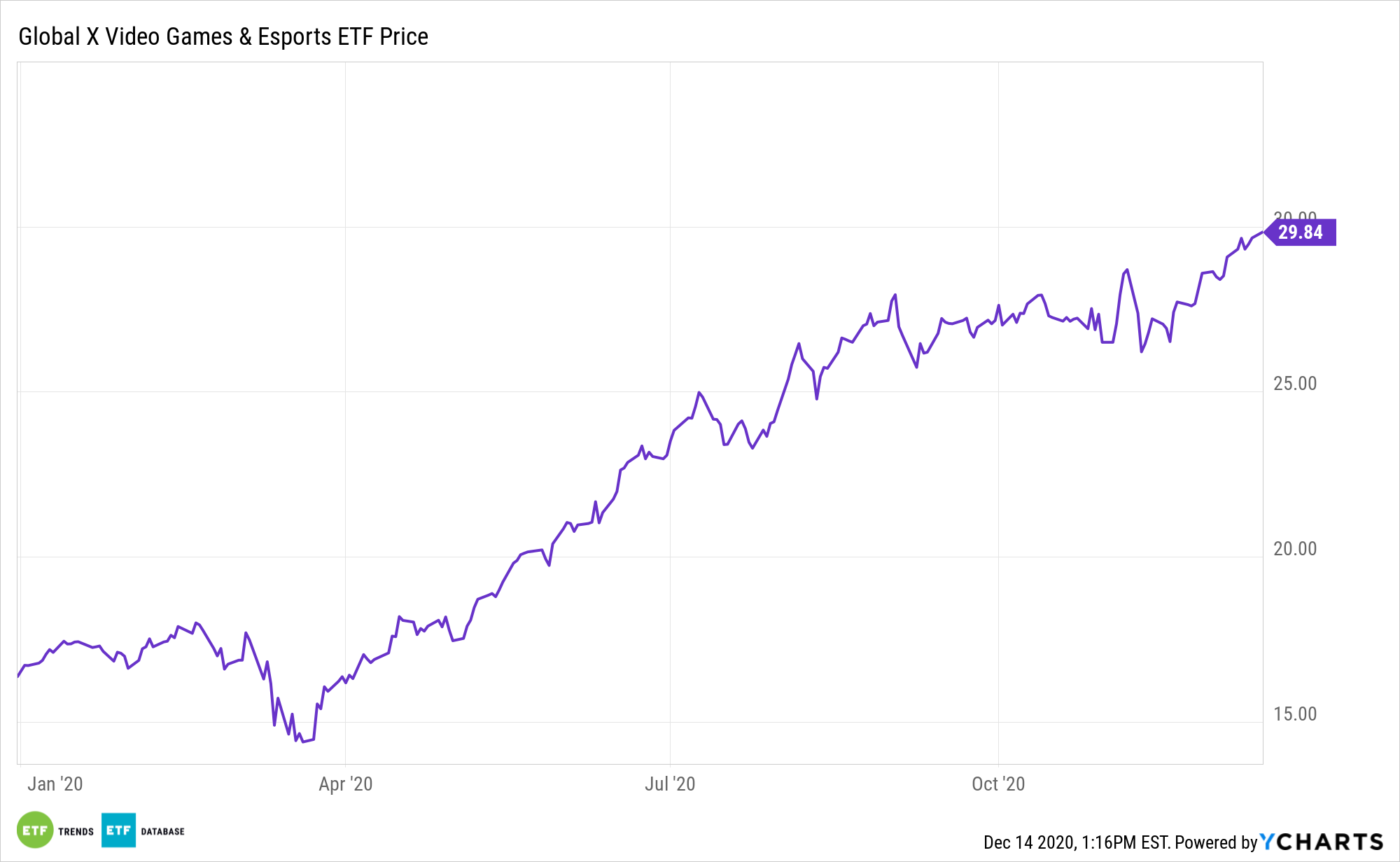

With the video gaming and Esports industry getting a major boost thanks to the social distancing measures brought on by the pandemic, it’s prudent to give funds like the Global X Video Games & Esports ETF (HERO) a look. Amid market uncertainty, the fund’s performance is nothing short of heroic with year-to-date gains of over 80%.

HERO seeks to invest in companies that develop or publish video games, facilitate the streaming and distribution of video gaming or Esports content, own and operate within competitive Esports leagues, or produce hardware used in video games and Esports, including augmented and virtual reality. It achieves this goal by providing investment results that correspond generally to the price and yield performance, before fees and expenses, of the Solactive Video Games & Esports Index.

Along with its YTD gain of 80%, the fund has been returning over 90% since its date of inception, which was just over a year ago. Its total expense ratio comes in at 0.50%.

Video Gaming Is Growing Rapidly

Video games and Esports will continue to be a prevailing trend in 2021 and well beyond that.

The space has already seen dramatic global growth this year and per a CNBC report, “video gaming ETFs are also on track for another winning year, Todd Rosenbluth, senior director of ETF and mutual fund research at CFRA, said in the same ‘ETF Edge’ interview.”

“These video gaming-oriented ETFs have gathered about $1 billion of net inflows in 2020,” Rosenbluth said.

“These are global ETFs, so, while you have exposure to Electronic Arts and Activision Blizzard, about 25% of HERO … is in the United States. You’ve got exposure to Nintendo,” he said.

Given the global appeal of video games, ETF investors can also use HERO as an international diversification tool. One of the fund’s top 10 holdings (as of December 11) includes Japanese video game developer Capcom.

For more news and information, visit the Thematic Investing Channel.