By Ploutos Investing

- VGT invests in large- and giant-cap technology stocks in the United States.

- Stocks in VGT’s portfolio have competitive positions over its peers.

- VGT will benefit from several growth trends in the IT industry in the next few years.

- The ETF is trading at a premium valuation to its historical average.

ETF Overview

The Vanguard Information Technology ETF (VGT) owns a portfolio of large- and giant-cap technology stocks in the United States. The fund tracks the information technology sector of the MSCI US Investable Market 25/50 Index. Most of these large- and giant-cap stocks in VGT’s portfolio have competitive positions over their smaller peers. In addition, they have much better market liquidity than small-cap stocks. While the fund is expensive right now, stocks in VGT’s portfolio have good long-term growth outlook. Therefore, we think it is okay to continue to own VGT.

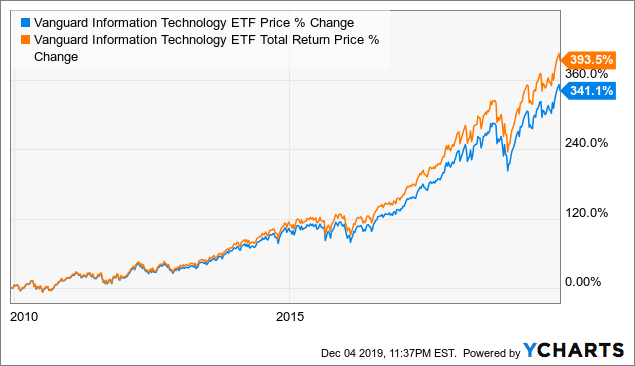

Data by YCharts

Fund Analysis: VGT’s top holdings are moaty stocks

VGT’s top-10 holdings are companies with moats. As can be seen from the table below, all of the top-10 holdings in VGT’s portfolio receive narrow or wide moat status according to Morningstar’s research. These top 10 stocks represent nearly 56.4% of its total portfolio. Most of these stocks have products or services that are very sticky to their customers. As such, it is very difficult for its customers to switch to their competitors.

For example, Apple (AAPL) has an ecosystem with multiple services (Apple TV, cloud, etc.) that attract its customers to use its services. Similarly, Visa (V) and Mastercard (MA) have networks of millions of merchants and customers that are difficult for its smaller competitors to replicate.

| as of 08/27/2019 | Morningstar Moat Status | % of ETF |

| Apple (AAPL) | Narrow | 17.40% |

| Microsoft (MSFT) | Wide | 15.90% |

| Visa (V) | Wide | 4.40% |

| Intel (INTC) | Wide | 3.90% |

| Mastercard (MA) | Wide | 3.80% |

| Cisco (CSCO) | Narrow | 3.10% |

| Adobe (ADBE) | Wide | 2.10% |

| Oracle (ORCL) | Wide | 2.00% |

| Salesforce.com (CRM) | Wide | 2.00% |

| IBM (IBM) | Narrow | 1.80% |

| Total: | 56.40% |

Source: Created by author

Recurring revenues is a big plus

Several companies in the top 10 holdings derive most of their revenues from recurring sources. For example, Oracle and Adobe derive most of their revenue from recurring sources.