As summer turned into fall during the month of September, it seems like investors paired their pumpkin-spiced lattes with exchange-traded funds (ETFs). It wasn’t just ETFs, but mutual funds too that saw a healthy influx of investor capital–a positive sign given the tumult experienced earlier this year.

“In a month when the S&P 500 crested at a new all-time high (on Sept. 2) before pulling back, long-term mutual funds and exchange-traded funds had inflows of $13 billion in September 2020–their sixth consecutive month of inflows since the $325 billion bloodletting in March,” a Morningstar article noted. “Money market funds had a hefty $223 billion of outflows in 2020’s third quarter, the most since 2010’s first quarter but only a fraction of the $1.5 trillion they collected from April 2019 through June 2020.”

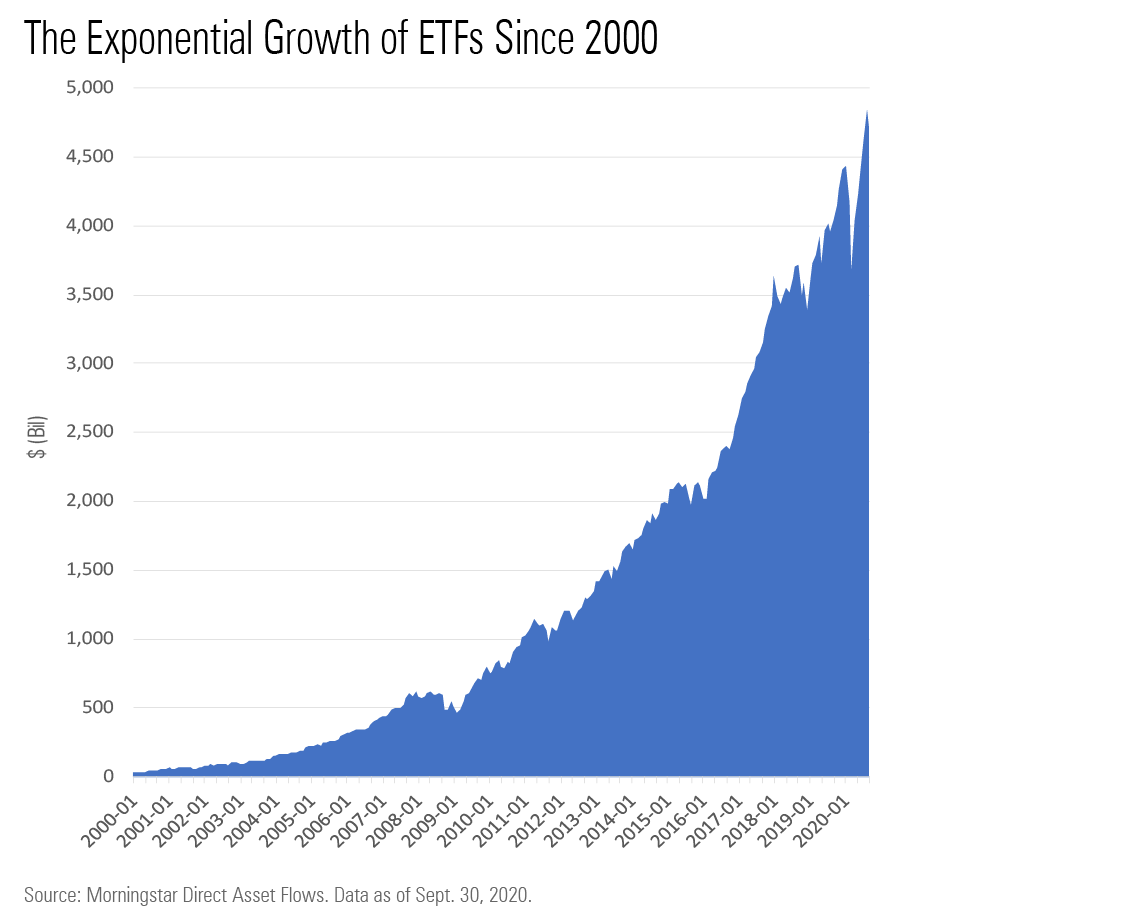

Additionally, score another win for ETFs, which saw the disparity between open-end funds and ETFs grow wider thus far this year.

“Among long-term funds, the paths of open-end funds and ETFs have increasingly diverged,” the Morningstar article said. “Open-end funds are on track for their worst calendar year ever, having suffered $317 billion of outflows so far in 2020. (Open-end funds suffered record calendar-year outflows of $169 billion in 2018, which topped the previous record of $157 billion set in 2008.) ETFs, by contrast, have collected $313 billion for the year to date. That is by far the widest asset-flows disparity between the two investment types in data going back to 1993. In September, open-end funds shed $22 billion while ETFs picked up $34 billion.”

The Federal Reserve certainly did their part to help spur excitement in the bond markets back in Q1 when the pandemic hit the hardest. By agreeing to backstop debt like corporate bonds, fixed income ETFs were the beneficiaries of this stimulus and that momentum has flowed all the way to September.

“Taxable-bond funds continued to lead all category groups with another $39 billion of inflows in September,” the article said. “They also netted a healthy $202 billion for the quarter–just shy of the record $203 billion they raked in during the previous quarter. As in August, investors continued to seek middle-of-the-road risk exposure in September, plowing nearly $15 billion into intermediate core and $10 billion into intermediate core-plus funds. A record $60 billion entered intermediate core bond products in the third quarter.”

It wasn’t a win for all corners of the bond market as high yield saw an exodus of investors’ capital.

“Not all taxable-bond funds drew investor interest, however,” the article said. “High-yield bond funds, which have benefited in recent months from the Federal Reserve’s corporate-bond purchasing program, posted $6.5 billion of outflows in September.”

To read the rest of the article, click here.

For more market trends, visit ETF Trends.