By William Sokol, VanEck Senior ETF Product Manager

In 2018, reports from the Intergovernmental Panel on Climate Change and the U.S. National Climate Assessment provided at least two grim conclusions. First, climate change is already occurring and significantly impacting millions of people in the U.S. and around the world on a daily basis. This may include hotter temperatures and more frequent extreme weather events, or as is the case for many in the developing world, food and water shortages, displacement from their homes, or increases in infectious diseases. Second, if we are to meet the goal of limiting additional warming to 1.5⁰ Celsius above pre-industrial levels, unprecedented action must be taken immediately. Existing infrastructure is not equipped to handle the consequences of rising temperatures, and new technologies are needed for both mitigation and adaptation to this new reality.

Although we have a good idea of what needs to be done in order to limit global warming and adapt to the irreversible effects that are already occurring, the challenges in implementing them are difficult to overstate. They include human inertia and an inability or unwillingness to fathom the extent of the impact of an additional degree or two of warming. Practically speaking, at least $6.9 trillion per year through 2030 is the estimated cost of financing the transition to a low/zero carbon economy.

Although only a piece of the solution, tapping the $100 trillion global debt markets via green bonds will be integral to financing projects to help meet climate and other sustainable development objectives. Green bonds provide fixed income investors with a way to invest sustainably within their portfolios, without necessarily compromising on risk and return objectives, through liquid and tradeable investments. With the first quarter of 2019 now behind us, we examine where the green bond market is today and what lies ahead.

Green Bonds Off to Strong Start This Year

The first quarter of 2019 saw a welcome boost in green bond supply, totaling over $40 billion, which is up approximately 46% versus the same period one year ago. [1] North American issuance was up approximately 30%, with green bonds from first time corporate issuers including Verizon and Citigroup as well as repeat issuance from companies such as Duke Energy and MidAmerican Energy.[2] Globally, large banks and sovereign issuance have continued to dominate issuance. Credit Agricole, ING, and BNP Paribas all returned to the market, as did Poland. The Netherlands will soon be issuing a green bond with a size of up to EUR 6 billion, becoming the first country with a triple-A rating to come to market.[3]

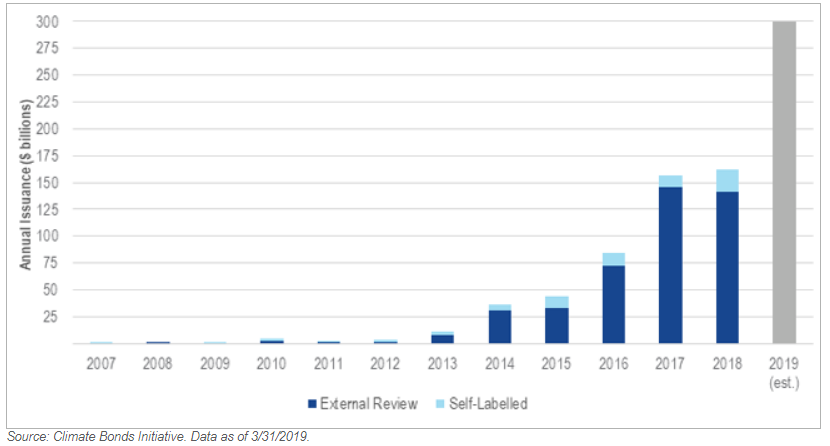

This comes after what may appear to be a disappointing 2018 at first glance. Issuance totaled approximately $167 billion, just $5 billion above the year before, which follows several years in which the market nearly doubled in size annually.[4]

2018 in Review

The green bond market showed resilience through extremely volatile periods last year. For example, as stock markets globally were reeling on October 11, more green bonds were being issued in the primary market than traditional bonds.[5] When La Poste, France’s national postal service company, issued its inaugural green bond in November, it was the only corporate bond issued in Europe that week.[6] The ability to raise capital in volatile environments may be a testament to the value of this additional funding route for issuers, and may reflect the demand for sustainable fixed income options.

U.S. issuers were the largest green bond issuers in 2018. However, this was driven by approximately $20 billion in green mortgage backed security issuance by Fannie Mae, the majority of which are relatively small and not included in major green bond indices. Excluding these bonds, Europe dominated developed markets issuance, driven by financial and sovereign issuers, and euro-denominated green bonds were the most widely issued. France and Poland expanded their presence in the green bond market, while Belgium and Ireland made their debuts.

Emerging market issuance also continued to grow in 2018, accounting for approximately 30% or global issuance. In terms of country of issuer, China was by far the largest. China’s green bond market has benefitted from clear green bond standards from its regulator. India and the ASEAN countries have also adopted similar standards.

Green bonds are defined primarily by the transparency provided into the use of proceeds at the time of issuance. A study by the Climate Bonds Initiative found that 87% of bonds (in terms of issue amount) also provide some type of reporting post-issuance, including actual details on the projects financed, their environmental impact, or both. Contrary to the perception that emerging markets investing involves less transparency, the study revealed that 91% of bonds from emerging markets issuers provided such post-issuance disclosure. Further, nearly 90% of all green bonds issued in 2018 featured an external review of some type, providing additional assurance to investors that the bonds are financing green projects and that issuers are following best practices in terms of project evaluation, tracking of proceeds, and reporting.

Regulators Taking Action as Greater Ambition Needed

With resilient issuance, even in a shaky market environment, and near universal agreement on the pathways towards global climate objectives, there are many reasons to be optimistic. A record number of coal plants were shuttered last year in the U.S., and the cost of renewable energy is now economically competitive with other fossil fuel-based sources of energy. In China, although sales of new cars powered by internal combustion motors were flat, the country is leading the world in electric vehicle sales.

