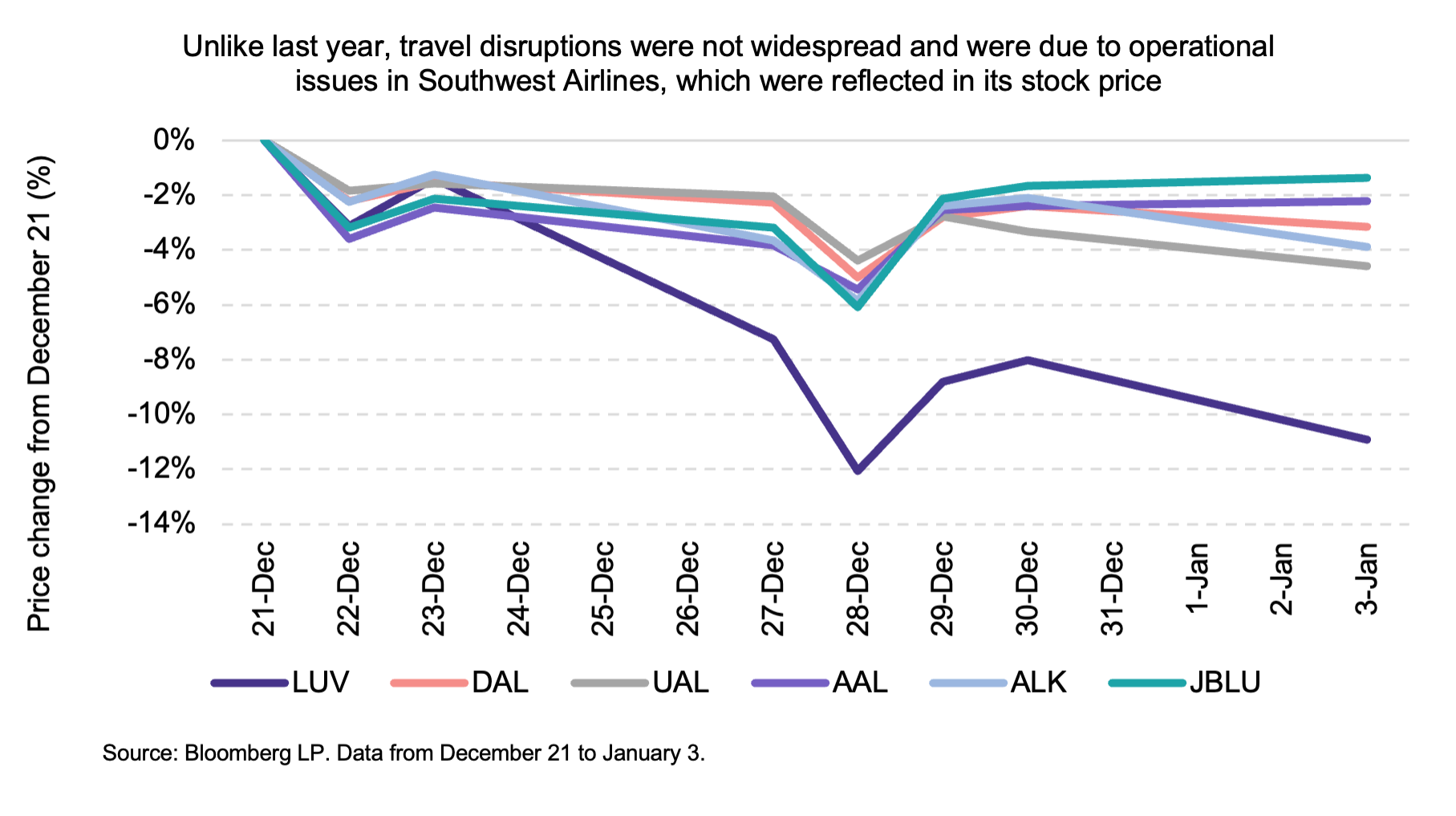

At first, the 2022 holiday travel season seemed to be a flashback to 2021—last minute flight cancellations occurred Christmas week leaving delayed flights and stranded passengers during one of the busiest travel weeks of the year. But unlike the 2021 holiday season (discussed here), these were fortunately not attributed to broader issues like aircraft supply or COVID-19 pandemic staffing issues and had little effect on travel stocks. These cancellations were mostly limited to Southwest Airlines (LUV, 3.0% index weight)—which experienced issues from its out-of-date scheduling system called SkySolver—while other U.S. airlines were still operating at normal levels. According to Flightaware, Southwest canceled over 60% of its flights at its peak during the week following Christmas, while other airlines were canceling an average amount of flights (varies by airline but ranging from 0-10%). While cancellations for Southwest recovered to only 3% of its total flights as of January 3, the stock price was still down almost 11% as investors realize that these disruptions will affect 4Q earnings results (from rebooking fees, refunds, and expense reimbursements). Other airlines, however, experienced relatively more stable price performance during this time and we do not anticipate many negative readthroughs for the airline or travel industry.

