It’s been an interesting past week in the capital markets, but not all the action was in GameStop. Thematic ETF provider Global X saw some strong inflows in its gaming ETF, along with interest in autonomous driving and lithium.

Here are three Global X funds with the highest inflows the past week:

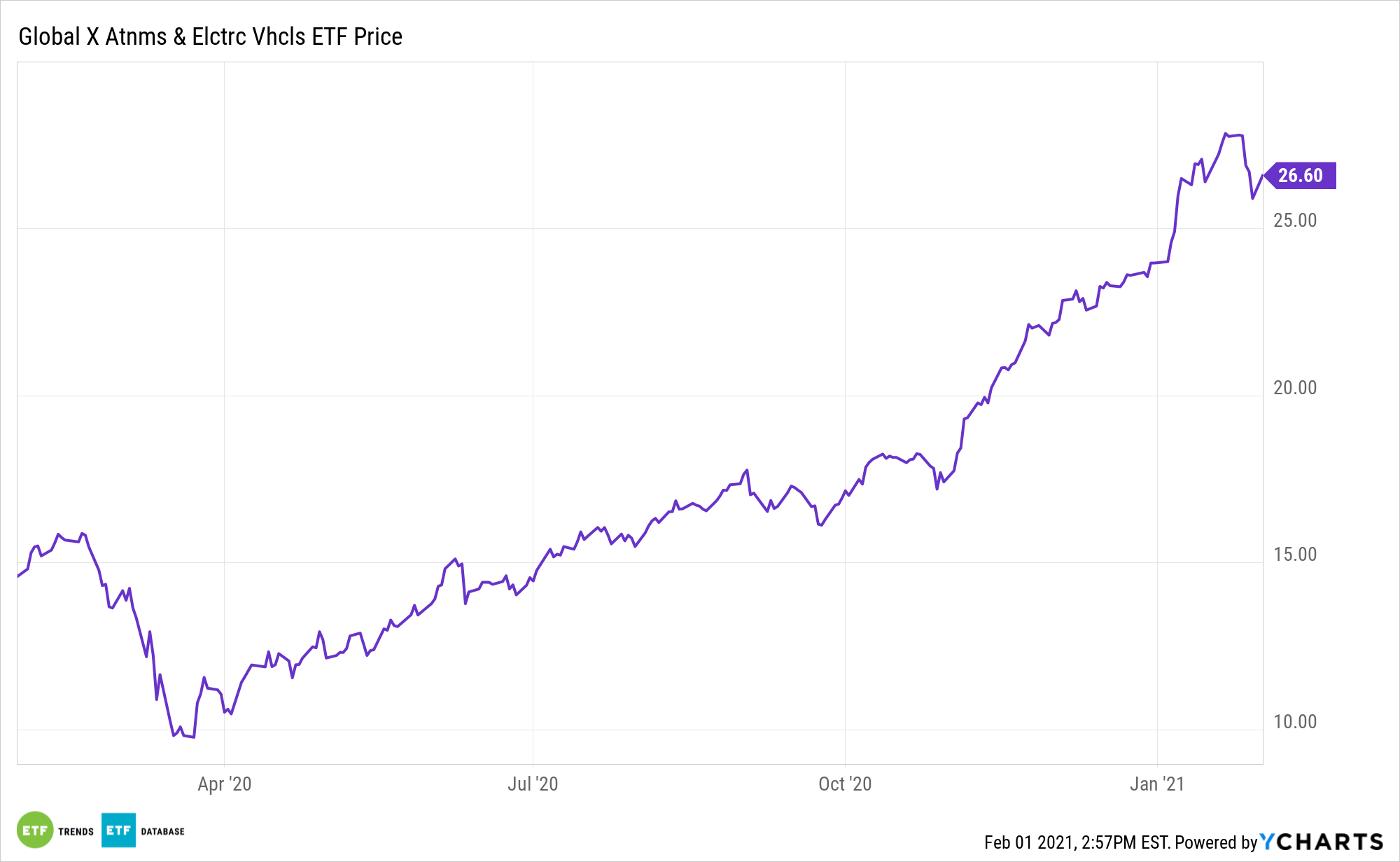

Global X Autonomous & Electric Vehicles ETF (DRIV): DRIV seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials. This includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

DRIV seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Autonomous & Electric Vehicles Index. The fund offers:

- High Growth Potential: DRIV enables investors to access high growth potential through companies critical to the development of autonomous and electric vehicles – a potentially transformative economic innovation.

