China is facing its own energy crisis, which is causing the prices of utilities to also spike — as such, Global X has a pair of ETFs that investors will want to watch.

“China’s curbs on carbon-intensive industries and the ensuing energy crisis have scrambled supply and demand calculations for some of the world’s key commodities, sending prices on a wild ride that market players say may not yet be over,” a Nikkei Asia article said.

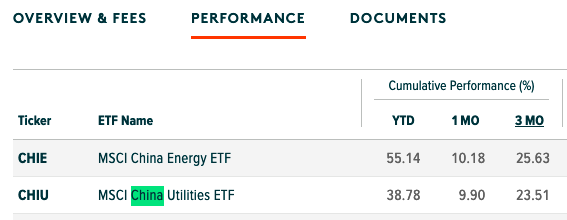

In the meantime, the Global X MSCI China Utilities ETF (CHIU) is up 26% the past few months while the Global X MSCI China Energy ETF (CHIE) has risen by 24%. Year-to-date gains are also strong for both funds, with the former at 55% and the latter at almost 40%.

CHIU seeks to provide investment results that correspond generally to the price and yield performance (before fees and expenses) of the MSCI China Utilities 10/50 Index. The underlying index tracks the performance of companies in the MSCI China Index that are classified in the utilities sector, as defined by the index provider.

CHIU gives investors:

- Targeted exposure: CHIU is a targeted play on the energy sector in China, the world’s second-largest economy by GDP.

- ETF efficiency: In a single trade, CHIU delivers access to dozens of energy companies within the MSCI China Index, providing investors with an efficient vehicle to express a sector view on China.

- All share exposure: The index incorporates all eligible securities as per MSCI’s Global Investable Market Index Methodology, including China A, B, and H shares, red chips, P chips, and foreign listings, among others.

A Bet on China Energy

CHIE seeks to provide investment results that correspond generally to the price and yield performance (before fees and expenses) of the MSCI China Energy IMI Plus 10/50 Index. The underlying index tracks the performance of companies in the MSCI China Investable Market Index that are classified in the energy sector, as defined by the index provider.

CHIE gives investors:

- Targeted exposure: CHIE is a targeted play on the energy sector in China, the world’s second-largest economy by GDP.

- ETF efficiency: In a single trade, CHIE delivers access to dozens of energy companies within the MSCI China Investable Market Index, providing investors an efficient vehicle to express a sector view on China.

- All share exposure: The index incorporates all eligible securities as per MSCI’s Global Investable Market Index Methodology, including China A, B, and H shares, red chips, P chips, and foreign listings, among others.

For more news, information, and strategy, visit the Thematic Investing Channel.