By Natalia Gurushina

Chief Economist, Emerging Markets Fixed Income

Slower growth can free room for EM rate cuts and potentially lead to better current account outcomes. Still, EM is not a monolith, and slower growth will pose policy challenges for many.

Market Rates Expectations

The market stepped up its expectations for the implied policy rate in Japan (to “mighty” 0.3% in one year or so), but the outlook for many emerging markets (EM) is decidedly less hawkish. The Czech National Bank kept its policy rate on hold once again – as expected – and the market sees room for about 80bps of rate cuts next year on the back of on-going disinflation (to mid-single digits in H2-2023) and a significant growth slowdown (from 2.4% in 2022 to zero next year). Colombia’s inflation risks are more persistent – this fact was reflected in yesterday’s central bank minutes – but the economy is slowing, and this might pave the way for smaller rate hikes in H1-2023 (with some potential for easing in H2, if disinflation allows). The market also started to price in a small H2-2023 rate cut in India – even though the central bank minutes cautioned against excessive optimism on the disinflation front.

Milder Recession

Softer growth – both on a country level and global – can pose policy challenges for those EMs where inflation is the farthest from the target. The latest data flow, however, suggests that the slowdown might be less dramatic than previously feared. South Korea reported a small pickup in its 20-day exports, while the Conference Board Consumer Confidence Index in the U.S. surprised meaningfully to the upside. Germany’s IFO survey was also slightly better than expected. And, of course, we are eagerly awaiting China’s domestic activity gauges for December to see whether the reflation narrative is working. The share of negative 2023 growth revisions reached 83% in the past three months (Bloomberg’s consensus pool of 101 countries) – but are we at the bottom of the “growth negativity” trend?

External Balances in EM

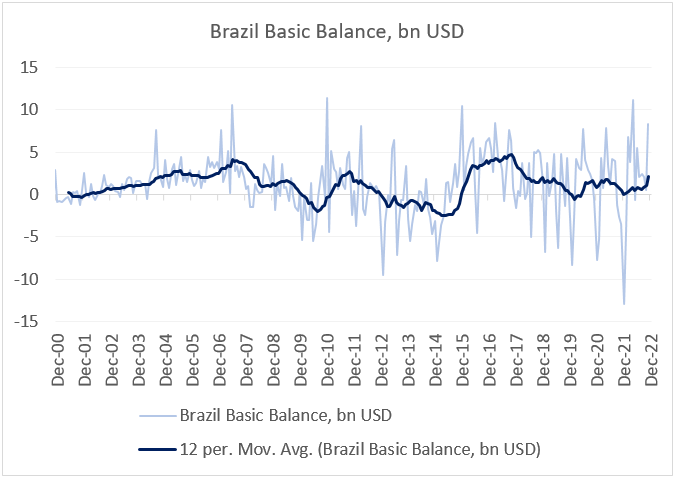

One potential silver lining in a slower growth environment is that it can lead to better current account outcomes. Naturally, this does not apply to all EMs, but the market might appreciate smaller current account deficits in Central Europe (expected 4% of GDP in Poland and 7% of GDP in Hungary in 2022) and Colombia (5.8% of GDP in 2022) – because the respective fiscal gaps are also wide, translating into additional bond issuance. We also keep an eye on Brazil – the country’s basic balance (current account + foreign direct investments) is very healthy now (see chart below), but incoming administration’s spending plans can boost domestic consumption (and, potentially, demand for imports), whereas stalling reforms can discourage capital inflows (including direct). Stay tuned!

Chart at a Glance: Brazil’s External Balance Is Healthy but Will It Last?

Source: Bloomberg LP.

Originally published by VanEck on 21 December 2022.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

PMI – Purchasing Managers’ Index: economic indicators derived from monthly surveys of private sector companies. A reading above 50 indicates expansion, and a reading below 50 indicates contraction; ISM – Institute for Supply Management PMI: ISM releases an index based on more than 400 purchasing and supply managers surveys; both in the manufacturing and non-manufacturing industries; CPI – Consumer Price Index: an index of the variation in prices paid by typical consumers for retail goods and other items; PPI – Producer Price Index: a family of indexes that measures the average change in selling prices received by domestic producers of goods and services over time; PCE inflation – Personal Consumption Expenditures Price Index: one measure of U.S. inflation, tracking the change in prices of goods and services purchased by consumers throughout the economy; MSCI – Morgan Stanley Capital International: an American provider of equity, fixed income, hedge fund stock market indexes, and equity portfolio analysis tools; VIX – CBOE Volatility Index: an index created by the Chicago Board Options Exchange (CBOE), which shows the market’s expectation of 30-day volatility. It is constructed using the implied volatilities on S&P 500 index options.; GBI-EM – JP Morgan’s Government Bond Index – Emerging Markets: comprehensive emerging market debt benchmarks that track local currency bonds issued by Emerging market governments; EMBI – JP Morgan’s Emerging Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a selection of emerging market countries; EMBIG – JP Morgan’s Emerging Market Bond Index Global: tracks total returns for traded external debt instruments in emerging markets.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.