Yield-starved investors don’t have to take on multiple positions in high-yield bonds, emerging markets bonds, and other assets in order to get yield in today’s environment. They can have it all and stay on target with their income requirements using the Global X TargetIncome Plus 2 ETF (TFLT).

TFLT seeks investment results that correspond to the price and yield performance, before fees and expenses, of the Wilshire TargetIncomeTM 10-Year Treasury +2% Plus Index. The fund is a fund of funds and invests at least 80% of its total assets in the securities of the underlying index.

The underlying index seeks to provide broad exposure to income-producing asset classes using a portfolio of exchange-traded funds, with the goal of providing exposure that may be sufficient to support an annualized yield of the U.S. 10-Year Treasury yield plus two percent for the fund, net of fees.

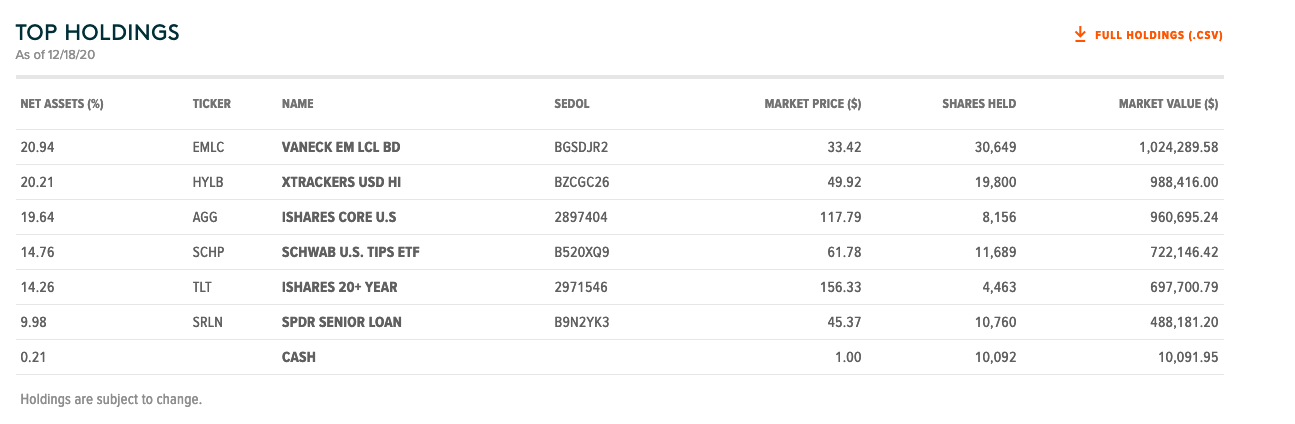

Looking at its top holdings, you’ll see a majority of the fund lies within a mix of ETFs focusing on high yield, emerging markets bonds, and even Treasury Inflation Protected Securities (TIPs).

Low Rates Piloting a Flight From Safe Havens

Low rates are certainly piloting a flight from safe haven government debt with low yields. Funds like TFLT can help combat the current low-rate market environment that could persist for some time if the Fed stays true to its pledge to keep rates low.

“The ultra-low rates have sent investors chasing after high-yield dividend stocks this year,” a Zacks article explained. “This is especially true as the 10-year Treasury yields were at historically lower levels of below 1% for most of the year and will remain under pressure given the inflow of cheap money into the economy.”

“The Fed has pledged to keep interest rates near zero and will continue to buy at least $120 billion of bonds each month until “substantial further progress” has been made toward reaching maximum employment and healthy inflation,” the article added. “Additionally, the coronavirus outbreak wreaked havoc on the economy, driving the appeal for dividend-paying stocks. Though the pandemic is seemingly nearing its end with the arrival of the vaccine, the surging number of new cases is still weighing on investors’ sentiment. Concerns over the availability of safe vaccines to all Americans soon added to the woes.”

For more news and information, visit the Thematic Investing Channel.