The increase in the use of sustainable energy sources could benefit copper in the long run, raising growth prospects for copper-focused ETFs like the Global X Copper Miners ETF (COPX).

According to an S&P Global article, market experts predict that copper consumption could rise by 5% in 2021 and then fall to half that percentage the following year. However, the “medium-term” outlook remains filled with optimism as the move towards green energy is expected to fuel a demand for copper.

“The green energy transition is important, as prospects for copper use in green applications are already influencing market sentiment,” said Vanessa Davidson, CRU director of base metals research & strategy. “It’s fair to say that 2020 has been an inflection point for the industry. EV sales have been rising in all the key regions — US, Europe and China — and according to our forecasts, EVs as a share of total light duty sales, should increase from around 7% this year to nearly 30% by 2030.”

The article also noted that CRU’s forecast “estimated that green application would consume 1.2 million mt of refined copper in 2021, representing 5% of the world total, she said. This was forecast to rise to 10% by 2025 and 20% in 2030, which was equivalent to nearly 6 million mt of refined copper.”

Copper supply is also expected to recover after 2020 saw a decrease in production at mines. CRU estimates that a growth of 6% could occur in 2021, but then be followed by a fall 3% in 2022.

“In the short-term, supply is expected to be sufficient for demand due to new projects, but it will be insufficient to enable industry stocks to rise from presently low levels,” Davidson said.

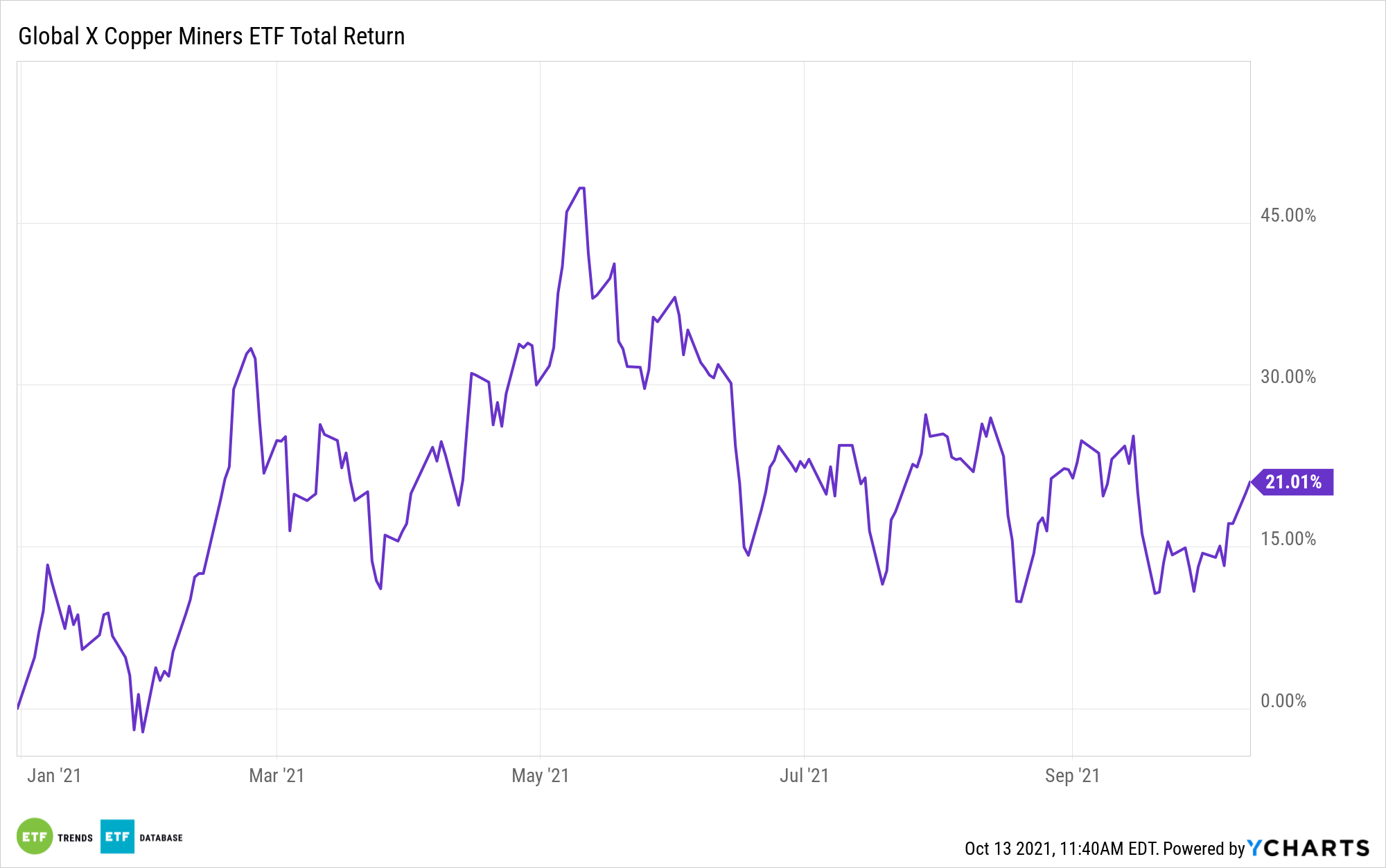

Up 21% on the Year

COPX allows ETF investors to bet on copper without having to play prices directly via miners. According to Morningstar performance figures, the ETF is up about 21% for the year.

COPX seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Copper Miners Total Return Index, which is designed to measure the broad-based equity market performance of global companies involved in the copper mining industry.

COPX provides investors with:

- Targeted exposure: COPX is a targeted play on copper mining.

- ETF efficiency: In a single trade, COPX delivers efficient access to a basket of companies involved in the mining of copper.

For more news, information, and strategy, visit the Thematic Investing Channel.