Editor’s Note: The original article was published on December 16, 2019 at https://www.

By Will Hershey, Roundhill Investments

For most people, the concept of esports may be foreign. It seems strange that people would rather watch someone playing a game than play themselves. However, for the current generation of children and young adults, spectating video games has become a notably popular activity, one that could conquer the landscape of traditional live media, sports, and entertainment. Over the past few years, esports and game streaming have rapidly moved from the fringe to the mainstream, and viewership is challenging that of traditional sports.

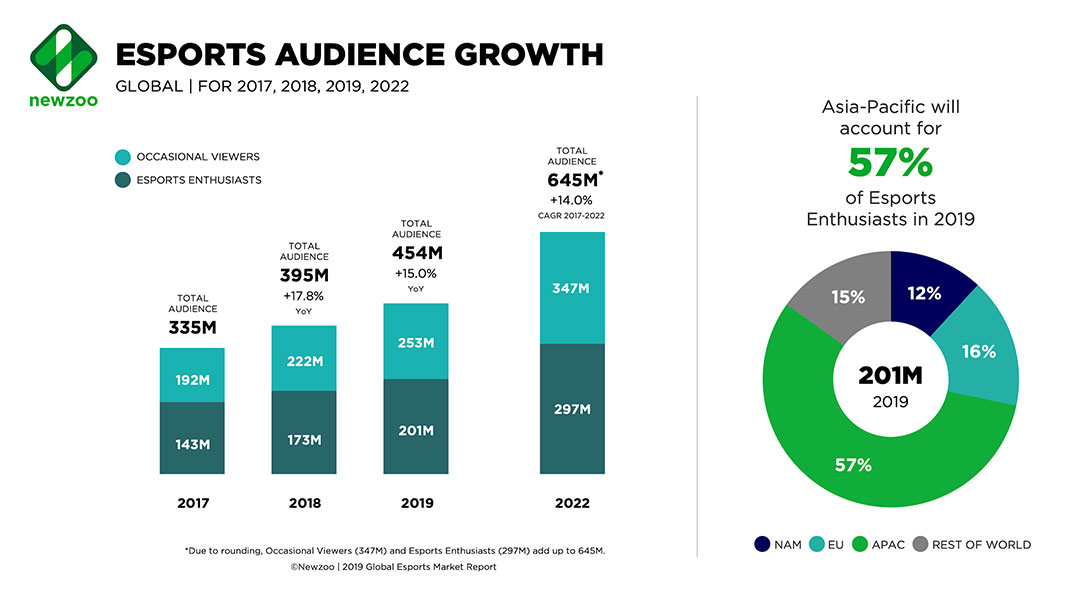

Source: Newzoo

On a global basis, Newzoo estimates that there are 173 million frequent viewers of esports and an additional 222 million occasional viewers today. By 2022, Newzoo expects the esports total audience to reach 645 million, roughly double the entire population of the United States. These figures may suggest esports has already become a mainstream form of entertainment, though the industry is still seeking more effective audience monetization channels. Uncovering these monetization channels is likely a key factor in industry revenue and profitability going forward.

While many opportunities to invest in esports are private, we designed the Roundhill BITKRAFT Esports Index to provide exposure to esports via public companies. We identified four primary types of public companies that provide exposure to the esports ecosystem — games, media, hardware, and broad-based. In our analysis below, we highlight each type of company and provide examples of holdings from our Index.

Games – Publishers / Developers

Games companies are primarily involved in the business of developing and distributing gaming software. In several cases, these companies own and operate competitive esports leagues.

- Game publishers benefit from ownership in the underlying intellectual property, and unlike traditional sports, these companies control the ecosystem surrounding that IP.

- Historically, game publisher revenues have been hit-driven and dependent on one-time title sales. As the industry moves to a “games-as-a-service” model, publishers are increasingly able to monetize existing IP over longer time horizons.

- As it relates to esports and game streaming, not all publishers are created equal. Certain game publishers are positioned for esports growth, with a lineup of competitive game titles, while others focus on casual gameplay.

Activision Blizzard (ATVI)

Market Capitalization: $45.0 billion

Activision Blizzard is a globally-leading developer and publisher of interactive entertainment software. The company operates three primary business segments: Activision (console-focused), Blizzard (PC-focused) and King Digital (mobile-focused). The company’s most popular esports franchises include Call of Duty, World of Warcraft, Overwatch, StarCraft, and Hearthstone. Activision Blizzard acquired King Digital, the company behind popular mobile franchise Candy Crush, and esports platform, Major League Gaming, in 2016.

Overwatch League: Activision’s Overwatch League was the first professional esports league to adopt a city-based, franchise model – a model very similar to that of traditional sports. For the 2019 season, the Overwatch League supported an ecosystem of 20 teams, including 13 in North America, 5 in Asia, and 2 in Europe, highlighting the brand’s global reach. According to various reports, Blizzard sold franchise slots for $25 million in year 1, and increased to more than $30 million for year 2. The Overwatch League also reportedly signed a two-year, $90 million deal with Twitch for exclusive media rights beginning in 2017.

Call of Duty League: Call of Duty is the best-selling first-person shooter franchise in video game history. Beginning in 2020, the professional Call of Duty League will adopt the city-based, franchise model first implemented in Overwatch. The inaugural season will feature 12 teams, including 10 based in North America, and 2 in Europe. Once again, franchise slots were reportedly sold for $25 million each.