- An Unconstrained Approach: DRIV’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging technological theme.

- ETF Efficiency: In a single trade, DRIV delivers access to dozens of companies with high exposure to the autonomous and electric vehicles theme. Having the disruptive automotive industry in an ETF wrapper also gives traders access to short-term market maneuvers in this sub-sector.

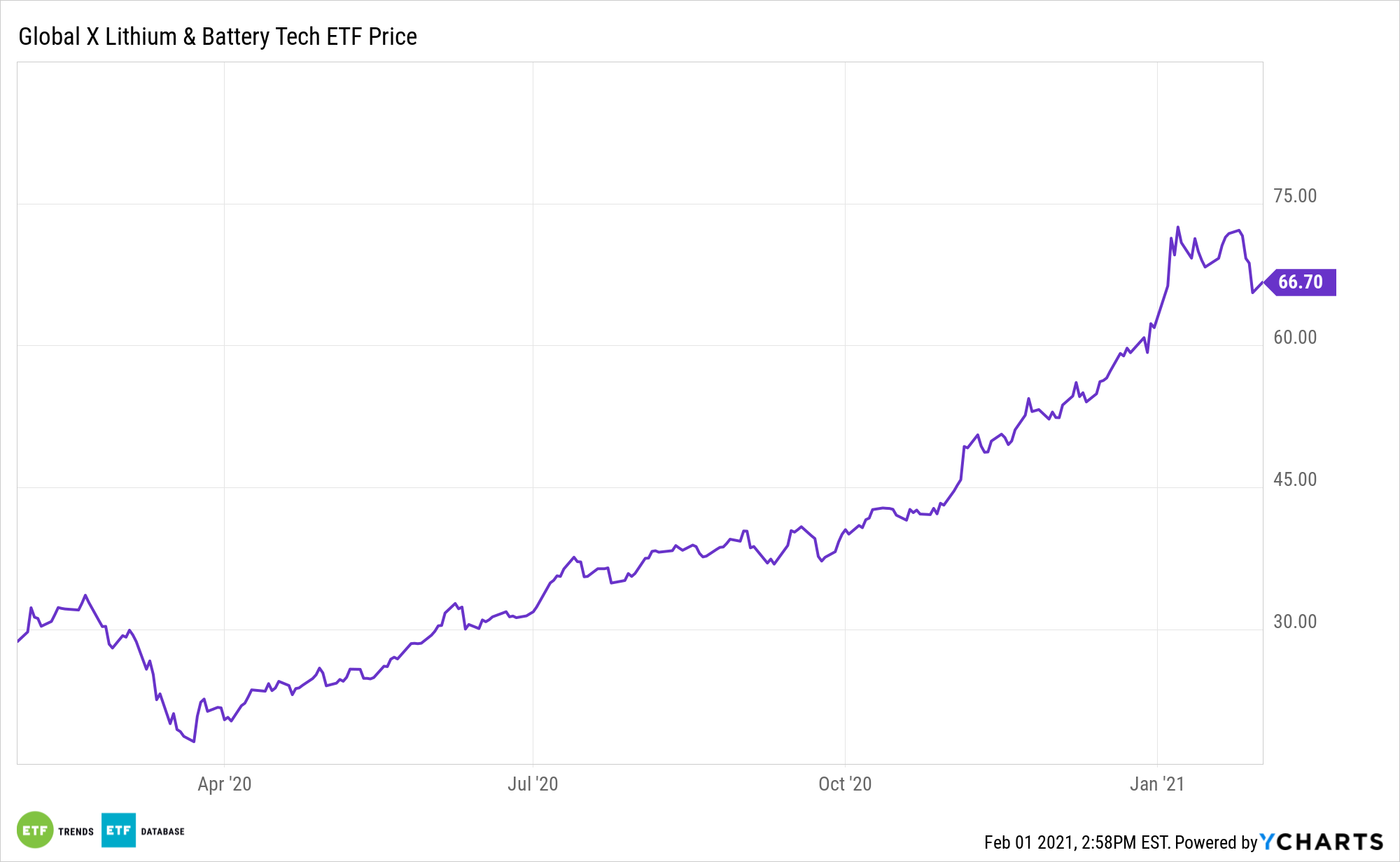

Global X Lithium & Battery Tech ETF (LIT): LIT seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry. LIT gives investors:

- Efficient Access: LIT offers efficient access to a broad basket of companies involved in lithium mining, lithium refining, and battery production.

