Chinese stocks are currently out of favor, but that could spell opportunity for prescient investors. With that, some experts are apt to say it’s a stock picker’s market, but investors could be well served by simply opting for an exchange traded fund.

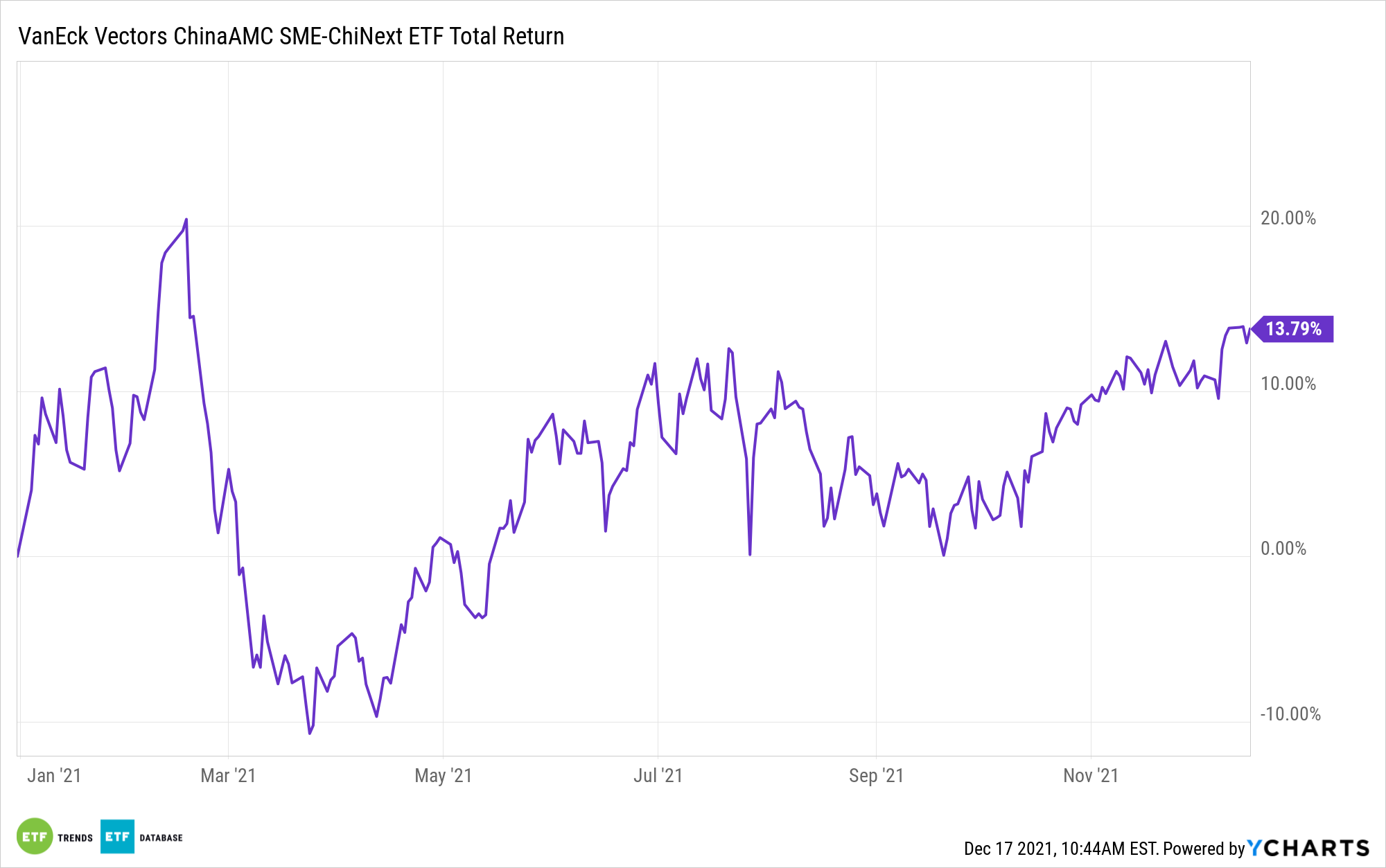

An idea to consider is the VanEck Vectors ChinaAMC SME-ChiNext ETF (CNXT). CNXT, which is about seven and a half years old, recently swapped indexes. Last week, the ETF moved from the SME-ChiNext 100 Index to the ChiNext Index.

SME and ChiNext merged so the former no longer exists, making CNXT’s dedicated ChiNext focus potentially appealing for investors looking to position for a rebound in Chinese growth stocks.

“According to the Shenzhen Stock Exchange, the ChiNext Market provides an important platform for implementing the national strategy of independent innovation by helping to accelerate the transformation of economic development and galvanize growth in emerging industries of strategic importance. As of November 11, 2021, there are 1,057 listed companies on the ChiNext Board,” says Nicolas Fonseca, VanEck associate portfolio manager.

China is taking an active role in supporting emerging industries it deems as strategic, including biotechnology, disruptive technology, clean energy, next generation materials, energy storage, and more.

While past performance isn’t guaranteed to repeat, it’s worth noting that CNXT’s index swap links the fund to a benchmark with an impressive track record. Additionally, CNXT’s new index has often had higher return on equity than competing benchmarks.

“As of 11/30/2021, the ChiNext Index has outperformed the SME-ChiNext 100 Index since June 2010 on a cumulative basis, and over recent trailing periods,” adds Fonseca. “Note that the key difference between the two indices is the eligible universe covered by each, which is based on listing venue. The ChiNext Index is based on the 100 largest and most liquid A-share stocks of the ChiNext Market, which tends be large cap and some mid cap vs. the SME-ChiNext 100, which comprises SMEs (small and medium enterprises) of both the original SZSE SME and ChiNext markets.”

CNXT’s 100 member firms have a weighted average market capitalization of $60.2 billion. Industrial and technology stocks combine for half the fund’s weight, indicating that CNXT is a credible play on emerging growth equities in the world’s second-largest economy. The top 10 holdings combined for 40.36% of CNXT’s weight as of the end of November.

For more news, information, and strategy, visit the Beyond Basic Beta Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.