For cost-conscious investors, getting single country exposure to China doesn’t have to come at a premium price. The Global X MSCI China Large-Cap 50 ETF (CHIL) offers investors a low-cost solution to a top-performing ETF.

The fund is up over 30% within the past year as it continues a checkmark-style recovery following the pandemic sell-offs back in March 2020. As China’s economy is in full recovery mode, look for more strength in the ETF.

CHIL seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Top 50 Select Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index, which is designed to select the 50 largest equity securities, by free-float market capitalization, of the eligible China equity universe, as defined by the index provider.

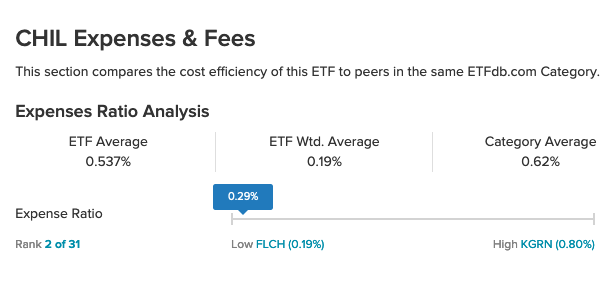

CHIL’s expense ratio comes in at 0.29%, which is 50% lower than its categorical average. For half the price, ETF investors can still outperform.

Overall, CHIL gives investors:

- Targeted Exposure: CHIL offers large cap exposure to China, the world’s second largest economy by GDP.

- ETF Efficiency: In a single trade, CHIL delivers access to a broad basket of 50 large cap Chinese securities.

- All Share Exposure: The Index incorporates all eligible securities as per MSCI’s Global Investable Market Index Methodology, including China A, B and H shares, Red chips, P chips and foreign listings, among others.

China Seeking Heavier Reliance on Domestic Demand

As a CNBC article noted, the second largest economy is looking to move toward more self-reliance as “Chinese authorities have been trying to increase the economy’s reliance on domestic demand, rather than more traditional growth drivers such as investment. For 2020, consumption accounted for 54.3% of GDP, Ning Jizhe, commissioner of the National Bureau of Statistics, told reporters Friday. That’s lower than 57.8% of GDP that was initially reported for 2019.”

“Bruce Pang, head of macro and strategy research at China Renaissance, expects retail sales will pick up in 2021, rising more than 10% from the prior year’s subdued levels, partly as consumers spend excess savings from 2020,” the article added further.

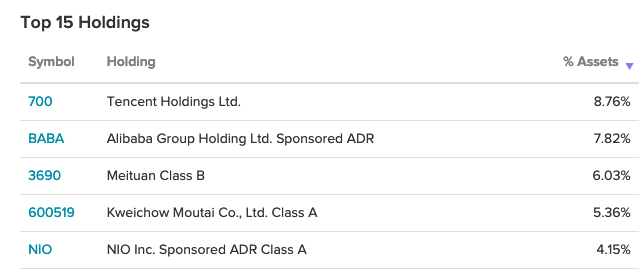

CHIL includes heavy hitters in the China tech industry. Names like Tencent Holdings (up 60% the past year) and Alibaba Group (up 15% the past year) are two prominent examples.

For more news and information, visit the Thematic Investing Channel.