Risk is back on in the debt markets. Rather than go the traditional high-yield route, ETF investors can opt for the VanEck Vectors Fallen Angel High Yield Bond ETF (BATS: ANGL).

ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance.

The fund focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status.

ANGL gives investors exposure to:

- Higher-Quality High Yield: Fallen angels, high yield bonds originally issued as investment grade corporate bonds, have had historically higher average credit quality than the broad high yield bond universe

- Outperformance in the Broad High Yield Bond Market: Fallen angels have outperformed the broad high yield bond market in 12 of the last 16 calendar years

- Higher Risk-Adjusted Returns: Fallen angels have historically offered a better risk/reward trade off than found with the broad high yield bond market

The fund is up almost 12% according to Morningstar numbers, and with a 0.35% expense ratio, it falls below its categorical average. Fixed income investors are well aware of the difficulties in finding yield in today’s low-rate environment, but ANGL gives investors a 12-month yield of almost 5%. Compare that to the benchmark Treasury yield of barely 1% and you can see its appeal.

Corporate Bond Demand Remains High

With the Federal Reserve looking to keep interest rates low for some time, fixed income investors will continue to seek yield where they can get it. Per a Wall Street Journal article, “negative real yields on U.S. Treasurys drive investors to buy riskier assets in search of better returns. Many have turned to corporate bonds, driving yields to new lows in recent months, investors and analysts say.”

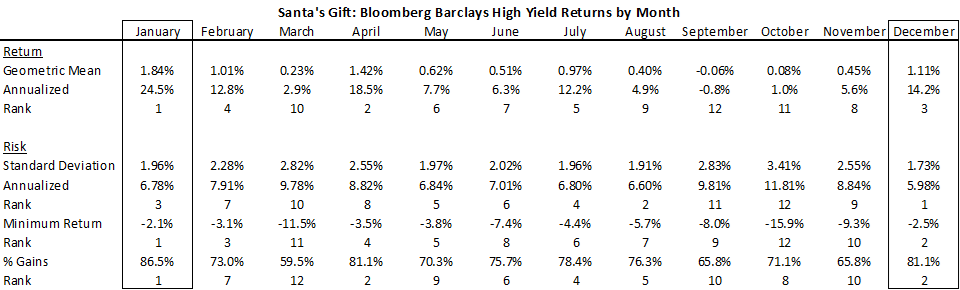

Other tailwinds include a calendar effect of December and January on high yield debt issues.

“December and January tend to be the best months for high yield corporate bond returns,” a Seeking Alpha article duly noted.

“These two months, which make up one-sixth of the calendar year, have historically generated just over one-third of the returns of the high-yield bond market,” the article continued.

For more news and information, visit the Tactical Allocation Channel.