As cryptocurrencies start to see further adoption, China could change the digital payment game even further. The Chinese government is releasing its own digital currency, which could be the next frontier for fintech ETFs like the Global X FinTech ETF (FINX).

“A thousand years ago, when money meant coins, China invented paper currency. Now the Chinese government is minting cash digitally, in a re-imagination of money that could shake a pillar of American power,” a Wall Street Journal report noted. “It might seem money is already virtual, as credit cards and payment apps such as Apple Pay in the U.S. and WeChat in China eliminate the need for bills or coins. But those are just ways to move money electronically. China is turning legal tender itself into computer code.”

With the backing of the central bank of one of the top economies in the world, the digital version of the yuan could see global adoption. Digital payments were already on the rise amid social distancing measures, but this new digital currency could up the ante.

“The entire digital payments structure could overnight adopt the digital yuan as a digital reserve currency for basic remittances,” said Dave Nadig, Chief Investment Officer and Director of Research of ETF Trends and ETF Database.

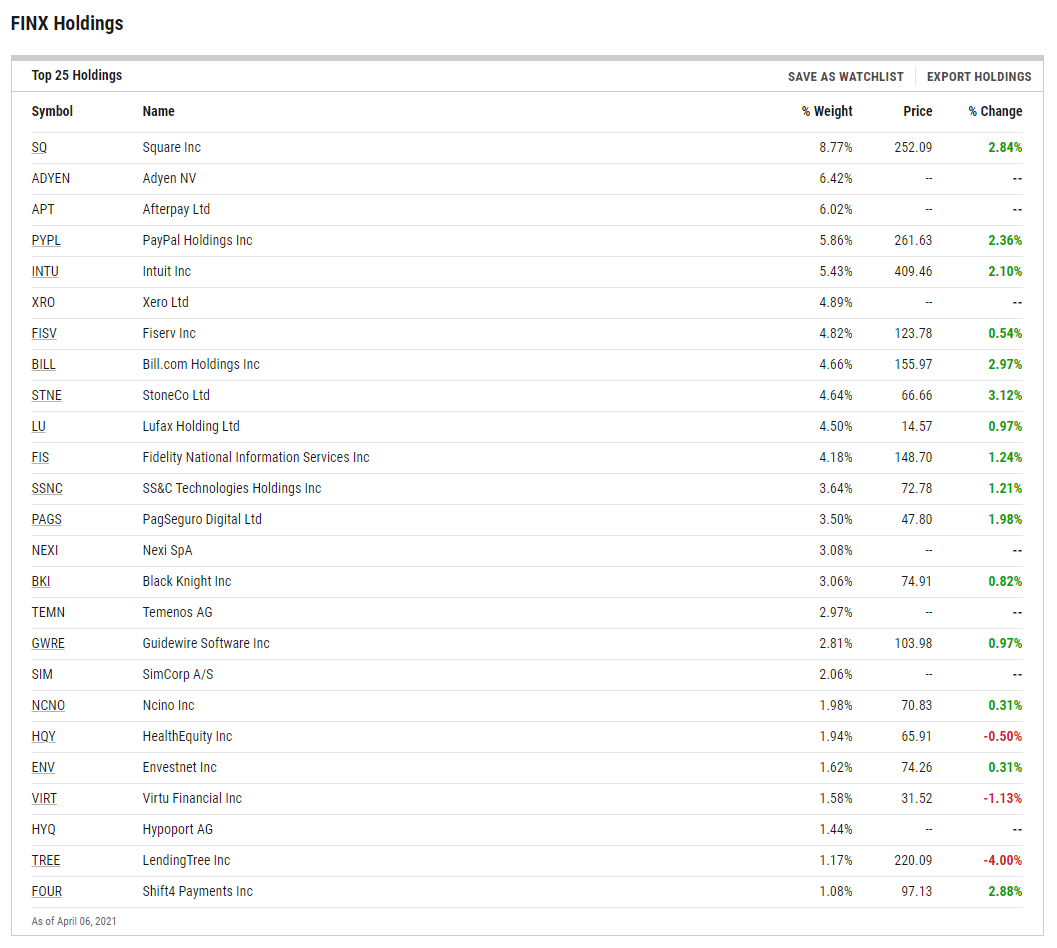

FINX seeks to provide investment results that correspond to the Indxx Global Fintech Thematic Index. The index is designed to provide exposure to exchange-listed companies in developed markets that provide financial technology products and services, including companies involved in mobile payments, peer-to-peer (P2P) and marketplace lending, financial analytics software, and alternative currencies, as defined by the index provider.

The fund gives investors exposure to:

- High Growth Potential: FINX enables investors to access high growth potential through companies that are applying technological innovations to disrupt and improve the delivery of financial services.

- An Unconstrained Approach: The fund’s composition transcends classic sector, industry, and geographic classifications by tracking an emerging theme.

- ETF Efficiency: In a single trade, FINX offers access to dozens of companies with high exposure to the fintech theme.

- Strong Performance: FINX is up almost 89% within the past year.

No Ties to the U.S. Dollar

FINX’s holdings are comprised mainly of U.S. companies, accounting for 55% of assets. Right now, about 6% is allocated towards China, but could that change with the introduction of the digital yuan?

“Beijing is also positioning the digital yuan for international use and designing it to be untethered to the global financial system, where the U.S. dollar has been king since World War II,” the WSJ report added. “China is embracing digitization in many forms, including money, in a bid to gain more centralized control while getting a head start on technologies of the future that it regards as up for grabs.”

For more news and information, visit the Thematic Investing Channel.