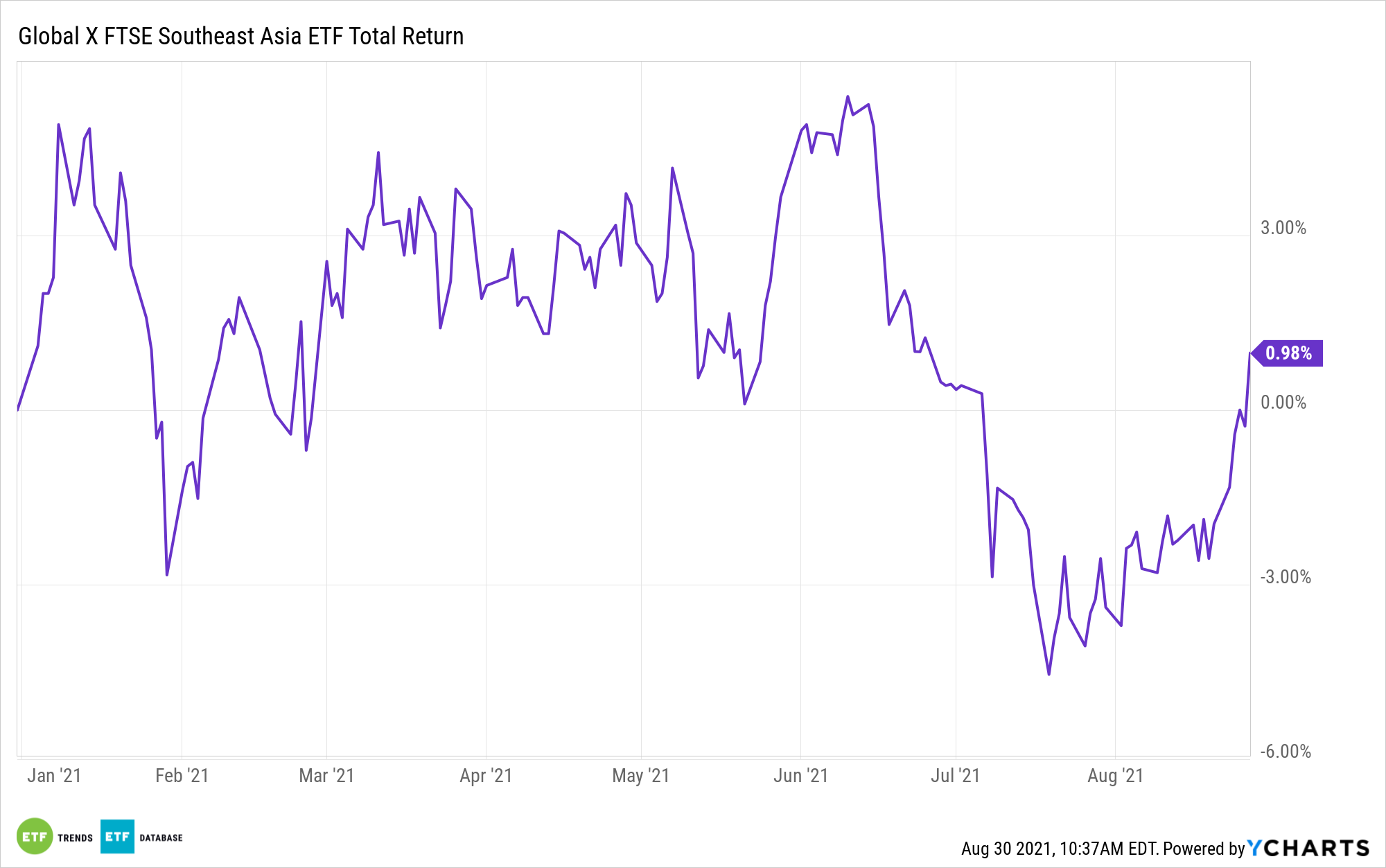

The green push can extrapolate investment gains from Southeast Asia, particularly the Global X FTSE Southeast Asia ETF (ASEA) and the Global X CleanTech ETF (CTEC).

“Southeast Asia stands to reap $12.5 trillion in economic gains by 2070 if it takes urgent moves to slow climate change, while inaction could yield losses more than double that size, according to the Deloitte Economics Institute,” a Bloomberg report said.

“The region’s gross domestic product could grow by an average of 3.5% per year over the next five decades if it nurtures industries and technologies to keep global average warming to around 1.5 degrees Celsius, compared to a baseline scenario of climate inaction, Deloitte said in a report Monday (August 23),” the report added.

ASEA seeks to provide investment results that correspond generally to the price and yield performance of the FTSE/ASEAN 40 Index. The underlying index tracks the equity performance of the 40 largest and most liquid companies in the five Association of Southeast Asian Nations (“ASEAN”) regions: Singapore, Malaysia, Indonesia, Thailand, and the Philippines.

