China’s recent crackdown on cryptocurrencies might cause investors to fret, but their underlying technology, blockchain, should still be well intact.

In the meantime, China’s regulatory sweep is causing leading cryptocurrency Bitcoin to falter. It’s fallen 2% the last week, while the second-largest cryptocurrency by market capitalization, Ethereum, has fallen 3%.

“China’s harshest anti-crypto moves yet were announced by the Chinese central bank and other government agencies,” a Motley Fool article reported. “Separately, the country’s planning department, the National Development and Reform Commission stepped up its activities against crypto mining.”

The latest moves by the Chinese government could be the result of the country’s move towards using its very own cryptocurrency. China has been mulling over this ambitious plan for some time, but it appears that their recent actions could be slowly bringing it to life.

“Another motive behind the latest steps could be that China is in the process of piloting its own digital yuan,” the article added. “This is a Central Bank Digital Currency (CBDC), also known as a GovCoin. It uses blockchain technology and carries many of the advantages of cryptocurrencies, such as fast and cheap payments. But it is centralized, meaning it is controlled and backed by the Chinese government.”

A Blockchain ETF Opportunity Worth Considering

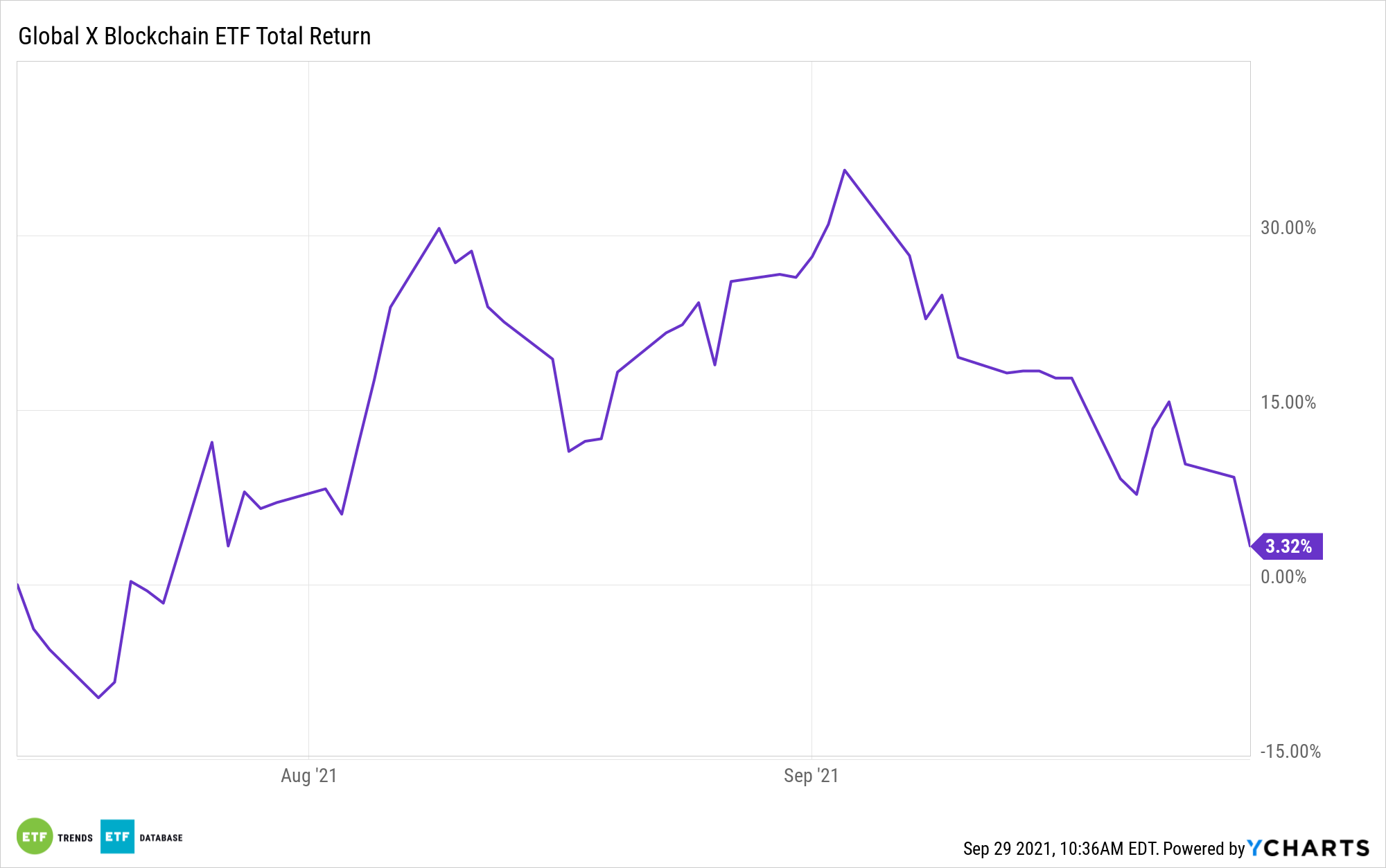

This shows China’s faith in blockchain technology as the disruptive wave of the future. As such, that shouldn’t tamp down gains for the Global X Blockchain ETF (BKCH).

The fund seeks to provide investment results that generally correspond to the price and yield performance of the Solactive Blockchain Index, which is designed to provide exposure to companies that are positioned to benefit from further advances in the field of blockchain technology.

BKCH gives investors access to:

- High growth potential: The global blockchain solutions market is expected to increase more than 50% from 2020 to 2021.

- Global tailwinds: Blockchain technology is a global theme, poised to benefit as governments and industries seek to improve the accuracy, transparency, and security of financial transactions.

- An unconstrained approach: This theme is bigger than just cryptocurrency. BKCH invests accordingly, with global exposure across multiple sectors and industries.

For more news, information, and strategy, visit the Thematic Investing Channel.