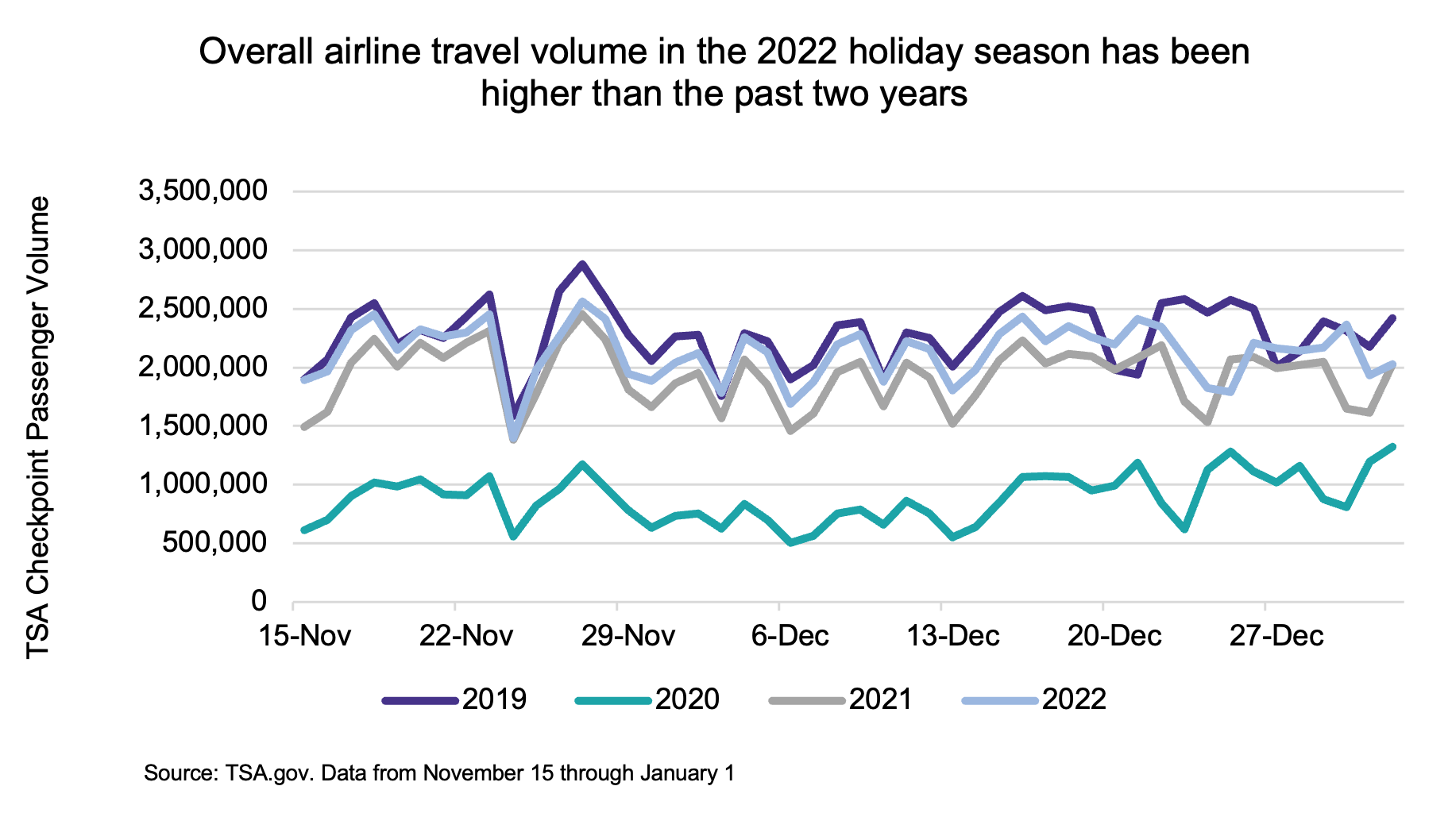

Despite the operational issues at Southwest, overall demand for travel this holiday season was actually much higher than the 2021 and 2020 holiday season. TSA checkpoint numbers show that over 2,000,000 passengers passed through TSA checkpoints from December 15 to December 30 (except for Christmas Eve and Christmas which are traditionally slower travel days). After two years of pandemic related lockdowns and cancellations, consumers were eager to celebrate the holiday season for the first time without any restrictions (see this note for more details on consumer spending this holiday season).

