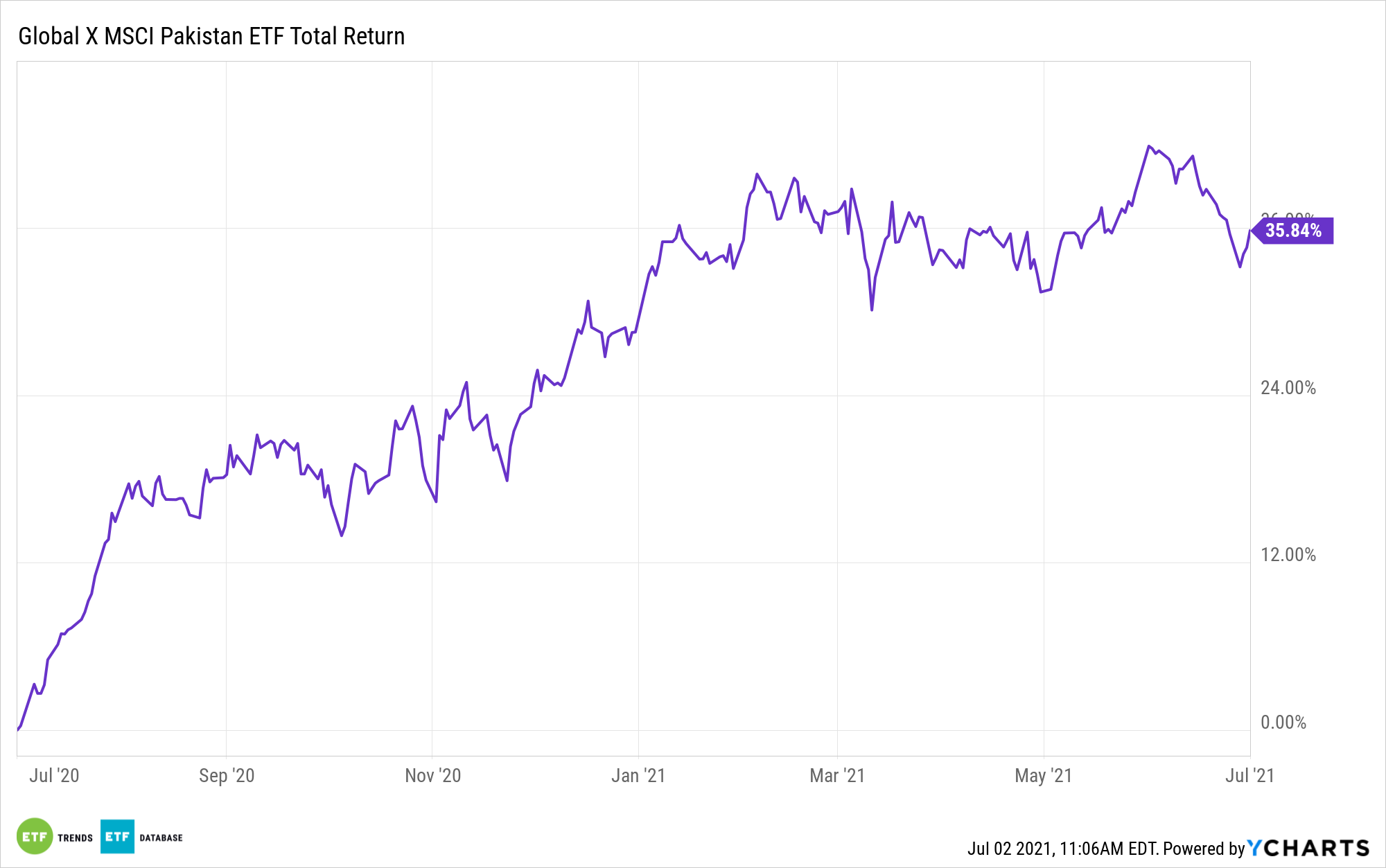

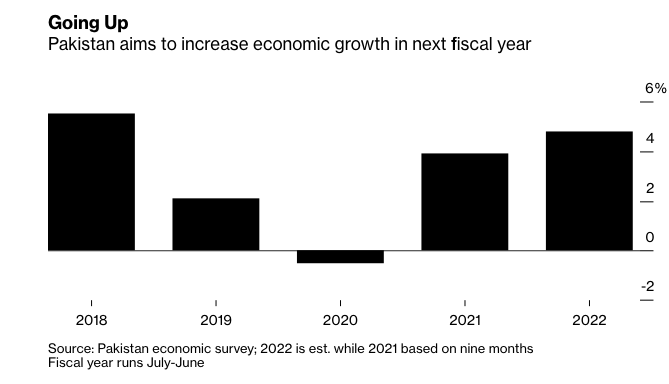

The pandemic has crippled many economies, but as the world continues to heal in 2021, the country of Pakistan is eyeing strong growth over the coming years, which is good news for the Global X MSCI Pakistan ETF (PAK).

“Pakistan plans to spend its way out of the pandemic-induced slump, with a new budget that seeks to put more money in the hands of people and boost economic activity,” a Bloomberg article noted.

“The federal government proposes to raise salaries of government employees by 10% in the year beginning July 1, Finance Minister Shaukat Tarin said in his budget speech in Islamabad on Friday,” the article added further. “Taxes on some equity as well as banking transactions will be pared or abolished, he said.”

PAK seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI All Pakistan Select 25/50 Index. The underlying index is designed to represent the performance of the broad Pakistan equity universe.

The fund’s sector breakdown includes a primary focus on materials, which comprises about 35% of the fund’s net assets. Next up are the financials and energy sectors, which make up 26% and 22%, respectively.

Overall, PAK provides investors with:

- Efficient Access: Efficient access to a broad basket of Pakistani securities.

- Targeted Exposure: The fund targets exposure to a single country.

- Frontier Market Exposure: Frontier markets are among the highest growth potential economies in the world.

Aiming to Meet Budgetary Goals

Budgetary goals will be the primary aim of Pakistan’s government. According to the Bloomberg article, Tarin hopes to “narrow the budget gap to 6.3% of gross domestic product from 7.1% of GDP this year, less than 1 to 1.5 percentage points the minister estimated last month.”

In order to do that, Tarin “aims to achieve that by ramping up revenue collection by 25% to 7.9 trillion rupees ($51 billion) in the next fiscal year.”

“Of that, 5.8 trillion rupees would be mopped up from taxes, compared with 4.7 trillion rupees this year,” the article added.

“The budget is an opportunity for Tarin to strengthen Pakistan’s fragile economy, which is currently under a $6 billion bailout program from the International Monetary Fund,” the Bloomberg article continued. “A drop in coronavirus cases is allowing the nation to reopen slowly, paving the way for demand to kick in.”

For more news and information, visit the Thematic Investing Channel.