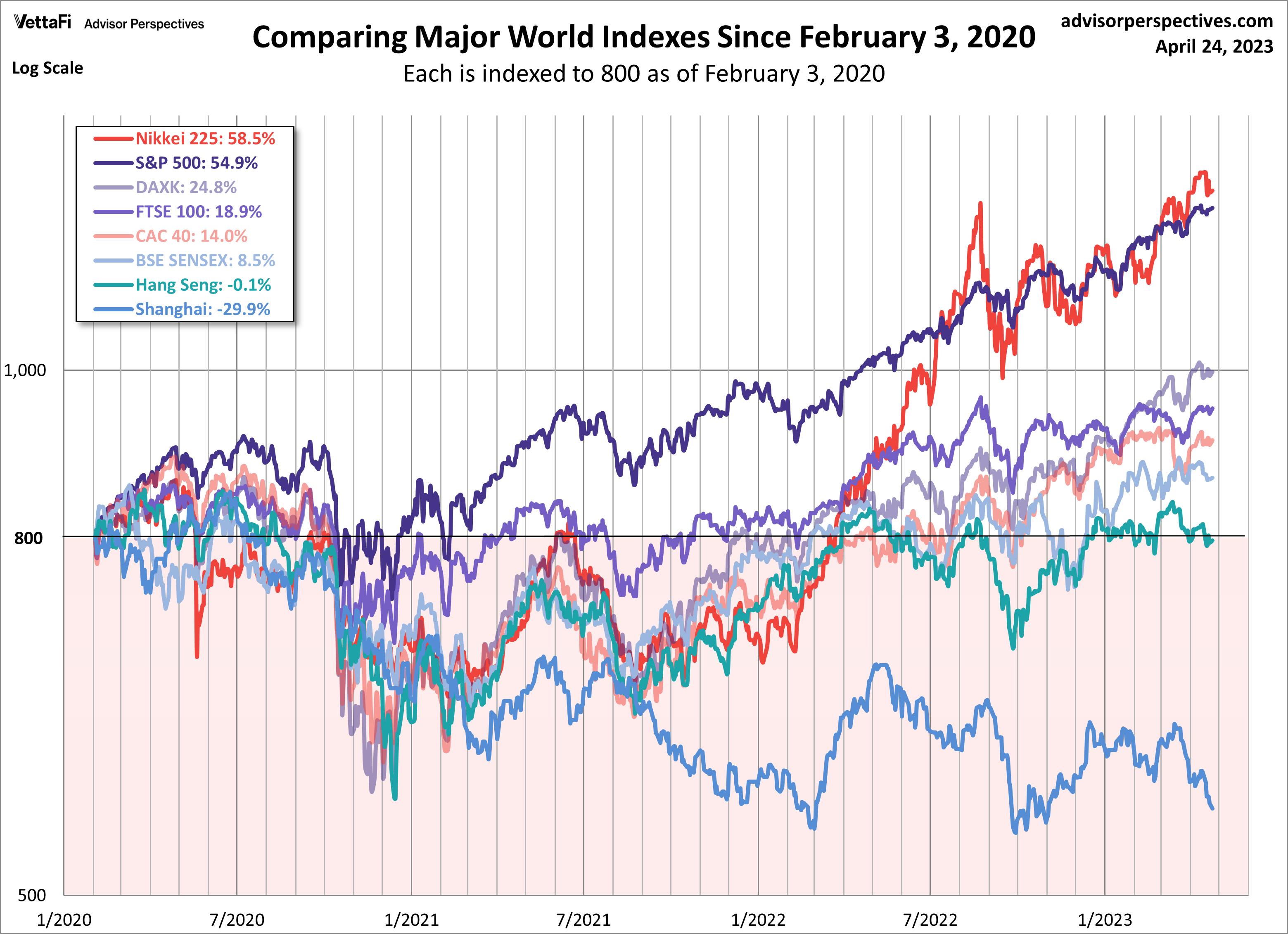

Let’s start with a very recent chart with the latest recession. We’ve used February 3, 2020 for our start date (this is the official NBER recession start).

