The trillion-dollar infrastructure bill moves beyond traditional infrastructure assets to the internet, which means stronger security measures are necessary to safeguard user information. The Global X Cybersecurity ETF (BUG) is a strong place to start.

“The United States faces a growing education gap due to digital inequity, mounting cyberattacks that threaten its economy and national security, and the mounting impacts of climate change,” a Global X blog post said. “If enacted into law, the bipartisan bill would move the needle on addressing these threats, investing over $100B across digital infrastructure areas like broadband and cybersecurity and in physical infrastructure resilience.”

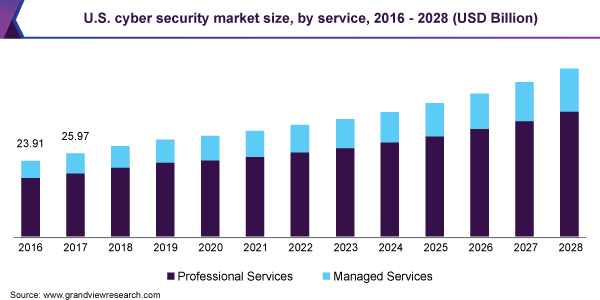

Just to show the magnitude of how cybersecurity growth will look like in the coming years, Grand View Research noted that the global cyber security market was valued at $167.13 billion in 2020 and is expected to register a compound annual growth rate (CAGR) of 10.9% between the years 2021 to 2028.

With those kinds of growth prospects, the trillion-dollar infrastructure plan is ready to pour copious amounts of capital into the cybersecurity market.

“The bill dedicates $50B of proposed new spending to bolstering the country’s resilience to cyberattacks, both broadly and specifically for infrastructure related to transportation, electric grids, and water infrastructure,” the blog post added. “It also allocates funds from this amount to improving the resilience of physical infrastructure to the impacts of climate change.”

BUG Is Gaining Steam

BUG has been rising the past few months—a gain of 14% on the back of the infrastructure plan pushing through the Senate. Next up, it faces an uphill battle as the bill is up for vote in the House of Representatives.

Nonetheless, as the federal government looks to build up digital infrastructure, it realizes that bolstering cybersecurity is imperative. The BUG fund seeks to provide investment results that generally correspond to the price and yield performance, before fees and expenses, of the Indxx Cybersecurity Index.

BUG gives investors:

- High Growth Potential: BUG enables investors to access high growth potential through companies that are positioned to benefit from the rising importance and increased adoption of cybersecurity technology.

- An Unconstrained Approach: The ETF’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, BUG delivers access to dozens of companies with high exposure to the cybersecurity theme.

For more news and information, visit the Thematic Investing Channel.