More companies are starting to make room for artificial intelligence (AI) in their budgets. One way to play the AI boom is the Global X Artificial Intelligence & Technology ETF (AIQ).

The use of AI only proliferated during the pandemic as social distancing measures forced companies to re-think their workforces and operations.

“Technology needs are rapidly changing in the wake of the pandemic,” an article said in the Motley Fool. “New challenges like remote workforces, talent shortages, and an accelerated need to build more digital-first systems have many organizations scrambling to update their operations.”

As a result of this scramble for more AI, companies may be becoming more willing to open up their wallets and front the costs for the technology.

“Artificial intelligence software can automate these new processes, and help companies keep up with the fast-changing world we live in,” the article said further. “As a result, tech researcher Gartner expects global spending on ‘hyperautomation’ (read: AI software and systems) to reach nearly $600 billion in 2022, up from about $530 billion this year.”

Capturing Growth Potential with AI

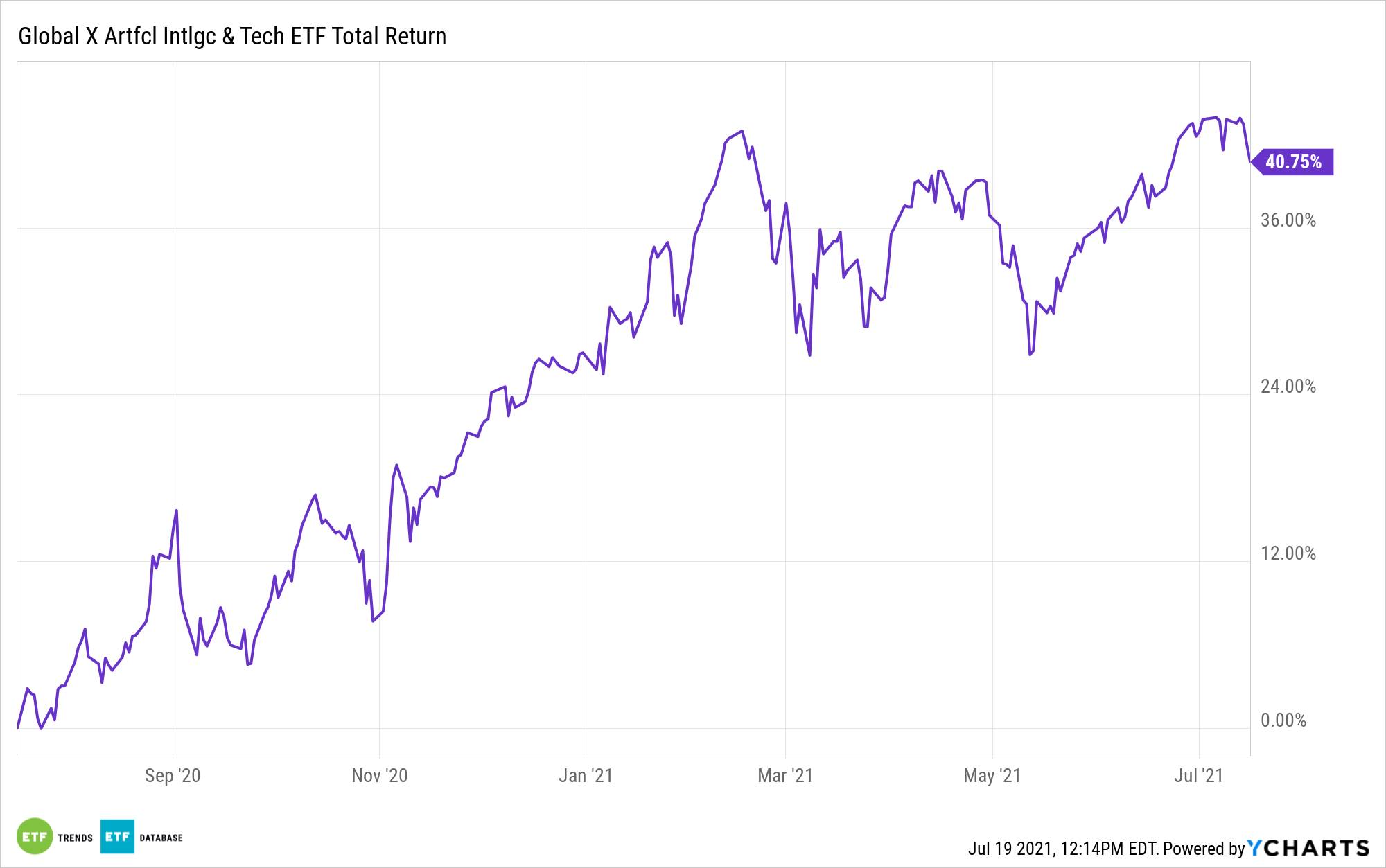

While value has been leading the way for most of 2021, growth is starting to re-take the lead and one way. One avenue for capturing it is the AIQ ETF.

With its 0.68% expense ratio, AIQ seeks to provide investment results that correspond generally to the price and yield performance of the Indxx Artificial Intelligence and Big Data Index. The fund invests at least 80% of its total assets in the securities of the underlying index, which is designed to track the performance of companies involved in the development and utilization of artificial intelligence and big data.

AIQ offers investors:

- High Growth Potential: AIQ enables investors to access high growth potential through companies involved in the development and utilization of artificial intelligence and big data technologies.

- An Unconstrained Approach: AIQ’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, AIQ delivers access to dozens of companies with exposure to the artificial intelligence and big data themes.

For more news and information, visit the Thematic Investing Channel.