2020 was obviously a forgettable year for most countries in terms of gross domestic product (GDP), but countries like Russia are finding out that last year didn’t end as poorly as expected. This adds to the case for single-country Russia ETFs such as the VanEck Vectors Russia ETF (RSX) and the VanEck Vectors Russia Small-Cap ETF (RSXJ).

RSX seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Russia Index. The index includes securities, which may include depositary receipts, of Russian companies.

A company is generally considered to be a Russian company if it is incorporated in Russia or is incorporated outside of Russia but has at least 50% of its revenues/related assets in Russia. Such companies may include medium-capitalization companies.

Overall, RSX provides exposure to:

- The Nation’s First ETF Focused on Russia: Largest, most liquid Russia ETF versus competing U.S.-listed ETFs.

- A Value Opportunity: Russia’s equity market is currently offering deep discounts versus emerging markets as a whole.

- A Pure Play: Companies must be incorporated in, or derive at least 50% of total revenues from Russia to be added to the index.

RSXJ seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Russia Small-Cap Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes securities of Russian small-capitalization companies. It will normally invest at least 80% of its total assets in securities of small-capitalization Russian companies.

Summarily, RSXJ gives investors a:

- Small Cap Focus: Small-caps may offer greater exposure to domestic growth, less exposure to global cyclicals.

- Value Opportunity: Russia’s equity market is currently offering deep discounts when compared to other emerging markets.

- Pure Play: Fund companies must be incorporated in or derive at least 50% of total revenues from Russia to be added to the index.

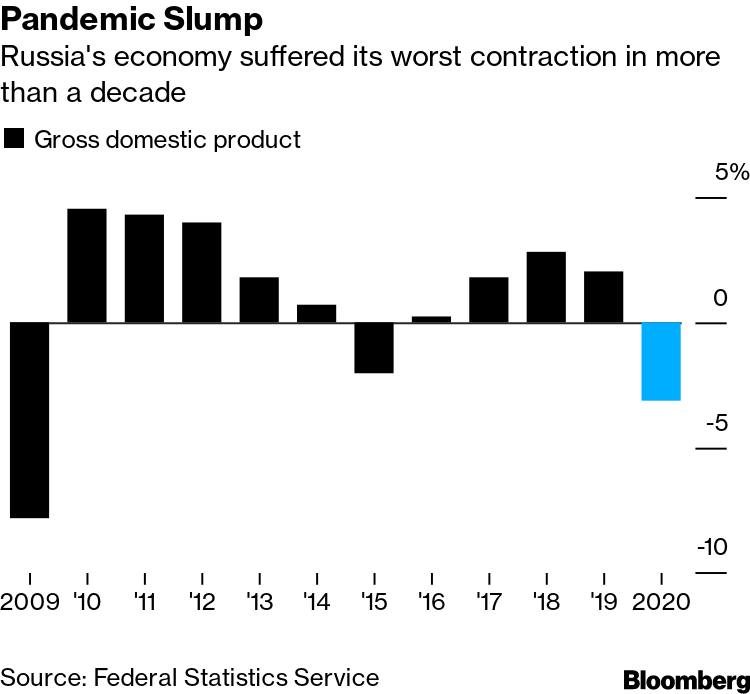

Russia Was Better Off Than Its Peers in 2020

As mentioned, global economies in 2020 suffered from the pandemic, but Russia is finding out that its contraction in GDP wasn’t as gruesome as anticipated. Per a Bloomberg article, “Russia suffered a smaller contraction than most major economies in 2020 after the government opted not to reimpose a lockdown in the second half of the year.”

“Gross domestic product contracted 3.1% last year, the biggest slump since 2009, Russia’s Federal Statistics Service said Monday,” the article added further. “The contraction was softer than expected by economists, who forecast a 3.7% drop in a Bloomberg survey. The Economy Ministry had projected a decrease of 3.9%.”

While the rollout of a Covid-19 vaccine should help, the pandemic still remains a wild card in the global landscape. That said, economists are warning that the vaccine won’t be an immediate panacea for GDPs around the world.

For more news and information, visit the Tactical Allocation Channel.