Electronic Arts (EA)

Market Capitalization: $31.9 billion

Electronic Arts is one of the largest video game software companies in the world, currently ranked number two throughout Europe and North America in terms of revenue and market capitalization. EA publishes and distributes games, content and services on a variety of platforms, including consoles, PCs, mobile phones and tablets. Notable intellectual property includes established brands such as FIFA, Madden NFL, The Sims, and Battlefield, and newer releases Apex Legends and Anthem.

EA Sports

EA is the largest video game licensor of IP from traditional sports leagues, and as a result, is best-known for its sports simulation franchises, which include FIFA and Madden. FIFA is the 6th best-selling franchise in the history of gaming, having sold a reported 260 million copies as of 2018. Meanwhile, interest in competitive FIFA continues to grow. According to EA, the title’s 2019 eWorld Cup Grand Final viewership increased 60% percent versus 2018, setting a new record for the title.

Apex Legends

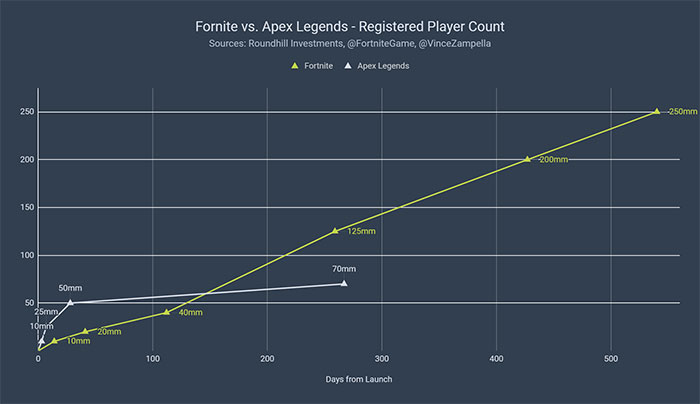

Apex Legends is a free-to-play battle royale game developed by Respawn Entertainment and published by EA. Following a “surprise launch”, the title amassed 25 million registered players in its first week, and 50 million in its first month. As early as three months following its launch, esports organizations began to field teams in Apex. The title has since been featured as part of the ESPN’s EXP program and Apex Legends has already distributed more than $2 million in prize money, including $500,000 at the inaugural Apex Legends Preseason Invitational held in Krakow, Poland. Viewership for the title has struggled to keep pace with its initial success, which was driven by a streamer-focused marketing campaign.

Media – Streaming Platforms, Live Events, Esports Teams

Esports media companies operate livestreaming platforms, entertainment properties, and / or esports events. These companies may also own or operate esports teams.

- Esports media companies offer a derivative form of entertainment to the underlying games, allowing for increased engagement and monetization.

- Unlike publishers, media companies are typically game agnostic, and their business models can adapt to the industry as new titles and genres gain in popularity.

- The business models employed by esports media companies can vary significantly.

Huya (HUYA) & Douyu (DOYU)

Combined Market Capitalization: $6.3 billion

Tencent-backed Huya and sister company Douyu are two of the largest livestreaming platforms in China. Both companies operate as platforms for watching and interacting with live streamed content — focused on gaming and esports. As of their most recent filings, Huya and Douyu collectively accounted for 310 million monthly active users.

Source: Seeking Alpha

Huya

Huya currently derives more than 95% of its revenues from virtual gifting on its platforms, including core Huya and its subsidiary Nimo TV, a livestreaming platform focused on mobile in Southeast Asia and Latin America. In addition to its core business, Huya owns Royal Never Give Up (League of Legends Team) and the Chengu Hunters (Overwatch Team). Huya also recently announced a JV with ESL to expand its esports competitions into China.

Douyu

Compared to Huya, Douyu’s focus has been on content creators. Douyu employs an “exclusive contract model” whereby it signs streamers to 3-5 year contracts in exchange for salaries and a cut of virtual gifting revenues. For the first quarter 2019, Douyu derived more than 60% of revenues from exclusive streamers. In esports, Douyu has exclusive streaming rights to 29 major tournaments in China, including League of Legends, PUBG, and Dota 2.

Modern Times Group (MTGB SS)

Market Capitalization: $774 million

Modern Times Group (MTG) is a Sweden-based holding company focused on esports and gaming entertainment. MTG portfolio companies include strong global brands in the industry, including stakes in ESL (an esports league and events operator), Dreamhack (the world’s largest gaming and esports festival), Innogames, and Kongregate (online gaming companies). In 2019, the company completed a spin-off of Nordic Entertainment Group to become a pure-play on esports and gaming.

Turtle Entertainment (ESL)

ESL, formerly known as ‘Electronic Sports League’, is the world’s largest esports-dedicated company, offering services in gaming technology, event management, advertising, and media production. Each year, ESL runs 13 mega esports events with thousands of attendees and millions of viewers online. Most recently, ESL One hosted the Intel Extreme Masters Major in Katowice, Poland. The event saw attendance of 174,000 alongside 230 million viewers online.

Dreamhack

DreamHack is a Swedish production company specialized in organizing esports tournaments and conventions worldwide. DreamHack helped to pioneer esports and currently holds the Guinness World Record for the world’s largest LAN (Local Area Network) party. By the end of 2019, Dreamhack will have hosted 15 events in 8 countries on 4 continents.

Enthusiast Gaming (EGLX CN)

Market Capitalization: $86 million

Enthusiast Gaming is a vertically integrated gaming media, esports and live events company. The company’s media segment owns and operates 100+ gaming websites, with more than 150 million unique monthly visitors. The company’s esports division is Luminosity Gaming, which owns / manages 7 esports teams including the Vancouver Titans (Overwatch) and the Seattle Surge (Call of Duty). Enthusiast also owns and operates the largest gaming expo in Canada, EGLX.