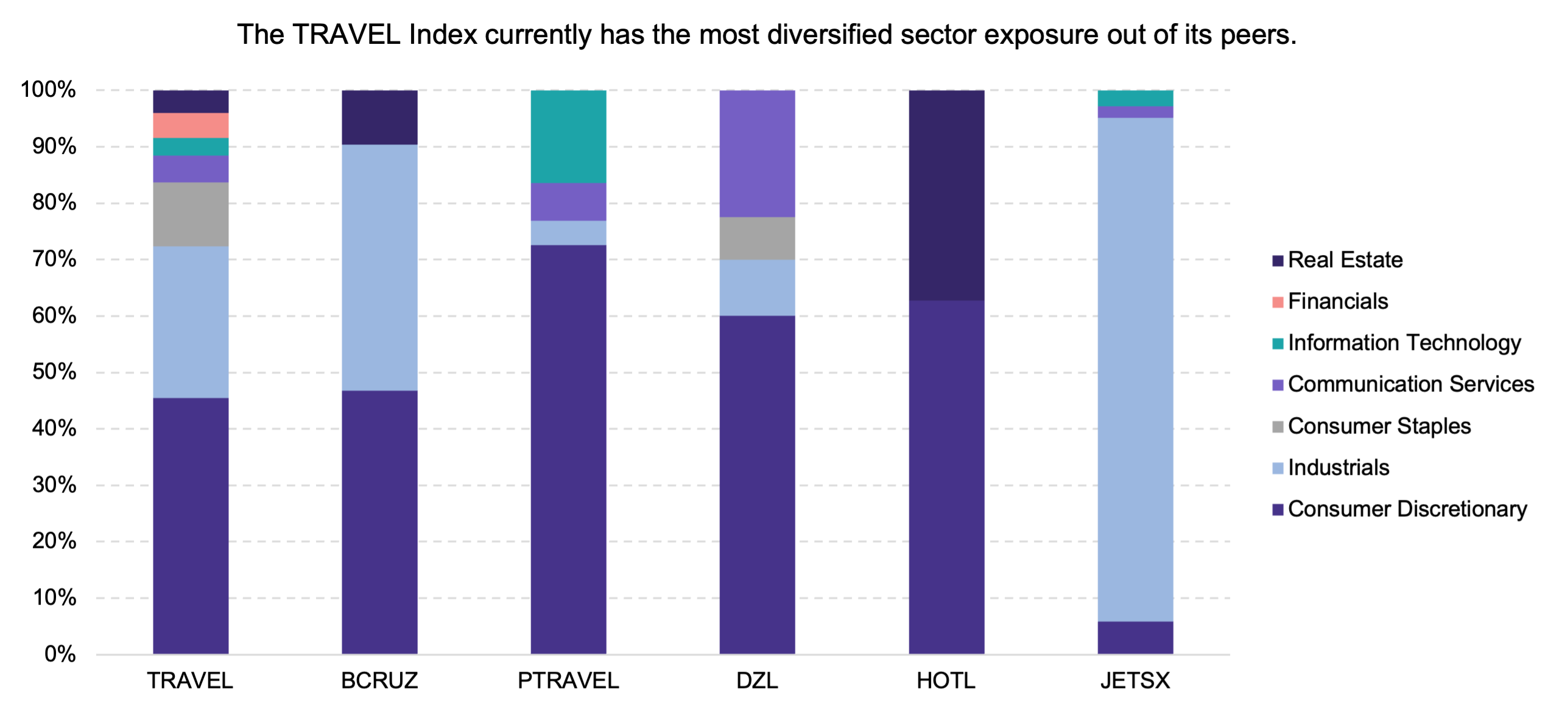

We often discuss airlines within our travel research because they serve as a leading indicator for the rest of the travel industry; however, the airlines and airport services segment makes up only around 16.9% of the index so any disruption in the airline sector may not be reflected in overall index performance. Out of the top ten constituents, (which equal 43.3% of the total index weight) none of the top ten constituents are airlines. Most are consumer-oriented sectors which will benefit from consumers continuing to spend on higher end goods, travel, and services despite inflationary pressures on more price sensitive consumers (see this note for more details on luxury spending).

Bottom Line:

While operational issues at Southwest Airlines made headlines this past week, these issues were limited to the company and not the broader airline sector. In addition, travel indexes like the S-Network Global Travel Index (TRAVEL) do not have concentrated exposure to the airline sector and are diversified with travel and leisure stocks.

For more news, information, and analysis, visit the Thematic Investing Channel.