By Eric Fine, Portfolio Manager, VanEck

China cash squeeze continues. Chinese authorities remain focused on risks around speculation, and are continuing their liquidity crunch. Overnight interbank borrowing rose 29bp to 3.34% today, a level last seen in March 2016. This rate was 0.6% at the beginning of January, and it is now higher than the yield of Chinese 10-year bonds. Nonetheless, we see this as mature and confident policy, employing a variety of tailored tools. Overall market calm (other than the stock-that-shall-not-be-named) seems to validate that angle. Nonetheless, this remains a trend to watch.

Turkey’s December trade balance better than expected. Turkey’s December trade deficit came in at $4.53bn, a smidgen better than the expected $4.60bn, and an improvement from November’s $5.03bn. This could be interpreted as fruit borne by the central bank’s hawkish policy U-turn, and the Turkish lira seemed to agree; the lira continues to trade well and is among the stronger EMFXs this morning (though low positioning is a big factor, we think). Good news in a country that hasn’t had much for years, either way.

Brazil’s primary fiscal deficit better than expected. Brazil released its December fiscal results and the primary deficit came in at BRL44bn, better than consensus expectations. Nonetheless, the country still has one of the planet’s highest primary fiscal deficits, at 10.1% of GDP, or BRL 743bn. Revenues for 2020 declined by 13.5%, and spending increased by 31.1%, due to its Covid experience. The big upcoming issue is the lower house and senate speakers that get announced on February 1, many of which favor extending emergency Covid aid that could threaten fiscal spending caps and tip the whole debt dynamic into a dangerous place.

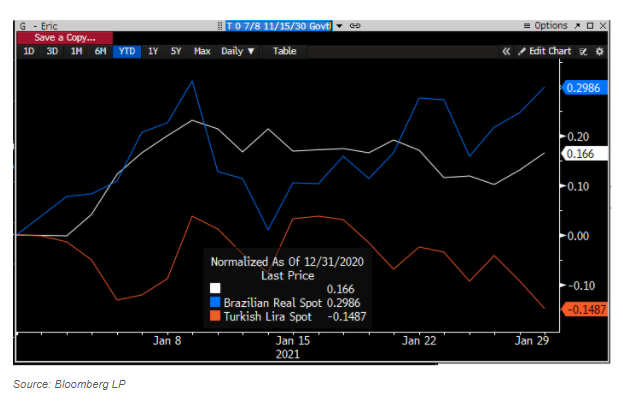

Charts at a Glance: EMFX Behaving according to fundamentals, not GameStop-amentals: BRL weaker (deservedly), TRY stronger (deservedly), despite/because UST yields grinding higher (deservedly)

Originally published by VanEck, 1/29/21

IMPORTANT DEFINITIONS & DISCLOSURES

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments.; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.