However, when viewed against where the world must be in order to be on a “1.5⁰C pathway,” there is still significant progress that must be made quickly. Carbon emissions actually accelerated in 2018 globally, driven largely by economic growth. Although the U.S. has benefitted from its shift away from coal towards cleaner natural gas, this won’t be enough to satisfy the emissions targets that are consistent with a 1.5⁰C scenario. In addition, although much progress has been made at a city and state level in the U.S., federal regulations have recently gone in the other direction. For example, a rollback in federal fuel-efficiency standards is just one of 21 other rollbacks completed or in process by the current administration.[7]

Calls for greater ambition from policymakers at all levels are becoming louder, and experts are urging governments to think big. Renewable energy is part of the solution, but investments in other technologies are needed as well, such as carbon capture, carbon removal, advanced storage technology, carbon pricing, and even nuclear.

Greater ambitions also require greater cooperation among policymakers globally. At the most recent U.N. Climate Change Conference (COP 24), important progress was made on developing a rulebook for how individual countries report on progress towards meeting the goals established under the Paris Agreement, including consistent requirements for developed and developing nations. The European Central Bank (ECB) is soon expected to formalize existing green bond market practices as a clear standard, which will bring reporting requirements, stringency to the verification process, and potentially incentives for certain issuers or investors. The Task Force on Climate-related Financial Disclosures now recommends that firms provide disclosure about the potential impact of climate change on their operations. The Financial Stability Board has focused on the impact on asset values, and the potential risk to global markets, as climate risks get priced in. With the devastating 2018 wildfires in California and the resulting bankruptcy of PG&E in recent memory, along with increased shareholder resolutions related to climate issues, the pricing of climate risk into asset prices may begin to receive heightened investor attention going forward.

Moves by policymakers to bring standards and transparency to the market will likely help to grow the green bond market further. Demand for sustainable investing across asset classes is already substantial. According to the U.S. Forum for Sustainable and Responsible Investment, there is already $12 trillion of assets managed under a responsible investment mandate, an increase of 38% from two years ago.[8] Globally, that number is over $30 trillion.9 Although growing, the green bond market’s $400 billion size is still miniscule, and calls from climate leaders to reach $1 trillion of issuance per year should not pose a challenge in this context. As investors seek ways to hedge climate risks in their bond portfolios, we believe that demand for green bonds will continue to increase. Because they offer investors exposure to a diverse set of issuers who are proactively managing and mitigating climate risks in their own operations at yields similar to those of traditional bonds, they may provide investors with a cheap (or free) hedge against climate risk.

What’s Ahead for Green Bonds

Green bond issuance is expected to hit $250 billion this year. We believe many of the same drivers of growth are expected to continue. In particular, we expect sovereign and financials to lead the way, and hope that the spate of new U.S. corporate entrants to the market are the beginning of a larger trend. The adoption of the Green Loan Principles, which are largely modeled on the guiding principles that have driven growth in the green bond market, may help spur green financing from banks. Although not directly tied to the green bond market, growth in the loan market may result in additional green bond issuance (which may be used to finance loans) as well as growth in the securitized space. Pent up demand and refinancing activity may also provide tailwinds to market growth this year.

In addition, there are signs that the political winds may be shifting to align with sustainability goals, and bring with it a massive scaling up in green finance. For example, in the U.S. almost 75% of respondents to a Reuters/Ipsos poll stated that they believe climate change is a threat, with nearly 60% classifying that threat as serious or imminent. Two-thirds of Americans want politicians to work with other countries to combat climate change.10 Furthermore, a majority of registered voters from both parties favor the “Green New Deal,”11 which is generally viewed as aspirational but lacking any clear policy direction. These numbers are at odds with the current administration’s positioning, and may have repercussions on future policies, particularly as 2020 elections come into focus.

Regardless of the speed at which regulators in the U.S. and abroad enact policies aligned with the pathways laid out by climate scientists, we believe that green financing, and the green bond market in particular, are poised for significant growth. In markets in which regulators have provided a favorable environment for green bonds, supply has increased. New and repeat issuers continue to come to market to finance sustainability initiatives their stakeholders are increasingly demanding. In addition to growing interest in building portfolios aligned with values and causes investors believe in, there is greater recognition that environmental, social and governance factors such as climate risk can impact asset prices significantly. Green bonds provide a way for investors to build environmentally aware portfolios without having to compromise on risk and return objectives, that may fit nicely into a core bond allocation.

IMPORTANT DISCLOSURE

1.HSBC

2.Climate Bonds Initiative

3.Dutch State Treasury Agency Ministry of Finance. https://english.dsta.nl/news/news/2019/04/08/issuance-20-year-sovereign-green-bond-on-21-may-2019

4.Climate Bonds Initiative

5.Bloomberg

6.SEB

7.New York Times, 12/28/2018

8.US SIF Trends Report 2018

9.Global Sustainable Investment Alliance 2018 Investment Review

10.Reuters, 12/13/2018. https://www.reuters.com/article/us-climate-change-usa-poll/more-americans-view-climate-change-as-imminent-threat-reuters-ipsos-poll-idUSKBN1OC1FX

11.The Hill, 12/17/2018. https://thehill.com/policy/energy-environment/421765-poll-majorities-of-both-parties-support-green-new-deal

Please note that Van Eck Securities Corporation (an affiliated broker-dealer of Van Eck Associates Corporation) may offer investments products that invest in the asset class(es) or industries discussed in this podcast.

This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Fund shares are not individually redeemable and will be issued and redeemed at their NAV only through certain authorized broker-dealers in large, specified blocks of shares called “creation units” and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results. Returns for actual Fund investments may differ from what is shown because of differences in timing, the amount invested, and fees and expenses.

All investing is subject to risk, including the possible loss of the money you invest. Bonds and bond funds will decrease in value as interest rates rise. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future results.