Domestic dividend growth is on a torrid pace this year, and market observers expect that the trend will continue in 2022.

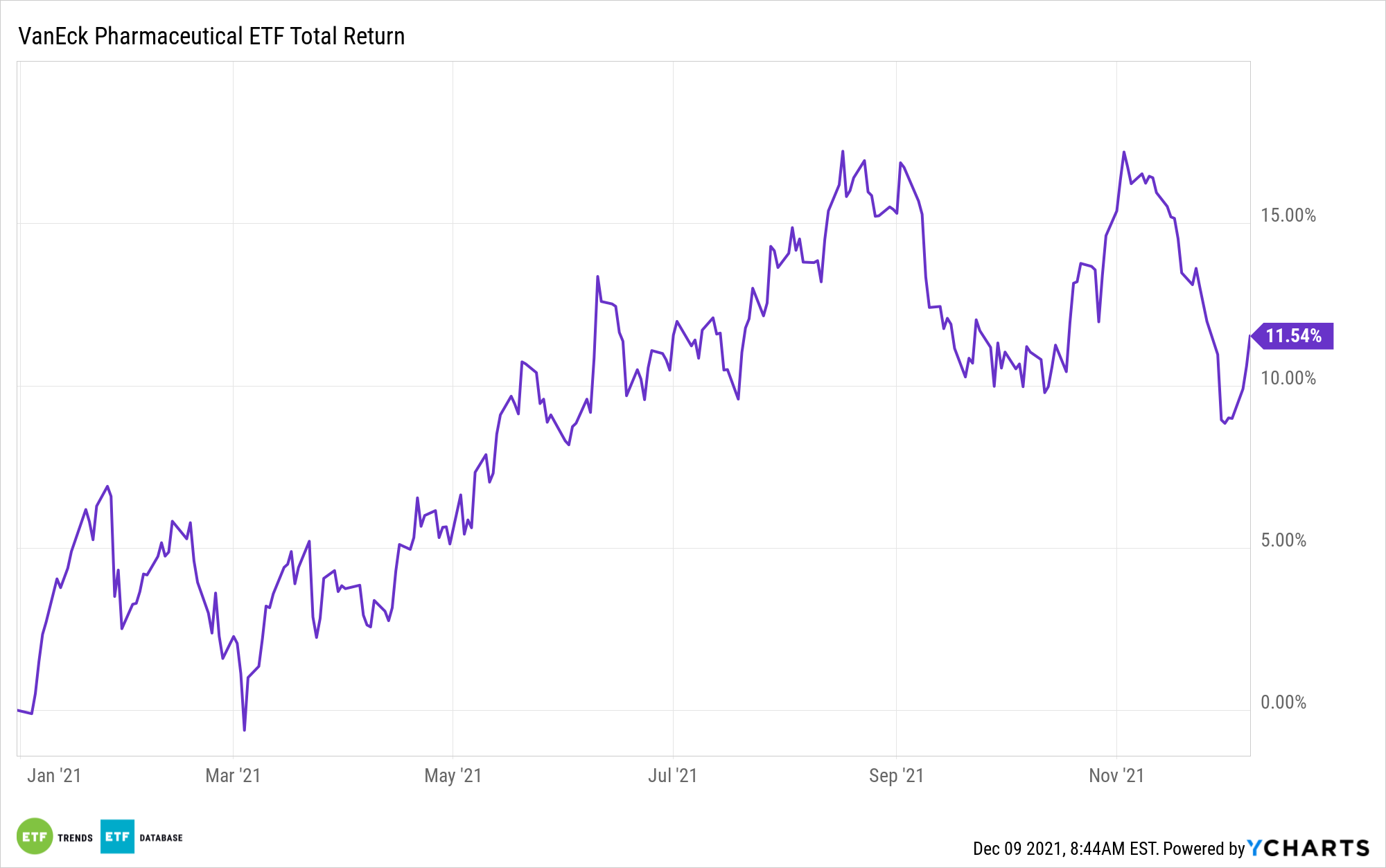

Investors searching for sector and industry exchange traded funds with which to access baskets of impressive dividend growers ought to consider healthcare, namely pharmaceuticals equities. Enter the VanEck Vectors Pharmaceutical ETF (PPH).

PPH follows the MVIS US Listed Pharmaceutical 25 Index, and as that name implies, the ETF holds 25 stocks. While that’s a concentrated basket, it’s one that provides investors access to a host of quality companies, many of which have enviable track records of payout growth.

“When you think about dividends within healthcare, most of the dividends are going to be coming from biopharma,” says Morningstar analyst Damien Conover. “A lot of these dividends are very secure, and we anticipate the large-cap pharmaceutical stocks to be very secure in their payments going forward.”

Regarding dividend security, PPH has that, since its dividend yield of 1.74%, though significantly higher than that of the S&P 500, implies ample room for growth. As for payout growth, PPH components offer that, too. For example, Dow component Johnson & Johnson (NYSE:JNJ) has a dividend increase streak approaching six decades. Likewise, some of PPH’s foreign components — 33% of the fund’s weight — are among the steadiest dividend growers in their home countries.

Deep competitive moats, fortress balance sheets, and strong product pipelines and portfolios are among the factors that bode well for future payout growth in the biopharma space.

“It really ties back to that economic moat that we were just talking about, this concept of having a portfolio of drugs that really enables strong cash flows and really more predictability than what you would normally think around drug companies,” adds Conover.

Regarding product portfolios, several PPH components are among the marquee makers of coronavirus vaccines, including J&J, Pfizer (NYSE:PFE), and U.K.-based AstraZeneca (NYSE:AZN). More good news: Some pharmaceuticals equities are inexpensive, and many payout ratios in the industry are low.

“I think a lot of these stocks look undervalued. So, you have some capital appreciation there. And then, two, bringing it back to the dividend: I think the dividend growth for these firms is going to track pretty close to earnings growth,” concludes Conover. “So, I think the dividend payout ratio is probably going to stay pretty static, close to that 50% that the industry on average is paying out. But I think as earnings grow, the dividends will probably grow along with it. So, as an investor, you should be really looking for capital appreciation and dividend yield.”

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.