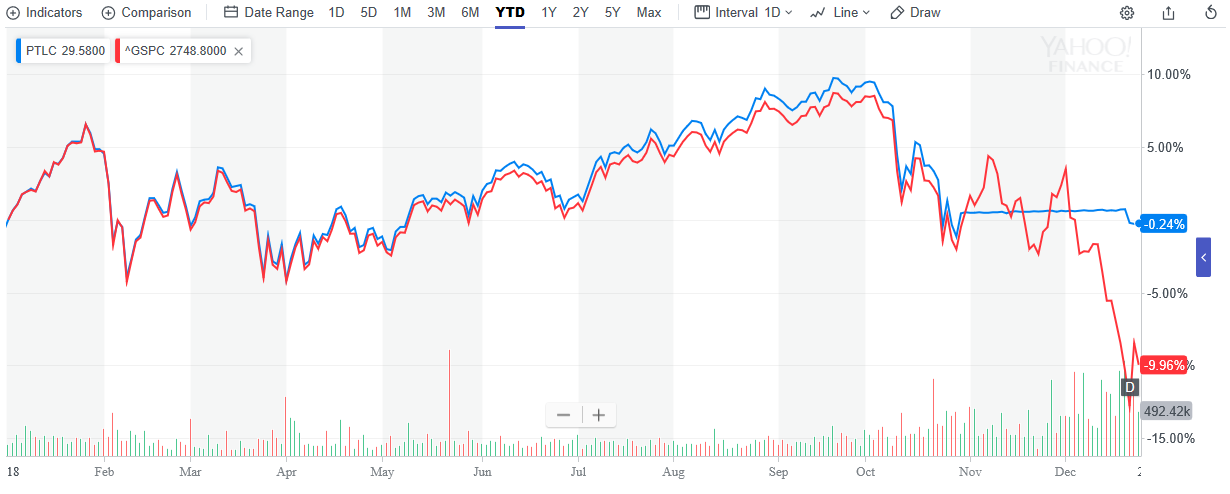

According to Morningstar, PTLC has been yielding 1.45 percent trailing total returns year-to-date as of Dec. 26, leaving the S&P 500 in its rearview mirror, which has lost 7.70 percent YTD. Even during the height of the bull market through the summer, PTLC was outpacing the S&P 500 in a dogfight.

Growing at the Speed of Sound

The markets are watching the latest returns from not just the TrendPilot series, but across the board for all Pacer ETF products, and are responding as such–since debuting in 2015, Pacer ETFs has amassed $3 billion in assets under management six months after already reaching $2 billion in March. In fact, in a one year span from October 2017 to October 2018, Pacer ETFs grew its assets by 114 percent.

“Our growth proves that our mission to provide passive, rules-based strategies to navigate turbulent markets is resonating with advisors and investors alike,” says Sean O’Hara, president of Pacer ETFs Distributors. “It took us two years to amass the first billion dollars in assets under management. The third billion in assets came in under six months, making us one of the fastest-growing ETF issuers in the industry. We owe a special thanks to some of our partners including U.S. Bank, S&P, NASDAQ, FTSE Russell, NYSE and CBOE who help make our ETFs possible, as well as the financial advisors who use our strategies.”

For more information on Pacer ETFs, visit their website.

For more market trends, visit ETF Trends.