With oil prices soaring and interest rates low, income-starved investors have a friend in the form of the midstream energy segment and the related exchange traded funds.

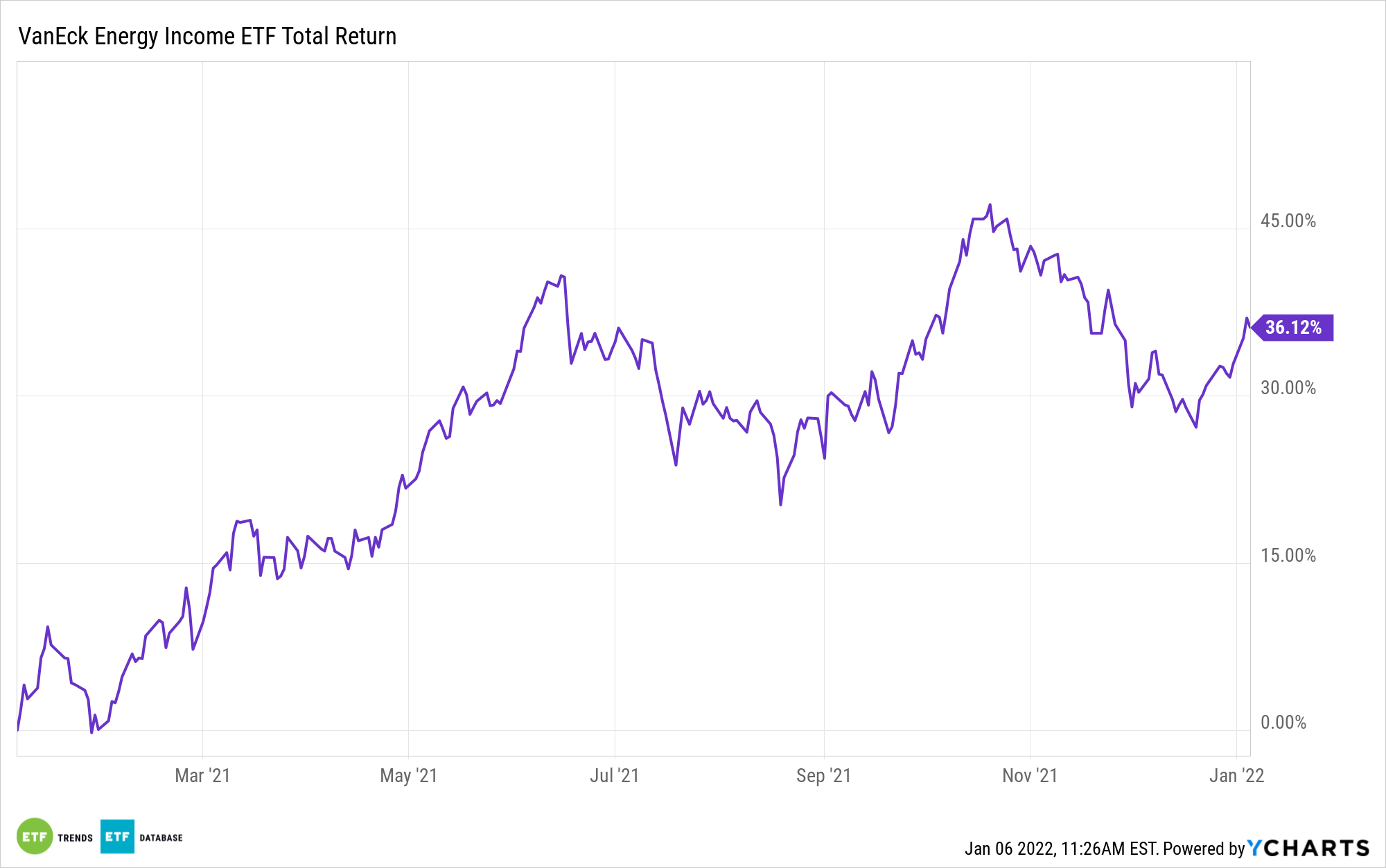

Take the case of the VanEck Vectors Energy Income ETF (EINC). EINC, which tracks the MVIS North America Energy Infrastructure Index, yields an eye-catching 4.96% and is higher by just over 36% over the past year. To be sure, those are impressive percentages, but EINC also offers allure on the basis that the midstream energy industry could see elevated mergers and acquisitions activity this year.

In a recent note, Citi analysts perform some “just for fun” math, noting that Energy Transfer (NYSE:ET) could command a staggering premium of 80% in a buyout by a private equity company and that even at that premium, the buyer could still generate ample return on investment over five years immediately following the deal.

The Citi analysts do acknowledge that Energy Transfer, which accounts for 4.62% of EINC’s weight, isn’t likely to be taken over by a private equity company. However, they add that private equity suitors, many of which are sitting on massive cash stockpiles, should be focusing on more midstream possibilities as opposed to other industries.

“Given the favorable financing environment, and the cash-flowing nature of midstream assets, Citi thinks private equity should be spending more time on a company like ET at less than 7x forward earnings, and less time on railroads at 24x,” according to Seeking Alpha.

The weighted average market capitalization of EINC’s 29 member firms is just over $26 billion. Even when factoring in takeover premiums, that’s a potentially attractive area in which private equity companies looking for larger deals could go shopping.

Nearly 21% of EINC holdings have market values of $5 billion or less, and those firms could be ideal targets for suitors. Beyond that, private equity has an established track record of acquiring energy assets, so it’s not a stretch to think that the midstream could be appealing to such buyers.

For now, however, it’s only speculation, and it remains to be seen whether private equity comes calling for pipeline operators. In the interim, EINC offers investors robust income and an avenue with which to play higher oil prices.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.