The consumer staples sector doesn’t have the pizazz of the tech sector, but just because it doesn’t boast the latest iPhone doesn’t mean it should be avoided. With Congress still mulling over a stimulus deal amid the Covid-19 pandemic, consumer staples exchange-traded funds (ETFs) could be the beneficiary of future gains.

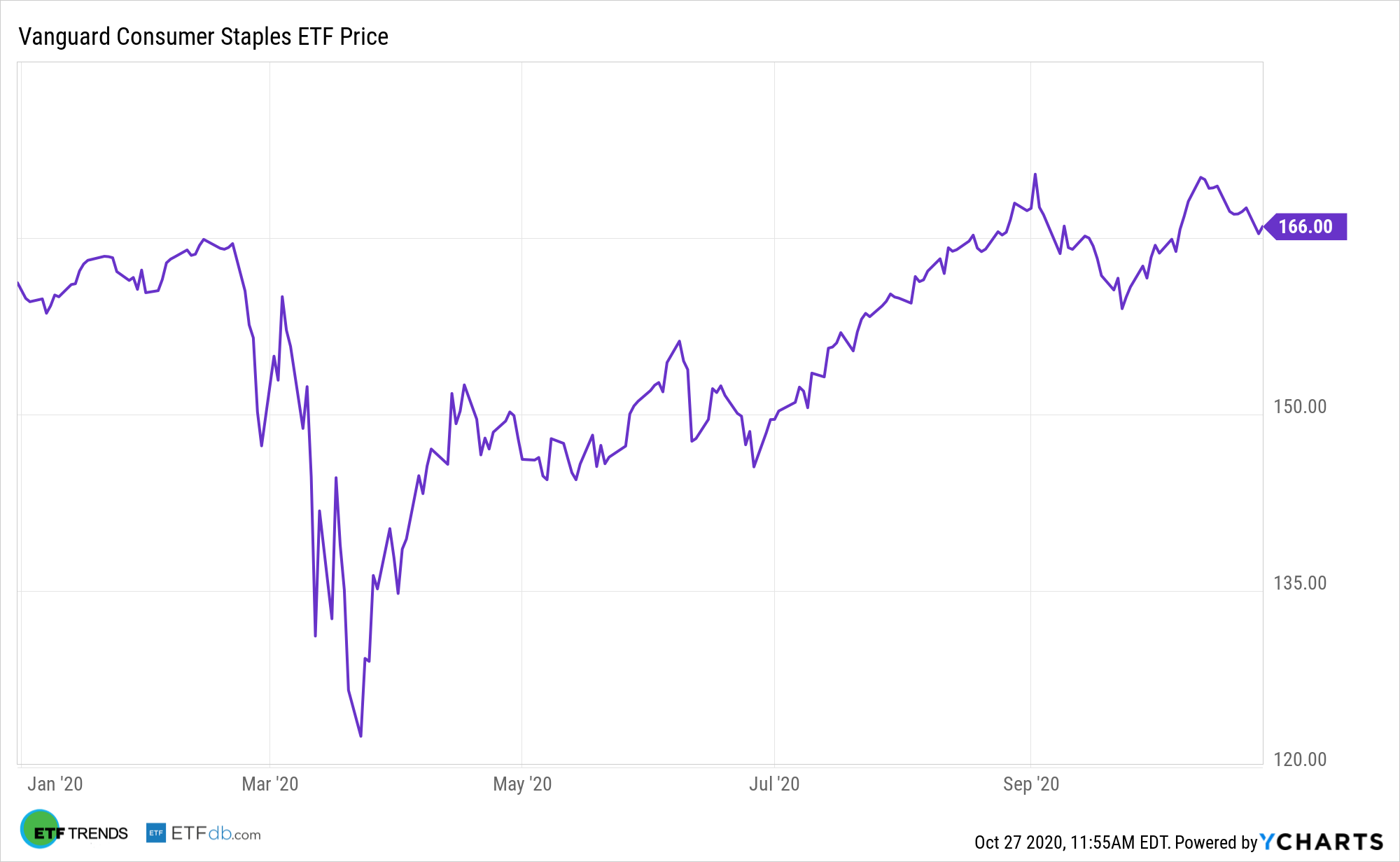

That said, one fund to look at is the Vanguard Consumer Staples Index Fund ETF Shares (VDC). VDC seeks to track the performance of a benchmark index.

The fund employs an indexing investment approach designed to track the performance of the MSCI US Investable Market Index/Consumer Staples 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the consumer staples sector, as classified under the Global Industry Classification Standard. The Advisor attempts to replicate the target index by seeking to invest all, or substantially all, of its assets in the stocks that make up the index, in order to hold each stock in approximately the same proportion as its weighting in the index.

As mentioned, consumer staples might not be the flashy play, but when it comes to spending money on stimulus, consumers still need to think about what they need rather than what they want. An article in Motley Fool underscores the importance of VDC:

“Consumer staples might not be exciting, but they are a reliable category,” the article noted. “Survey respondents and spending data showed that households used stimulus checks to purchase food, clothing, and basic items. Some portions of this sector are recession-proof, as they experience sustained demand even in the worst economic conditions. However, certain apparel, cosmetic, nutritional, and hygiene purchases are sacrificed during lean times, and it appears that stimulus checks have supported those categories earlier this year, as well as in previous recessions.”

“There are a ton of different ways investors can gain exposure to these stocks, but a great place to start is the Vanguard Consumer Staples ETF,” the article added. “This is a very reputable fund with plenty of AUM and trading volume to provide great liquidity and narrow bid-ask spreads. A low expense ratio and adequate 2.27% distribution ratio are also attractive. This ETF is never going to provide outrageous growth opportunity, but it does offer the rare combination of potential upside with downside protection. The stimulus bump could give a nice little bit of assistance to holders, while the non-cyclical characteristic along with quarterly distributions should reduce drawdowns while providing returns through bad market spells.”

For more market trends, visit ETF Trends.