Navigating emerging markets (EM) can already be a risky affair with equities, but it could even be more so with bonds, which could warrant an active approach.

Sure, fixed income investors can do all the analysis themselves, but there are a plethora of nuances tied to EM bonds, and they can turn a trying task to a seemingly impossible one quickly given the vast universe of EM bond options.

“Individual EM bonds can each have unique characteristics and considerations, such as whether its issued in hard versus local currency, if it’s from a sovereign, quasi-sovereign, or corporate issuer, its coupon and maturity dates, whether its recently issued (on-the-run) versus an older issuance (off-the-run), and more,” ETF provider Global X noted on their website. “Each of these characteristics can affect their risk and return profiles, which ought to be considered by a manager.”

An Active Fund to Consider

Rather than do all the heavy lifting yourself with EM bonds, you can turn to ETFs that can handle the legwork. One such fund from Global X is the Global X Emerging Markets Bond ETF (EMBD).

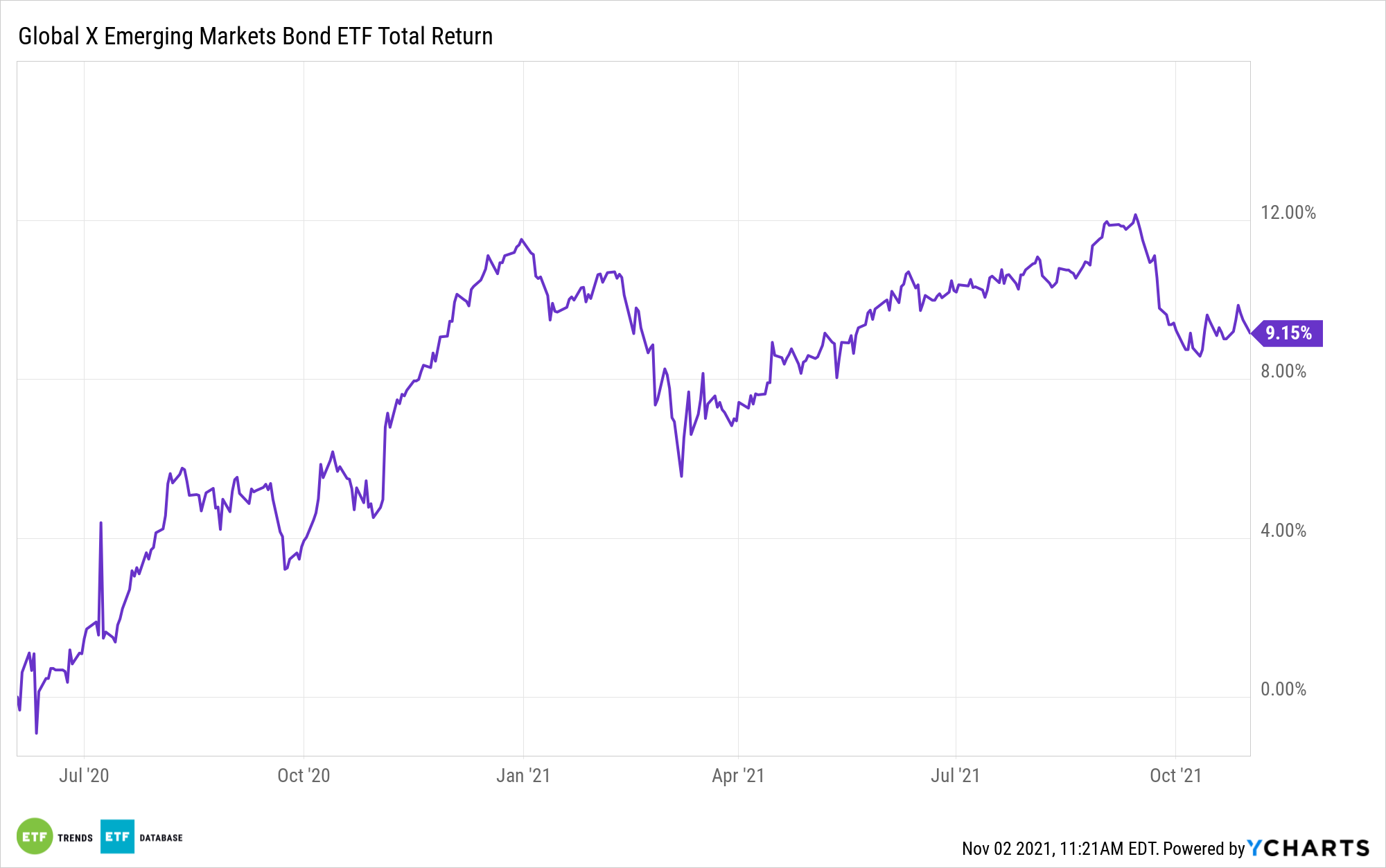

EMBD is an actively managed fund sub-advised by Mirae Asset Global Investments (USA) LLC that seeks a high level of total return, consisting of both income and capital appreciation, by investing in emerging market debt. EMBD primarily invests in emerging market debt securities denominated in U.S. dollars; however, the fund may also invest in those denominated in applicable local foreign currencies.

Securities may include fixed-rate and floating-rate debt instruments issued by sovereign, quasi-sovereign, and corporate entities from emerging market countries. This can add a touch of diversification to an investor’s core bond portfolio.

EMBD gives investors:

- Experienced portfolio managers: EMBD’s portfolio managers have extensive track records in actively managed emerging market debt strategies.

- Competitive cost: At a 0.39% total expense ratio, EMBD offers the outperformance potential and risk management of active portfolio managers, at a competitive cost.

- High yield potential: By targeting emerging market debt securities, EMBD aims to offer high yields with low correlations to other fixed income securities.

“Seeking a high level of total return consisting of both income and capital appreciation, EMBD’s portfolio managers incorporate both top-down macro views consistent with the firm’s Investment Committee and bottom-up fundamental research to evaluate the investment attractiveness of select countries and companies that are believed to offer superior risk-adjusted returns,” Global X said. “The portfolio managers determine country allocation primarily based on economic indicators, industry structure, terms of trade, political environment and geopolitical issues.”

For more news, information, and strategy, visit the Thematic Investing Channel.