Investors looking for emerging market (EM) opportunities for growth might want to consider Vietnam or, more specifically, the Global X MSCI Vietnam ETF (VNAM).

EM countries can provide potential growth opportunities for investors who do their due diligence. EM investing can come with its own nuances, particularly because each country’s performance can vary with respect to their economic stability.

The COVID-19 pandemic certainly roiled a lot of EM opportunities in 2020, but certain countries that were able to respond swiftly muted its economic effects. Vietnam, for example, was able to rebound from the pandemic due to a quick, pointed response by its government.

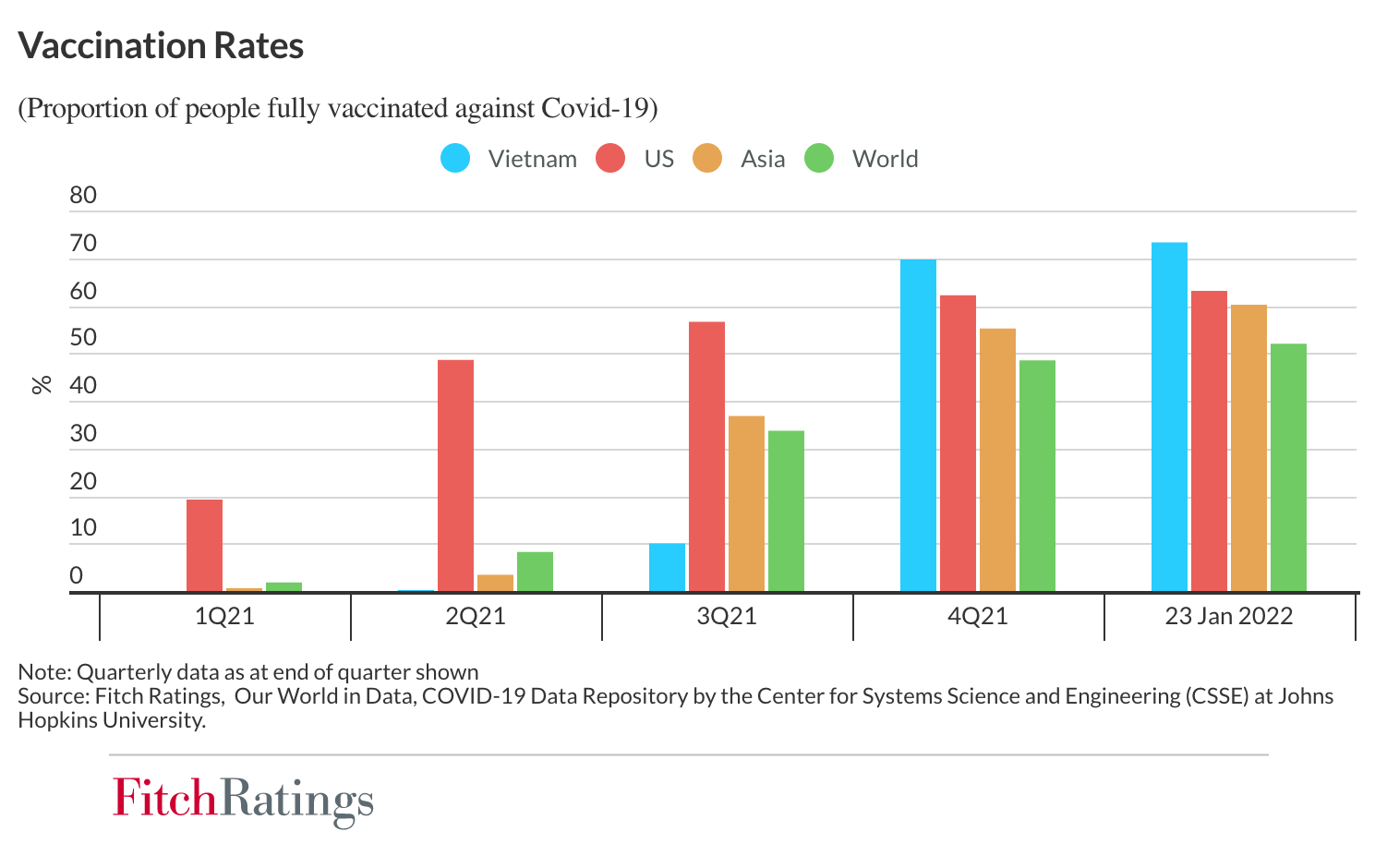

“Vietnam’s recovery is set to gather momentum in 2022, as domestic demand rebounds and export performance remains strong, says Fitch Ratings,” a Fitch Ratings article says. “Improving levels of vaccination should reduce the risk that the recovery is set back by further Covid-19 outbreaks. However, the evolution of the pandemic remains subject to uncertainties, in particular as daily cases have trended higher in recent months.”

Growth Expected for Vietnam in 2022

Fitch Ratings forecasts growth ahead for Vietnam in 2022. Economic effects related to the pandemic don’t appear to be as severe, thanks to the government’s move to increase vaccinations in the country.

“Economic growth in 2021, at 2.6%, was much weaker than the 7% that we had expected in April 2021, when we affirmed Vietnam’s rating at ‘BB’ and revised the Outlook to Positive, from Stable,” Fitch Ratings says. “This partly reflected a 6% yoy contraction in real GDP in 3Q21, as the authorities moved to control a surge in Covid-19 cases.”

“Further pandemic-related shocks, while possible, are unlikely to be so severe, because the government has shifted from a ‘zero Covid’ approach to one of flexible adaptation as vaccination rates have increased,” Fitch Ratings adds.

VNAM seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the MSCI Vietnam IMI Select 25/50 Index. The index is designed to represent the performance of the broad Vietnam equity universe, while including a minimum number of constituents, as defined by MSCI, Inc.

“We expect growth to accelerate to 7.9% in 2022 and 6.5% in 2023 as the recovery becomes established. This partly reflects the low base set in 2021,” Fitch Ratings says. “Vietnam has also had less economic scarring than many emerging markets, as it is one of the few countries that did not experience an annual contraction in GDP amid the pandemic shock.”

For more news, information, and strategy, visit the Thematic Investing Channel.