While ETF investors can opt for broad exposure to China, they can also get sector-specific exposure to home in on specific market opportunities. While go-to sectors might include technology or health care, ETF investors can impressive performance from raw materials with the Global X MSCI China Materials ETF (CHIM).

CHIM seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI China Materials 10/50 Index. The fund invests at least 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index.

The underlying index tracks the performance of companies in the MSCI China Index (the ‘parent index’) that are classified in the materials sector, as defined by the index provider. Those looking to overweight China may find this ETF useful for fine-tuning exposure, especially those expecting strong performance from the industrial sector.

Investors bullish on the outlook for industrial stocks but hesitant to invest in U.S. equities should consider CHIM as well.

CHIM gives investors:

- Targeted Exposure: CHIM is a targeted play on the Materials Sector in China, the world’s second largest economy by GDP.

- ETF Efficiency: In a single trade, CHIM delivers access to dozens of materials companies within the MSCI China Index, providing investors with an efficient vehicle to express a sector view on China.

- All Share Exposure: The Index incorporates all eligible securities as per MSCI’s Global Investable Market Index Methodology, including China A, B, and H shares, Red chips, P chips and foreign listings, among others.

- Strong performance: The fund is up 64% within the last 12 months.

CHIM Dominating the Return on Capital Employed (ROCE) Game

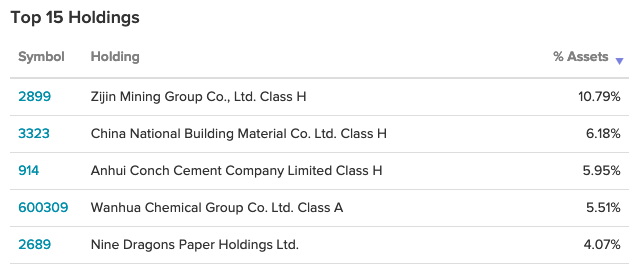

CHIM’s top holding is Zijin Mining Group, which comprises 11% of the fund’s assets. The company’s return on capital employed (ROCE) is something worth noting, as outlined in a Simply Wall St article.

“While in absolute terms it isn’t a high ROCE, it’s promising to see that it has been moving in the right direction,” the article said. “The data shows that returns on capital have increased substantially over the last five years to 9.8%. The company is effectively making more money per dollar of capital used, and it’s worth noting that the amount of capital has increased too, by 137%. So we’re very much inspired by what we’re seeing at Zijin Mining Group thanks to its ability to profitably reinvest capital.”

For more news and information, visit the Thematic Investing Channel.