The push for electric vehicles (EV) will be a persistent trend, which could keep lithium prices elevated and bolster assets like the Global X Lithium & Battery Tech ETF (LIT).

Data, research, and analytics company Fitch Solutions forecasts that lithium prices will continue to move higher through the rest of 2021 and into 2022. Demand for lithium combined with tighter supply should keep prices elevated.

China plays an outsized role in lithium market dynamics.

“In 2021 so far, lithium prices have experienced a significant rally, as post-covid demand for lithium chemicals recovered alongside the automotive industry,” a Mining.com article explained. “This spike intensified during the first two months of the year as Chinese lithium producers, such as Jiangxi Ganfeng, forecast limited supply due to increased downstream demand ahead of the Chinese Lunar New Year.”

“In line with Fitch’s view, broad lithium prices have since normalised, with Chinese spot prices for battery-grade lithium carbonate and lithium hydroxide exhibiting slower growth compared with January and February 2021,” the article added.

LIT seeks to provide investment results that correspond generally to the price and yield performance of the Solactive Global Lithium Index, which is designed to measure broad-based equity market performance of global companies involved in the lithium industry. LIT gives investors:

- Efficient Access: LIT offers efficient access to a broad basket of companies involved in lithium mining, lithium refining, and battery production.

- Thematic Exposure: The fund is a thematic play on lithium and battery technology.

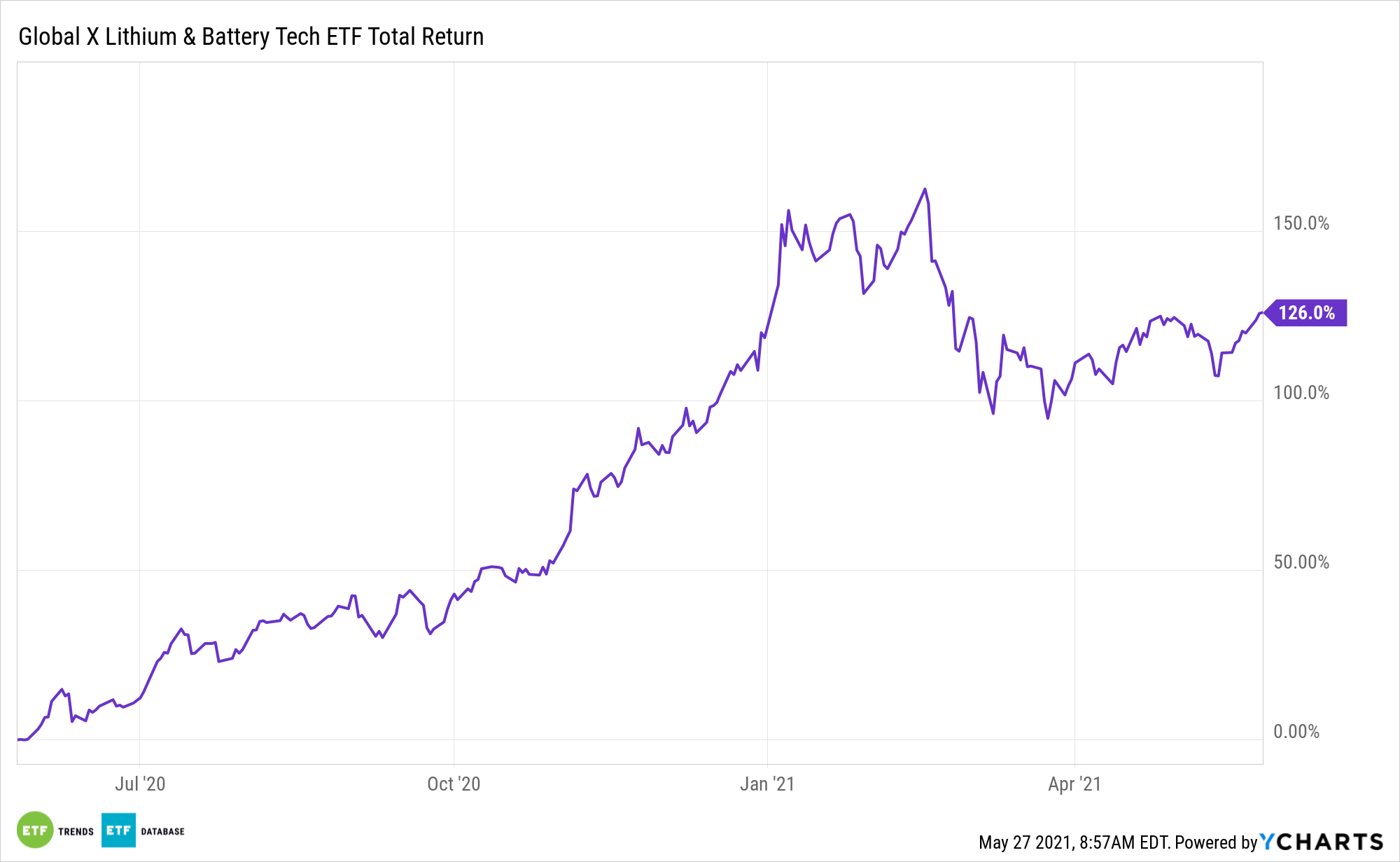

- Exceptional Performance: The fund is up about 140% the past year.

The Role of Electric Vehicles

U.S. president Joe Biden’s $2 trillion infrastructure plan is pushing an agenda to put more electric vehicles on the road with initiatives for more charging stations to undergird the electrical system.

“Increasing demand for lithium chemicals for use in electric vehicle (EV) batteries and energy storage systems will support elevated prices in the short term, but Fitch does not expect to see any large jumps that would push prices up to the highs observed in 2016 and 2017,” the Mining.com article said. “Lithium will be a key beneficiary of the accelerating uptake of EVs over Fitch’s forecast period to 2030, due to its prominent featuring in battery chemistry.”

For more news and information, visit the Thematic Investing Channel.