ETF Trends caught up with VanEck product manager William Sokol to discuss what to watch in the fallen angel bond space.

What has driven outperformance of fallen angels against the broad high yield market?

Fallen angel bonds, as represented by the ICE US Fallen Angel High Yield 10% Constrained Index (“Fallen Angel Index”), has outperformed the broad high yield market, as represented by the ICE BofA High Yield Index (“High Yield Index”), returning -1.2 %vs. -4.8% year-to-date as of 6/30/2020. This year’s outperformance is being driven by the same factors that have been key to the fallen angel bond strategy’s consistent long-term outperformance.

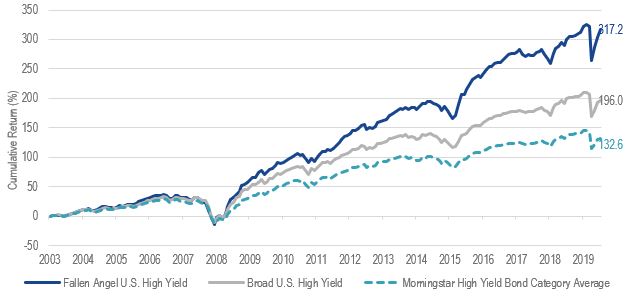

Fallen Angel Bonds Historically Outperform Broad High Yield

Source: ICE and Morningstar. Data as of 6/30/2020. Fallen Angel U.S. High Yield is represented by the ICE US Fallen Angel High Yield 10% Constrained Index (H0CF) and the Broad U.S. High Yield by ICE BofA High Yield Index (H0A0). Fallen Angel U.S. High Yield index data on and prior to February 28, 2020 reflects that of the ICE BofA US Fallen Angel High Yield Index (H0FA). From February 28, 2020 forward, the Fallen Angel U.S. High Yield index data reflects that of the the ICE US Fallen Angel High Yield 10% Constrained Index (H0CF). Fallen Angel U.S. High Yield index data history which includes periods prior to February 28, 2020 links H0FA and H0CF and is not intended for third party use.

First, bonds are typically oversold prior to being downgraded and typically recover in value within six months. There have been over $140B of new fallen angels this year[1], by far the largest year on record, which has provided an ample supply of deeply discounted bonds.

Second, fallen angel investing is a contrarian approach. The portfolio tends to be overweight sectors where values are depressed and fundamentals have bottomed out, providing the potential to benefit from a recovery. We’re seeing that right now with an overweight to the energy sector, which has actually been a positive contributor to the Fallen Angel Index’s outperformance this year (as of 6/30/2020) despite being one of the worst performing sectors in the broad High Yield Index.

Lastly, a fallen angel strategy has historically provided higher quality high yield exposure relative to the broad high yield market.[2] Fallen angel bonds typically have a BB rating, and higher rated bonds have historically had lower drawdowns in stressed periods and a lower default rate compared to lower rated bonds. The Fallen Angel Index currently has an allocation of over 90% to BB-rated bonds, as of 6/30/2020.

How have the Fed’s corporate bond purchases impacted fallen angel bonds?

The various programs announced by the Fed in late March have clearly had a significant impact on credit markets broadly, and have essentially provided a backstop to bond prices. The focus of the Fed’s bond buying programs is on maintaining a functioning, liquid investment grade market, but the impact has also been felt in the high yield space. This is at least partly because a subset of fallen angel bonds are eligible for purchase in the secondary market. However, the fallen angel bond story has not disappeared by any means, despite the introduction of these programs.

The average discount of fallen angels as they’ve entered the Fallen Angel Index this year through June is nearly 15%, more than twice the 10-year average prior to 2020[3]. This provides additional potential for investors to participate in a price recovery. Overall, we see that the market is continuing to differentiate between credits, and that the consistent and repeatable fallen angel technical effect remains intact.

What is the outlook for additional fallen angel bonds going forward?

Overall, we think this downgrade cycle is not over and there is still room for it to run. VanEck has forecasted $250B to $300B in fallen angel bond volume for the year, which would imply about $100B to $150B of additional fallen angel volume. Harder hit sectors like energy and autos could make up a significant portion of that, but we see fallen angel candidates across a variety of other sectors as well.