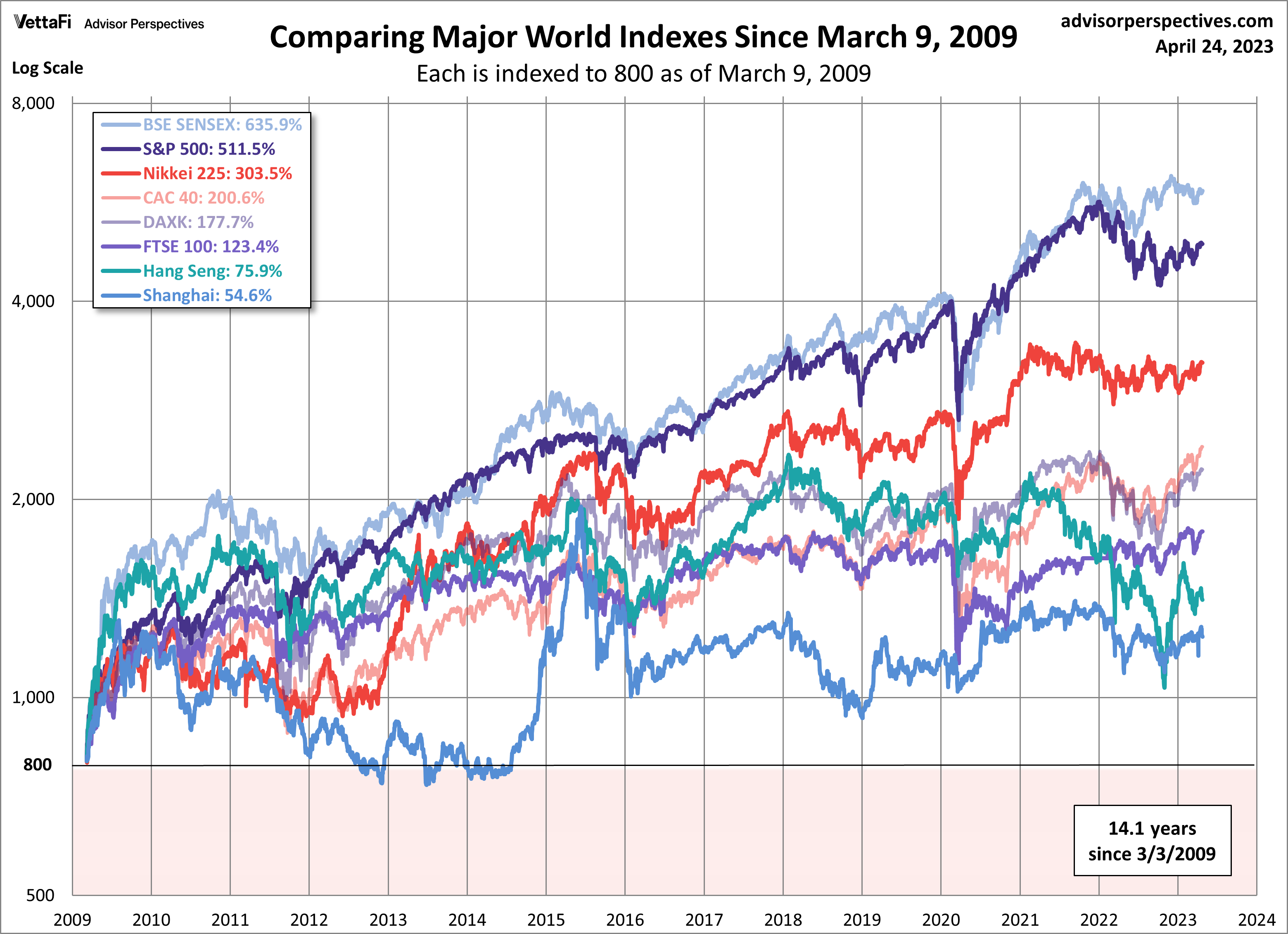

The chart below illustrates the comparative performance of world markets since March 9, 2009. The start date is arbitrary: The S&P 500, CAC 40, and BSE SENSEX hit their lows on March 9th, the Nikkei 225 on March 10th, the DAXK on March 6th, the FTSE on March 3rd, the Shanghai Composite on November 4, 2008, and the Hang Seng even earlier on October 27, 2008. However, by aligning on the same day and using a log-scale vertical axis, we get an excellent visualization of the relative performance. I’ve indexed each of the eight to 800 on the March 9th start date. The callout in the upper left corner shows the percent change from the start date to the latest weekly close.

Here is the same visualization, this time starting on October 9, 2007, a previous closing high for the S&P 500. This date is also approximately the mid-point of the range of market peaks, which started on June 1st for the CAC 40 and ended on January 8, 2008, for the SENSEX.

For a longer look at the relative performance, our final chart starts at the turn of the century, again indexing each at 800 for the start date.

Examples of single-country ETFs:

- Franklin FTSE Japan ETF (FLJP)

- Franklin FTSE United Kingdom ETF (FLGB)

- Franklin FTSE China ETF (FLCH)

- Franklin FTSE India ETF (FLIN)

- Franklin FTSE Germany ETF (FLGR)

- Franklin FTSE Hong Kong ETF (FLHK)

- Franklin FTSE France ETF (FLFR)

- SPDR S&P 500 ETF Trust (SPY)

Note: I track Germany’s DAXK a price-only index, instead of the more familiar DAX index (which includes dividends), for consistency with the other indexes, which do not include dividends.

For more news, information, and analysis, visit the Volatility Resource Channel.

VettaFi is an independent publisher and takes responsibility for our edit staff, research, and postings. Franklin Templeton is not affiliated with VettaFi and was not involved in drafting this article. The opinions and forecasts expressed are solely those of VettaFi and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.