- Thematic Exposure: The fund is a thematic play on lithium and battery technology.

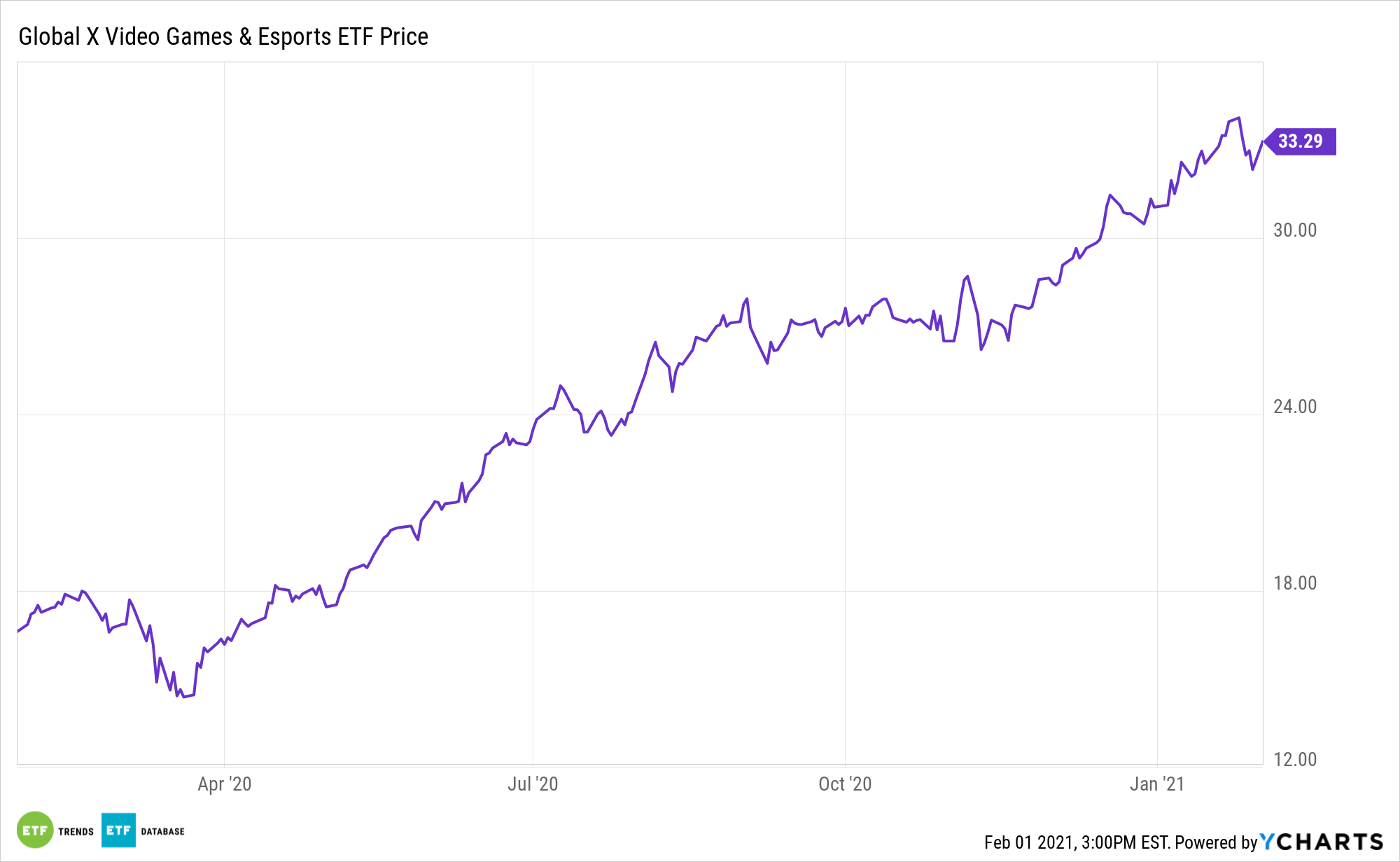

Global X Video Games & Esports ETF (HERO): HERO seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or Esports content, own and operate within competitive Esports leagues, or produce hardware used in video games and Esports, including augmented and virtual reality. It achieves this goal by providing investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Video Games & Esports Index.

For more news and information, visit the Thematic Investing Channel.