Healthcare stocks are solid but not spectacular performers. For example, the S&P 500 Health Care Index is higher by more than 17%, though that lags the broader market.

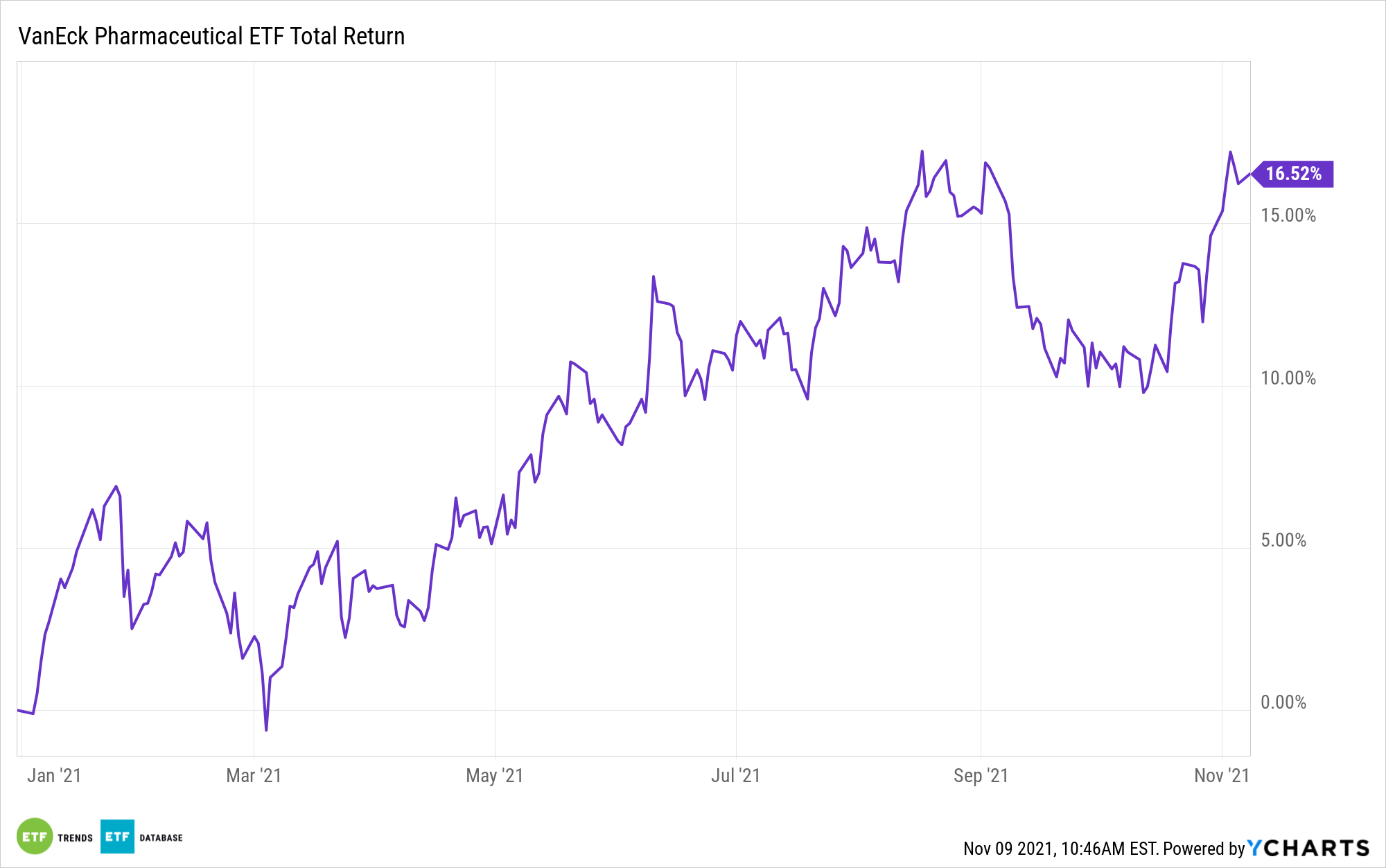

Speaking of lagging, that’s exactly what biotechnology and pharmaceuticals stocks are doing, but some blue chip, high-quality pharmaceuticals names appear poised to shed their laggard status. If that happens, the VanEck Vectors Pharmaceutical ETF (PPH) is an exchange traded fund that should benefit. PPH tracks the MVIS US Listed Pharmaceutical 25 Index and is home to 25 stocks.

“Overall, the large-cap biopharmaceutical group has strong balance sheets, makes solid investment decisions, and distributes cash appropriately,” according to Morningstar. “All of this supports the ability to develop the next generation of innovative drugs that are critical to an almost entirely wide-moat industry. With the current portfolios of the industry likely to become generic over the next two decades, capital allocation is particularly important for biopharma companies.”

The research firm highlights AstraZeneca (AZN) and Eli Lilly (LLY) as ranking among the pharmaceuticals names with the ability to generate industry leading growth. Those are PPH’s second- and fifth-largest holdings, respectively, combining for 10.66% of the ETF’s weight.

Morningstar adds that Roche (RHHBY) and Merck (MRK) are undervalued, noting that investors aren’t fully appreciating those companies’ capital allocation strategies. Roche isn’t a PPH component, but Merck is the ETF’s third-largest holding at a weight of 5.38%.

“We view upcoming inflection points in Merck’s capital allocation decisions targeted toward acquisitions and internal pipeline development, which should improve drug-development efforts while also addressing concerns about the large and growing dependence on Keytruda,” says Morningstar.

Healthcare has long been a source of steady, quality dividend growth, and some PPH member firms fit the bill as strong capital allocators. On that front, Morningstar deems Amgen (AMGN), AstraZeneca, Bristol-Myers Squibb (BMY), Eli Lilly, Novo Nordisk (NVO), and Roche “exceptional.”

Novo Nordisk and AstraZeneca are PPH’s top two companies. Throw in Eli Lilly and Bristol-Myers Squibb, and that quartet combines for roughly 20% of the ETF’s weight.

“We think shareholder distributions are about right for the majority of the large biopharma group. Partially due to steady and thoughtful investments in R&D, the industry supports consistent dividends that have rarely been cut over the past two decades,” adds Morningstar. “With solid capital allocation allowing for close to 50% payout ratios for the group, we believe investors looking for steady dividend income should consider the large-cap biopharma industry.”

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.