Getting dividends that can counteract low rates from safe haven government debt is just one aspect of the current fixed income game. The second key is getting quality dividend exposure, which investors can find in the VanEck Vectors Morningstar Durable Dividend ETF (DURA).

DURA seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar® US Dividend Valuation IndexSM (MSUSDVTU), which is intended to track the overall performance of high dividend yielding U.S. companies with strong financial health and attractive valuations according to Morningstar. The fund is able to extract not just high-yielding companies, but ones that offer value and strong fundamentals.

Overall DURA offers ETF investors:

- High Dividend Yield Potential: The index targets high yielding U.S. equities

- A Focus on Valuations: The index allocates to those companies trading at the lowest prices relative to Morningstar’s estimate of fair value

- Strong Financial Health: Index components feature strong balance sheet health relative to their peers

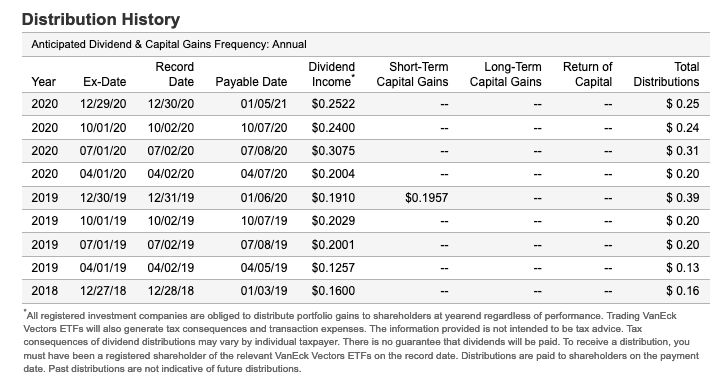

DURA pays a quarterly distribution with its last distribution recording in December 2020 and paid on January 5 at a $0.25 per share rate. DURA has a 12-month yield of 3.5%.

Under the Hood of DURA

DURA’s holdings span a variety of industries, with healthcare and consumer staples comprising about 50% of the fund’s net assets. Utilities and industrials come in next, making up roughly 25% of assets.

Here are the fund’s top five holdings:

Looking at the dividend yields between the top holdings, AT&T is in pole position after a strong fourth quarter in 2020. Phillip Morris International comes in second. Both companies combined comprise almost 10% of the fund’s assets, so the fund is never too allocated toward just one or two stocks.

“Despite the unpredictability of COVID-19, AT&T’s 2020 ended up working out. In its fourth-quarter earnings released on Wednesday (January 27), AT&T announced that it saw growth in wireless users, fiber customers and HBO Max activations,” a CNET article said.

AbbVie Inc tops the performance list for the past year with a 25% gain, with Johnson & Johnson coming in at second with a 7% gain.

“AbbVie stock topped a buy zone Wednesday (February 3) after the pharmaceutical company beat Wall Street’s fourth-quarter forecasts and delivered a strong 2021 earnings outlook,” an Investor’s Business Daily article noted.

For more news and information, visit the Tactical Allocation Channel.