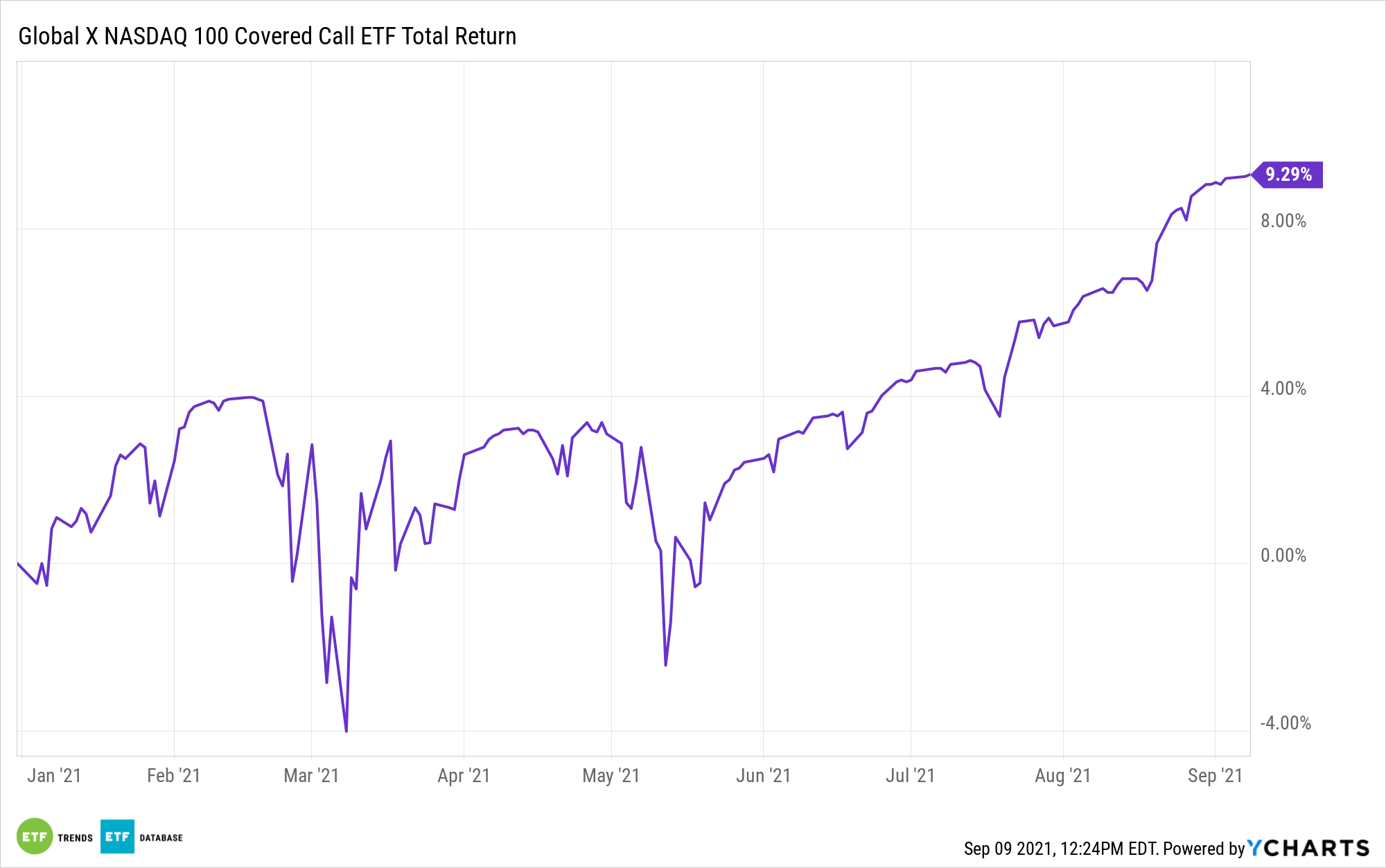

A heavy dose of volatility could be in store for Nasdaq 100 investors this fall, making ETFs such as the Global X Nasdaq 100 Covered Call ETF (QYLD) a worthy fund to consider for income.

The fund’s strategy employs covered calls in order to hedge out volatility and still capture market upside. It’s a built-in safety component that could be attractive to investors, given the pandemic wild card that keeps affecting the markets.

As a CNBC report noted, “Goldman Sachs downgraded its economic outlook over the weekend, citing the delta variant and fading fiscal stimulus. Goldman now sees 5.7% annual growth in 2021, below the 6.2% consensus. The firm cut its fourth-quarter GDP outlook to 5.5%, down from 6.5%.”

“The hurdle for strong consumption growth going forward appears much higher: the delta variant is already weighing on Q3 growth, and fading fiscal stimulus and a slower service sector recovery will both be headwinds in the medium term,” stated the Goldman note.

Generating Additional Income

QYLD follows a “covered call” or “buy-write” strategy, in which QYLD buys the stocks in the Nasdaq 100 Index and “writes” or “sells” corresponding call options on the same index.

Not only does QYLD provide equities exposure, the ETF also offers an income component. In today’s low-rate environment, fixed income investors understand how difficult it is to try to squeeze as much income as possible out of government debt.

Summarily, QYLD seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the CBOE Nasdaq-100 BuyWrite V2 Index. QYLD offers investors:

- High income potential: QYLD seeks to generate income through covered call writing, which historically produces higher yields in periods of volatility.

- Monthly distributions: QYLD has made monthly distributions six years running.

- Efficient options execution: QYLD writes call options on the Nasdaq-100 Index, saving investors the time and expense of doing so individually.

“QYLD buys stocks within the Nasdaq 100 index and utilizes a buy-write covered call strategy to generate income which is paid to investors in the form of dividends,” The Street article explained. “The Nasdaq 100 index comprises 100 of the largest domestic and international non-financial companies listed on the Nasdaq Stock Market based on market capitalization.”

“Each month QYLD will write or sell one-month call options on the Nasdaq 100 index, which are covered since QYLD holds the securities underlying the options written,” the article said further. “Each option written will generally have an exercise price at or above the prevailing market price of the Nasdaq 100 index from when it was written.”

For more news, information, and strategy, visit the Thematic Investing Channel.