ASEA fund highlights:

- Efficient access: Efficient access to a broad basket of Southeast Asian securities.

- Targeted exposure: The fund targets exposure to a specific region.

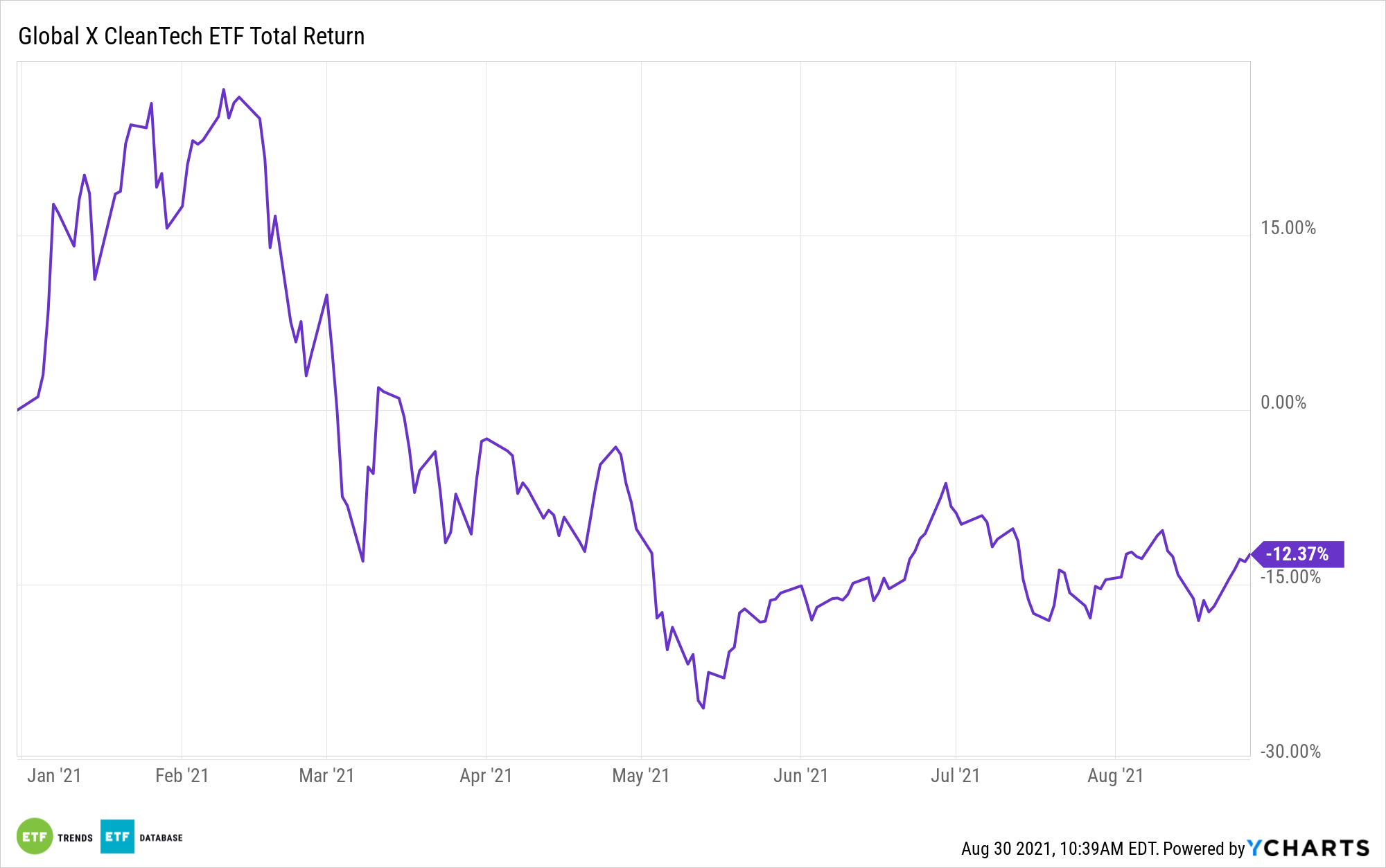

A Clean Energy Tech Play

If the region can make the green shift successfully, it will need the help of clean energy tech. This is where a fund like CTEC comes into play.

At a 0.50% expense ratio, CTEC seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global CleanTech Index. The fund invests at least 80% of its total assets, plus borrowings for investments purposes, in the securities of the index and in ADRs and GDRs based on the securities in the index.

The index is designed to provide exposure to exchange-listed companies that are positioned to benefit from the increased adoption of technologies focused on improving the efficiency of renewable energy production and/or mitigating the adverse environmental effects of resource consumption. Overall, the fund gives investors exposure to:

- High growth potential: CTEC enables investors to access high growth potential through companies at the leading edge of a structural shift in global energy use.

- An unconstrained approach: CTEC’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF efficiency: In a single trade, CTEC delivers access to dozens of companies with high exposure to the clean tech theme.

For more news and information, visit the Thematic Investing Channel.