Equities will always carry some degree of vulnerability, but investors with a low penchant for risk can consider the Global X Nasdaq 100 Covered Call ETF (QYLD).

Not only does QYLD provide equities exposure; the ETF also offers an income component. In today’s low-rate environment, fixed income investors understand how difficult it is trying to squeeze as much income as possible out of government debt.

Fortunately, there are exchange traded funds (ETFs) that offer strategic exposure to other income-generating sources, like covered calls. QYLD follows a “covered call” or “buy-write” strategy, in which the QYLD buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index.

Summarily, QYLD seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the CBOE Nasdaq-100 BuyWrite V2 Index.

QYLD offers investors:

- High Income Potential: QYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility.

- Monthly Distributions: QYLD has made monthly distributions 6 years running.

- Efficient Options Execution: QYLD writes call options on the Nasdaq-100 Index, saving investors the time and expense of doing so individually.

Higher Yields in Volatile Markets

Investors who got through 2020 are well aware of how volatility can affect their income-producing assets. With QYLD, investors have peace of mind knowing that income won’t be disrupted, even when markets are fluxing up and down.

Under the hood of QYLD are familiar names, particularly in the big tech arena. As such, names like Apple, Microsoft, and Amazon round out its top three holding. These big three firms make up about 30% of the fund’s assets.

“US equity investors have enjoyed a strong start to 2021,” Global X noted in an email. “For those seeking to retain equity exposure while lessening downside risk, we believe now could be the time to consider covered call strategies. Historically, covered call writing produces higher yields in periods of volatility.”

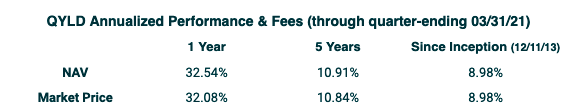

QYLD has also received a Morningstar Rating™ of five stars and has delivered a 12-month trailing yield of 12.23%.

For more news and information, visit the Thematic Investing Channel.