Like the rest of the world, Russia is trying to weather the economic storm caused by the Covid-19 pandemic. However, the country’s officials are projecting positive GDP growth for 2021, which is a good sign for the VanEck Vectors Russia Small-Cap ETF (RSXJ).

“Russia’s economy is recovering gradually after contraction amid the pandemic, Prime Minister Mikhail Mishustin said in a video address to participants,” according to a TASS Russian News Agency article. The article also noted that ” authorities expect sustainable growth of the economy as early as by the end of 2021.”

“The response of the Russian economy to the pandemic-related challenges was much more tepid than that of a whole number of economies in 2020, he noted,” the article said further.

“After contraction in the second quarter it is recovering gradually, and we plan to be positive and reach sustainable growth by the end of this year,” the Prime Minister said.

RSXJ seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS® Russia Small-Cap Index. The fund normally invests at least 80% of its total assets in securities that comprise the fund’s benchmark index.

The index includes securities of Russian small-capitalization companies. It will normally invest at least 80% of its total assets in securities of small-capitalization Russian companies. Summarily, RSXJ gives investors a:

- Small Cap Focus: Small-caps may offer greater exposure to domestic growth, less exposure to global cyclicals.

- Value Opportunity: Russia’s equity market is currently offering deep discounts when compared to other emerging markets.

- Pure Play: Fund companies must be incorporated in or derive at least 50% of total revenues from Russia to be added to the index.

In the last few months, the fund is up about 15%.

Russian Economy Seeing More Strength

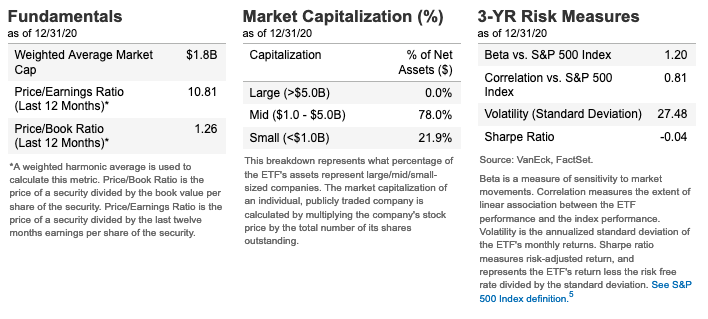

Taking a closer look at the fund’s portfolio analytics, investors can see the heavy allocation towards the mid cap space. Mid caps are often seen as the sweet spot between large cap stability and small cap growth potential.

Given that data, we can see how the Russia midcap market has been doing over the last six months via the MSCI Russia Mid Cap Chart. The index looks to be up 16% to highlight a recovery and subsequent rise from its pre-pandemic levels before a forgettable March that saw Covid-19 slam the capital markets.

Likewise, Russian small cap equities are seeing even stronger performance. The MSCI Russia Small Cap index is up almost 40% within that time frame.

For more news and information, visit the Tactical Allocation Channel.