Most economies went sideways in 2020, but some managed to fall right side up. Germany, for example, saw its economy shrink by less than expected, which is good news for the Global X DAX Germany ETF (DAX).

“Germany’s economy shrank by 5.0% in 2020, less than expected and a smaller contraction than during the global financial crisis, as unprecedented government rescue and stimulus measures helped lessen the shock of the COVID-19 pandemic,” a Reuters article said.

As for the fund, DAX seeks to provide investment results that closely correspond generally to the price and yield performance of the DAX® Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in American Depositary Receipts (ADRs) and Global Depositary Receipts (“GDRs”) based on the securities in the underlying index.

The index tracks the segment of the largest and most actively traded companies – known as blue chips – on the German equities market. Overall, DAX gives investors:

- Efficient Access: DAX offers access to 30 of the largest and most liquid publicly traded companies in Germany, spanning a wide range of economic sectors.

- Targeted Exposure: The fund provides targeted exposure to Germany, the largest economy in Europe by GDP.

- Low-Cost Access: A net expense ratio of just 0.21%

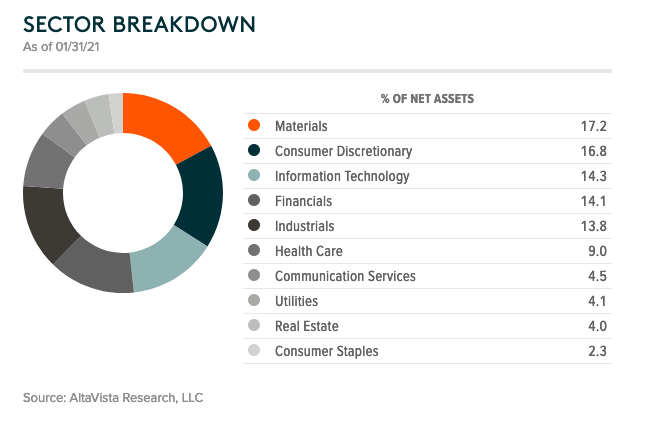

Almost 75% of the fund’s net assets are in materials, consumer discretionary, information technology, financials, and industrials.

Eurozone’s Top Economy Absorbs The Shock

As mentioned, Germany absorbed the economic shock of Covid-19 better than anticipated. The government’s response to the economic effects included “liquidity aid for struggling firms, job protection schemes for employees, tax cuts and cash handouts to boost domestic demand and long-term investments in green technologies and public infrastructure,” Reuters said.

The article noted GDP contraction was “smaller than a Reuters poll forecast of -5.1% and less severe than the record -5.7% suffered in 2009, during the financial crisis. Adjusted for calendar effects, gross domestic product declined by 5.3%, the statistics office said.”

“It was actually a year of disaster, but judging by what had been feared in the course of the year, one could say we got off lightly,” LBBW analyst Uwe Burkert said.

DAX is up 11% the past year. Within the last few months, the fund has gained about 8%.

For more news and information, visit the Thematic Investing Channel.