With spreads much tighter today than just a few months ago, this additional downgrade volume could provide an opportunity for high yield investors as more discounted bonds come into the portfolio. Some of the strongest years of absolute and relative performance have come after big waves of downgrades like we are seeing now. In these environments, a strategy like the VanEck Vectors® Fallen Angel High Yield Bond ETF (ANGL®) can be a way for investors to access the high yield market tactically and opportunistically, almost like a more liquid distressed debt strategy. However, we consider ANGL to be an attractive “through the cycle” high yield strategy, because it has consistently outperformed across different rate and credit environments. The higher quality, high income approach with alpha potential can make it an attractive strategic holding within a credit portfolio through market cycles.

DISCLOSURES

A fallen angel bond is a bond that was initially given an investment-grade rating but has since been reduced to junk bond status.

High yield bonds may be subject to greater risk of loss of income and principal and are likely to be more sensitive to adverse economic changes than higher rated securities.

This content is published in the United States for residents of specified countries. Investors are subject to securities and tax regulations within their applicable jurisdictions that are not addressed in this content. Nothing in this content should be considered a solicitation to buy or an offer to sell shares of any investment in any jurisdiction where the offer or solicitation would be unlawful under the securities laws of such jurisdiction, nor is it intended as investment, tax, financial, or legal advice. Investors should seek such professional advice for their particular situation and jurisdiction.

The information herein represents the opinion of the author(s), but not necessarily those of VanEck, and these opinions may change at any time and from time to time. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results, are valid as of the date of this communication and subject to change without notice. Information provided by third party sources are believed to be reliable and have not been independently verified for accuracy or completeness and cannot be guaranteed. Any discussion of specific securities/financial instruments mentioned in the commentary is neither an offer to sell nor a recommendation to buy these securities. Historical performance is not indicative of future results. Current data may differ from data quoted. Any graphs shown herein are for illustrative purposes only.

ICE BofAML US High Yield Index (H0A0, “Broad HY Index”), formerly known as BofA Merrill Lynch US High Yield Index prior to 10/23/2017, is comprised of below-investment grade corporate bonds (based on an average of various rating agencies) denominated in U.S. dollars.

ICE US Fallen Angel High Yield 10% Constrained Index (H0CF, Index) is a subset of the ICE BofA US High Yield Index and includes securities that were rated investment grade at time of issuance.

ICE Data Indices, LLC and its affiliates (“ICE Data”) indices and related information, the name “ICE Data”, and related trademarks, are intellectual property licensed from ICE Data, and may not be copied, used, or distributed without ICE Data’s prior written approval. The licensee’s products have not been passed on as to their legality or suitability, and are not regulated, issued, endorsed, sold, guaranteed, or promoted by ICE Data. ICE Data MAKES NO WARRANTIES AND BEARS NO LIABILITY WITH RESPECT TO THE INDICES, ANY RELATED INFORMATION, ITS TRADEMARKS, OR THE PRODUCT(S) (INCLUDING WITHOUT LIMITATION, THEIR QUALITY, ACCURACY, SUITABILITY AND/OR COMPLETENESS).

An investment in the VanEck Vectors® Fallen Angel High Yield Bond ETF (ANGL®)may be subject to risk which includes, among others, high yield securities, foreign securities, foreign currency, credit, interest rate, restricted securities, market, operational, call, sampling, basic materials, consumer discretionary, energy, financial, communications, information technology, index tracking, authorized participant concentration, no guarantee of active trading market, trading issues, passive management, fund shares trading, premium/discount risk and liquidity of fund shares and concentration risks, all of which may adversely affect the Fund.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Fund carefully before investing. To obtain a prospectus and summary prospectus, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing.

[1] Source: FactSet, ICE Data Indices, LLC and Morningstar as of 6/30/2020

[2] When comparing ICE US Fallen Angel High Yield 10% Constrained Index and ICE BofA US High Yield Index. ICE rating is a proprietary composite of various rating agencies.

[3] Source: FactSet and ICE Data Indices, LLC as of 6/30/2020