As the global ETF marketplace continues to grow exponentially, one of the sub-markets experiencing rapid growth is the thematic space.

Thematic ETFs can help give portfolios an added dose of diversification. The question becomes, “where to start?” One great way to parse the vast array of thematic ETFs is to narrow in on top-performing funds from Global X.

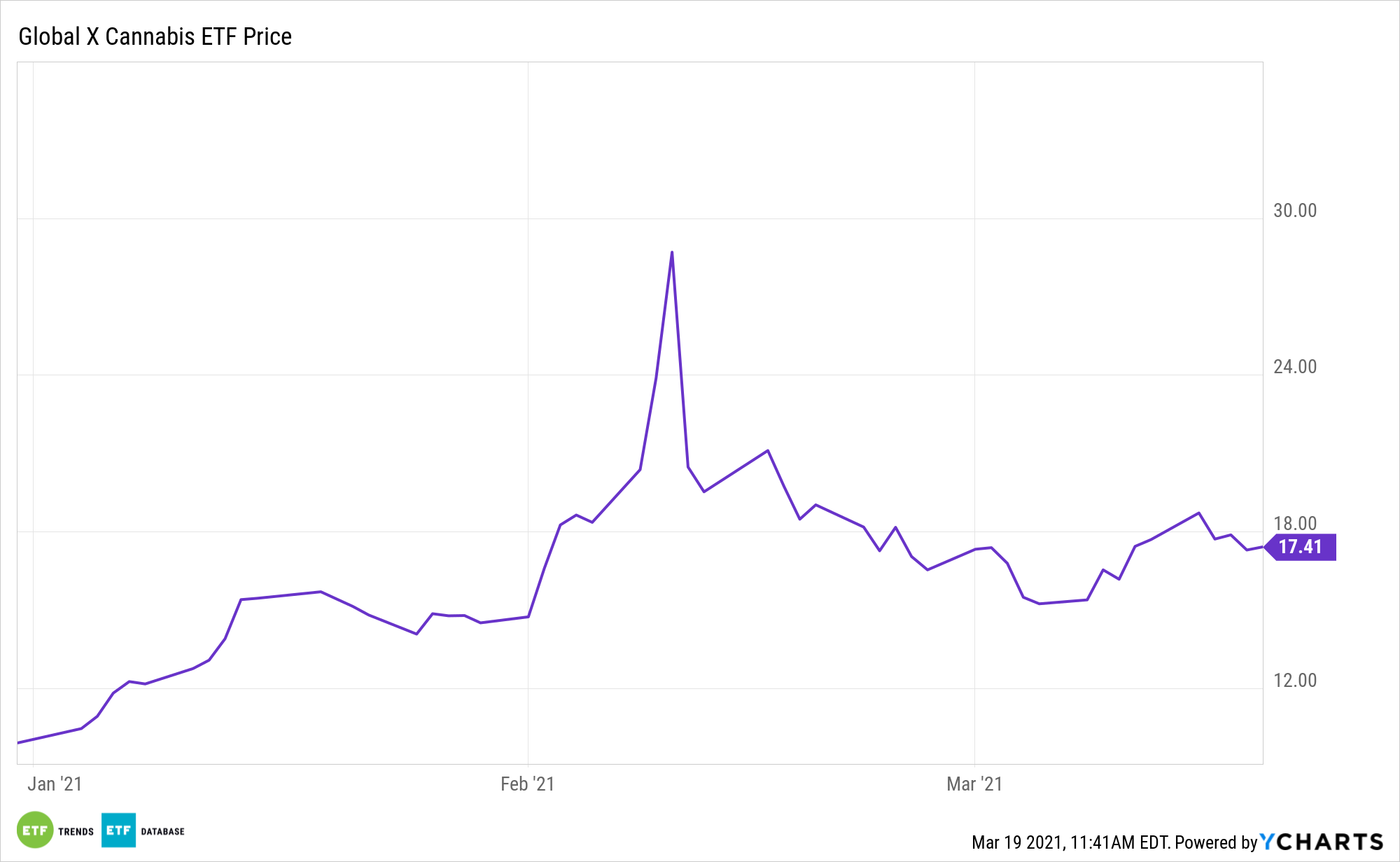

1. Global X Cannabis ETF (POTX): Up 75% YTD

POTX seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Cannabis Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (ADRs) and Global Depositary Receipts (GDRs) based on the securities in the underlying index.

The underlying index is designed to provide exposure to exchange-listed companies that are active in the cannabis industry, as defined by Solactive AG, the provider of the underlying index. Overall, POTX gives investors access to:

- High Growth Potential: POTX enables investors to access a basket of high growth potential companies from across the cannabis industry.

- An Unconstrained Approach: POTX’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, POTX delivers targeted access to dozens of companies with significant exposure to the cannabis theme.

2. Global X MLP ETF (MLPA): Up 19% YTD

MLPA seeks to replicate a benchmark that offers exposure the overall performance of the United States master limited partnerships (MLP) asset class. MLPs have become very popular in recent years for primarily two reasons: (1) required quarterly distributions provide a steady stream of current income, and (2) because they are partnerships, MLPs avoid corporate income taxes at both the federal and state level as the the tax liability is passed through to the individual partners.

By generating at least 90% of income from natural resource-based activities such as transportation and storage, an entity can qualify as an MLP and not be taxed as a corporation. So the IRS treats shareholders of an MLP as partners, making the MLP itself a pass-through entity, which means that investors avoid the double taxation of income.

3. Global X Copper Miners ETF (COPX): Up 21% YTD

COPX seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Copper Miners Total Return Index, which is designed to measure broad-based equity market performance of global companies involved in the copper mining industry.

COPX gives investors:

- Targeted Exposure: COPX is a targeted play on copper mining.

- ETF Efficiency: In a single trade, COPX delivers efficient access to a basket of companies involved in the mining of copper.

For more news and information, visit the Thematic Investing Channel.