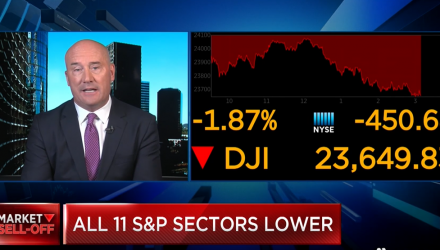

Monday’s trading session began with more sell-offs in U.S. equities with the Dow Jones Industrial Average losing over 500 points as a key rate decision by the Federal Reserve looms, which could impact emerging markets exchange-traded funds (ETFs).

The capital markets are widely expecting a fourth and final rate hike to cap off 2018 with algorithms like the CME Group’s FedWatch tool expecting a 69.7 percent chance of a rate hike on Wednesday. In the events leading up to the latest rate decision, the central bank has been offering the media sound bytes with increasingly dovish tones.

With rate hikes taking a toll on emerging markets ETFs, it could be the trigger event these funds need to shake out of their 2018 doldrums if the rates remain unchanged or Fed Chair Jerome Powell hints that 2019 will see less rate hikes. Moreover, a rate hike could see investors in general stay out of an already downtrodden stock market.

“If we do see a Fed hike this week, from an emotional standpoint many investors may move to the sidelines,” said ETF Trends Publisher Tom Lydon during CNBC’s “Closing Bell” segment on Monday.

Nonetheless, investors’ actions are speaking louder, particularly in the ETF space. From a year-to-date standpoint, capital has been flowing into ETFs to the tune of $280 billion with a total of $3.52 trillion total assets sitting in ETFs.