Brazil is seeing an uptick in consumer spending, according to the latest figures from the Brazilian Institute of Geography and Statistics (IBGE). Per the government agency, retail sales in Brazil rose 1.1% in February from January, beating analyst expectations. Economists in a Reuters poll had anticipated a month-over-month increase of only 0.1%, while a survey of analysts conducted by Bloomberg expected a median monthly increase of 0.3%.

Sales in February were up 1.3% over 12 months, while January’s increase was revised higher to 2.1%. When expanding the retail trade to include vehicles, motorcycles, parts and pieces, and construction material, sales went up 2% month-over-month.

Bloomberg cited eased pandemic restrictions and greater mobility within the Latin American country as tailwinds for the increased demand in retail. Headwinds, meanwhile, include high borrowing costs and inflation, driven by more expensive raw materials.

Of the eight retail categories surveyed, IBGE said that sales grew in six categories surveyed, with the biggest impacts coming from fuels and lubricants (up 5.3%), furniture and appliances (2.3%), and fabrics, apparel, and footwear (2.1%).

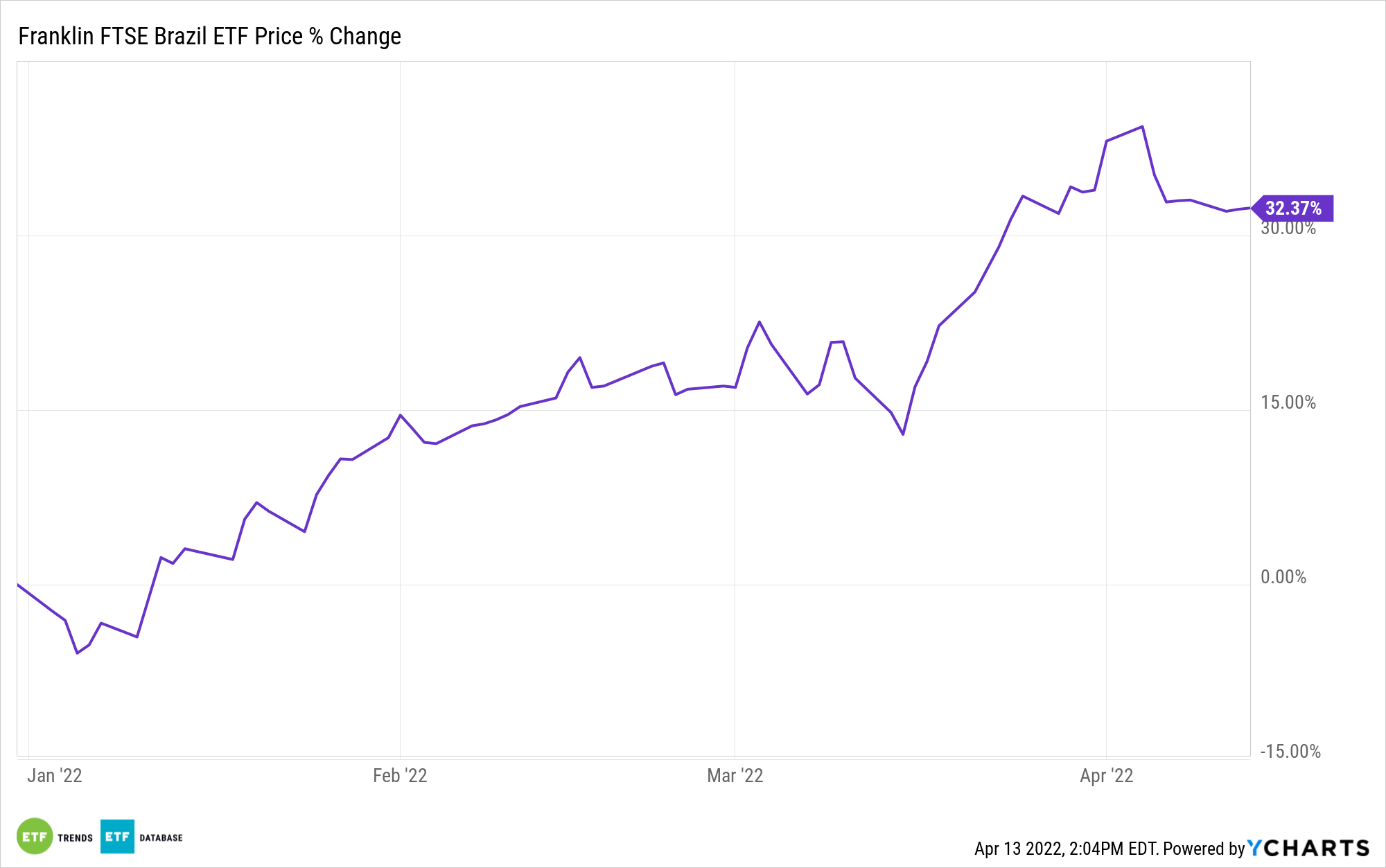

Investors looking to increase their exposure to Brazil-based equities may want to consider the Franklin FTSE Brazil ETF (NYSEArca: FLBR), which seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Brazil RIC Capped Index (the FTSE Brazil Capped Index). The index is based on the FTSE Brazil Index and is designed to measure the performance of Brazilian large- and mid-capitalization stocks.

The $523 million single-country ETF has 99 holdings as of April 12.

FLBR is part of a series of single-country ETFs that Franklin Templeton began rolling out in 2017. The fund has an expense ratio of 0.19%.

For more news, information, and strategy, visit the Volatility Resource Channel.