Getting single-country exposure to India can be had with a tilt towards growth via ETFs like the VanEck Vectors India Growth Leaders ETF (GLIN). Its sector emphasis on information technology helps give investors exposure to companies that are at the forefront of the country’s Covid-19 recovery.

“With International Monetary Fund (IMF) projecting that India will reclaim the status of world’s fastest-growing economy and projected its growth at 11.5 per cent in 2021, experts on Wednesday said that India is rebounding to achieve the target of a $5 trillion economy,” a Times of India article noted. “Commerce and industry minister Piyush Goyal termed the IMF projections for India as ‘Bright star in the global economy.'”

GLIN seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MarketGrader India All-Cap Growth Leaders Index. GLIN’s expense ratio comes in at 0.82%.

Overall, GLIN gives investors:

- Access to fundamentally sound Indian companies with attractive growth potential at a reasonable price (“GARP”)

- The entire Indian opportunity set regardless of size

- Potential to outperform traditional capitalization-weighted benchmarks by selecting top-ranked companies

The fund is up close to 30% the past six months.

The fund invests substantially all of its assets in the Subsidiary, a wholly-owned subsidiary located in the Republic of Mauritius. The index is comprised of equity securities which are generally considered by the index provider to exhibit favorable fundamental characteristics according to the index provider’s proprietary scoring methodology.

“As was expected, and I had been arguing that India’s fundamentals are strong, IMF, in its latest release has projected India’s growth at 11.5 per cent in 2021 and 6.8 per cent in 2022,” said Charan Singh, CEO, EGROW Foundation and former RBI chair professor. “This is the highest growth rate to be recorded by any country.”

Information Technology at the Forefront of the Recovery

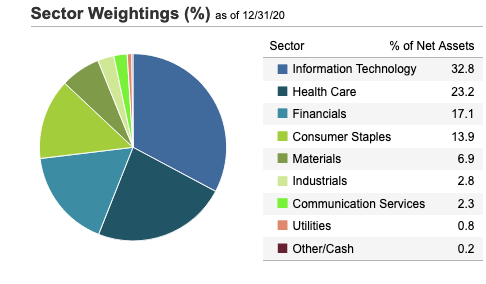

The top sector allocation in GLIN’s holdings is information technology. Analysts are expecting the IT sector to be a key driver in the country’s recovery.

“As India emerges from the economic slowdown, experts say that the IT industry will be at the forefront of this recovery and hence the government should offer tax rebates to software exporters as well as for import of technology products into India,” a New Indian Express article adds.

For more news and information, visit the Tactical Allocation Channel.