Key Takeaways

- It remains rare for two peer ETFs to have identical holdings.

With more than 2,000 ETFs to consider, investors need to look inside the portfolio to understand what they do and do not own.

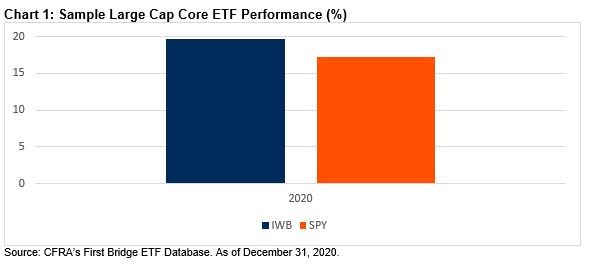

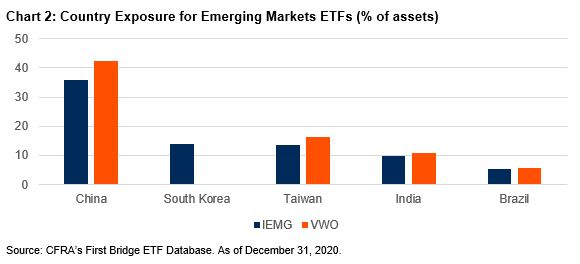

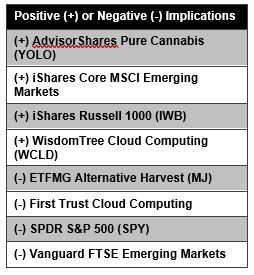

With more than 2,000 ETFs to consider, investors need to look inside the portfolio to understand what they do and do not own. - For example, market-cap weighted iShares Russell 1000 ETF (IWB) outperformed larger equity peer ETFs SPDR S&P 500 (SPY) and iShares Core MSCI Emerging Markets ETF (IEMG) outperformed Vanguard FTSE Emerging Markets ETF (VWO) by more than 300 basis points in 2020.

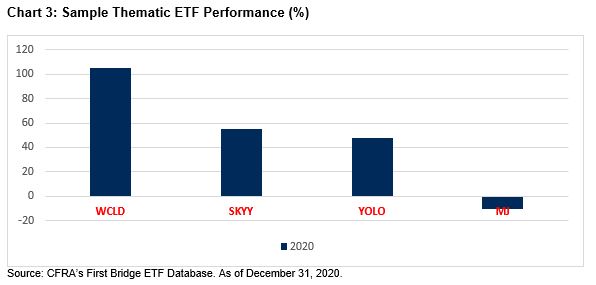

- The performance gap was even wider between similar sounding thematic ETFs. AdvisorShares Pure Cannabis ETF (YOLO) and WisdomTree Cloud Computing ETF (WCLD) beat certain larger peers by more than 5,000 basis points in 2020.

Fundamental Context

In the last 28 years, the U.S. ETF industry swelled to nearly $6 trillion in assets and more than 2,000 products. While the first ETF, SPY, remains the largest, investors are overwhelmed by the sheer number of ETFs providing exposure to broad and narrow segments of the equity, fixed income, and commodity markets. In rare instances, two ETFs will have identical portfolios, such as SPDR Portfolio S&P 500 ETF (SPLG) and SPY or Invesco QQQ Trust (QQQ) and Invesco NASDAQ 100 ETF (QQQM). When this occurs, we think costs and liquidity matter most. However, much of the time when an investor is choosing between ETFs, what is inside is highly important. Therefore, CFRA’s ETF star ratings incorporate proprietary holdings-level analysis with relative performance and cost metrics to identify what funds are positioned to likely outperform in the future.

U.S. large-cap core funds are not all the same. Despite a first quarter 2020 correction, the stocks inside SPY recovered quickly last year and finished the year up 17%. Investors should be pleased on an absolute basis, but large-cap core peer IWB climbed an even higher 20%, aided in part by longer-term ownership of Tesla (TSLA 845 ***) that was first added to SPY in December. As of late January, IWB had slightly more exposure to Information Technology and less in Consumer Discretionary due to the distinct inclusion criteria. CFRA favored SPY over IWB at the start of 2021.

Emerging markets are in the eye of the index provider. VWO ended 2020 with $71 billion in assets, narrowly ahead of IEMG’s $69 billion, but the gap narrowed due to relative flow trends and performance. VWO incurred higher net outflows last year ($3.2 billion vs. $570 million), while generating a 12.5% gain — lagging by approximately 300 basis points.

VWO tracks a FTSE Russell index and ended 2020 with approximately 43% of fund assets in China and 17% in Taiwan, a higher weighting than IEMG’s 36% and 14%, respectively. However, the major difference between the two ETFs is South Korea. IEMG tracks an MSCI index and had a 14% stake in the country, led by technology heavyweight Samsung Electronics. In contrast, VWO had no exposure to South Korea as the country is classified by FTSE Russell as a developed and not an emerging market. Both ETFs earn CFRA three-star ratings.

The performance gap widens when considering thematic ETFs. Over the past decade, asset managers have launched many funds focused on longer-term investment themes such as cloud computing and cannabis. Yet, while these ETFs often sound like they should perform in line with one another, they do not because they are built differently and own distinct securities.

For example, First Trust Cloud Computing ETF (SKYY) rose what would seem to be an impressive 55% in 2020, unless it was compared to the 105% gain for peer WCLD. Meanwhile, investors might presume cannabis was a poor investment last year if they focused on the 10% loss for the approximately $950 million ETFMG Alternative Harvest ETF (MJ 19 *). Yet, $160 million cannabis peer YOLO rose 48%, highlighting the largest fund in a style is not necessarily the best performer.

Conclusion

For the last four years, CFRA presented at the opening session at the well-attended Inside ETFs conference the importance of looking inside an ETF when conducting due diligence. While the 2021 event has been postponed, due to Covid-19, the message remains important. ETFs sounding like they provide the same exposure usually do not; buying the cheapest or the largest ETF will not necessarily be the best decision; and investors should not simply choose whichever ETF performed the best over the past year or three.

Rather, CFRA clients can use our ETF ratings and tools, focused in part on what is inside the fund, to help sort through the growing universe and make better-informed decisions.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.